What to know:

As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. The recent dip in Bitcoin (BTC) and other major cryptocurrencies seems to be another chapter in this ever-evolving story.

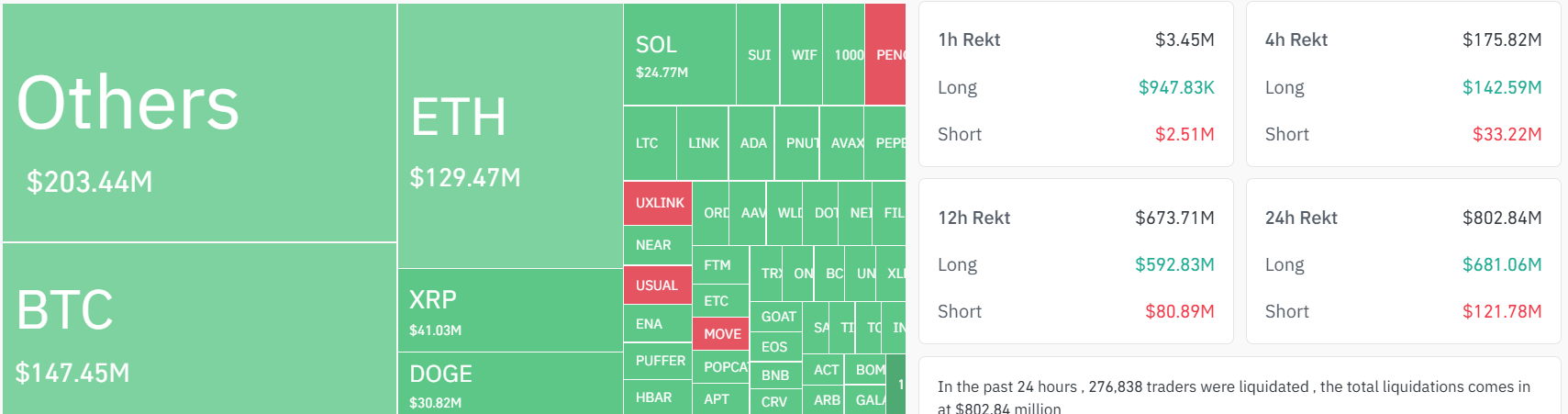

The drop in the value of Bitcoin (BTC) led to approximately $700 million in liquidations from futures contracts tied to prominent cryptocurrencies. Notably, XRP and Dogecoin (DOGE) derivatives experienced unusually large losses.

During U.S. hours on Wednesday, Bitcoin dropped below $100,000 but began to rebound slightly during early Thursday in Asia, following hints from the Federal Reserve about potential rate reductions in 2025. Later, Fed chair Jerome Powell clarified at a press conference after the FOMC meeting that the central bank is not permitted to own Bitcoin under existing regulations – this was in response to questions regarding President-elect Donald Trump’s proposed strategic reserve.

As an analyst, I find it prudent to suggest that such a matter warrants Congress’s attention, but I am not advocating for any legislative changes at this time. In his July campaign, President Trump expressed his intention to maintain a 100% ownership of all bitcoin currently held or acquired in the future by the government, referring to the existing stockpile of seized bitcoins under his administration.

Bitcoin experienced a 3% decrease following Powell’s remarks, leading to a general decline across other major cryptocurrencies. XRP, Dogecoin (DOGE), and Solana’s SOL dropped by up to 5.5%, while Binance Coin’s BNB and Ether (ETH) fell by 2.5%. Chainlink’s LINK saw the most significant drop of 10%, undoing some of its earlier gains this week as Trump-endorsed World Liberty Financial bought $2 million worth of these tokens.

Due to the market’s downturn, approximately $700 million worth of optimistic wagers were cancelled, with future contracts tied to smaller altcoins and meme tokens suffering greater losses compared to Bitcoin (BTC) and Ethereum (ETH) futures in an unexpected turn of events, as data reveals.

Liquidation refers to a situation where an exchange forcibly ends a trader’s leveraged deal because the trader is unable to fulfill the necessary margin conditions. Massive liquidations often signal intense market sentiment, such as widespread selling or purchasing in a state of fear or enthusiasm.

A series of collapses in asset prices may signal a shift in the market direction, as a possible correction or change in trend could be on the horizon following excessive enthusiasm or pessimism among investors.

According to some analysts, Powell’s statement could signal a peak in the market, potentially lowering anticipation for further gains by the end of the month.

If the U.S. no longer plans to create a strategic Bitcoin reserve, this could signal a market peak since the promise of such a reserve had contributed significantly to the recent surge in Bitcoin prices. This observation was made by Nick Ruck, director at LVRG Research, in a message to CoinDesk on Telegram. Even though a rate cut is typically positive for markets because it was widely anticipated, the market showed a strong negative response after Fed Chair Jerome Powell indicated that inflation will persist throughout next year.

Traders at Singapore-based QCP Capital, however, remain generally bullish for the coming year.

Even if there’s a decline, remain steadfast in your investments. Given that 2025 could be an optimistic year for cryptocurrency, especially with Trump as president, sticking to your plan might turn out advantageous,” the company suggested in their Thursday communication.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-19 09:57