Ah, Bitcoin! The digital gold, the modern-day philosopher’s stone, the currency of the future—or so they said. But lo and behold, the tides have turned, and the once-mighty BTC now finds itself in the throes of a sell-off so dramatic, it could make a Shakespearean tragedy blush. 🎭

According to the ever-watchful eyes of Glassnode, the on-chain metrics and data insights platform, Bitcoin’s downside pressure has shifted its focus from the newbies to the old-timers. Yes, the gradual capitulation is here, and it’s coming in hot amidst broader market weakness. 📉

Year-to-date, BTC has plummeted more than 17%, with a 9% decline in the past week alone. Tariffs and broader economic uncertainty have been the proverbial nails in the coffin for risk assets, including our beloved Bitcoin. 💔

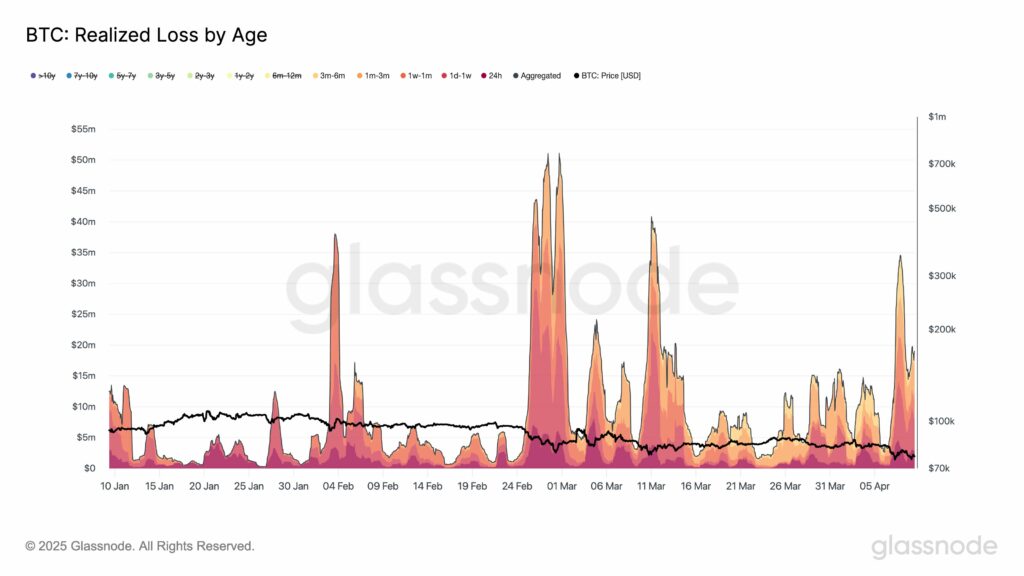

With this performance, coins in the three to six months cohort have seen their share of realized losses skyrocket to more than 19%. Back on Feb. 27, it was a mere 0.8% before the bear market sentiment decided to crash the party. 🐻

“In comparison to previous large Bitcoin sell-offs YTD, losses are now spreading to older coins – especially in the 3m–6m group, whose share in loss realization jumped from 0.8% to 19.4% of total losses since Feb 27,” Glassnode posted on X.

A chart the platform shared shows the BTC realized loss by age metric spiking sharply in April. 📊

Younger coins – in the one week to one month and one month to three months age accounted for more than 50% of total realized losses as February came to a close. But while the 3m–6m cohort then represented less than 1% of total losses, the trend has since reversed, with this group now accounting for a significantly larger share. 🔄

This shift intensified as BTC price declined from above $86,000 in late February. A retest of support below $75,000 in March accelerated the move toward capitulation for the 3m–6m holders. By March 11, the 1m–3m group’s share of losses had dropped to about 16.3%, while that of the 3m–6m cohort rose to 4.9%. 📉

By Apr 7, losses were evenly split between 1w–1m and 3m–6m, each contributing ~19%. This marks a structural shift in loss realization and points to sustained pressure on mid-term holders.

🔻 $BTC: $78.9k, realized losses: $34.4M

🔹1w–1m: $8.2M (23.8%)

🔹1m–3m: $6.5M (18.9%)…— glassnode (@glassnode) April 9, 2025

Despite total BTC losses falling to roughly $41 million, Glassnode’s on-chain data shows older cohorts are undergoing a “gradual broadening of capitulation.” As of early April, the 1w–1m and 3m–6m cohorts were each responsible for around 19% of realized losses. 📉

“This marks a structural shift in loss realization and points to sustained pressure on mid-term holders,” the analysts noted.

Bitcoin is down 2% in the past 24 hours. But hey, who’s counting? 🤷♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- Mirren Star Legends Tier List [Global Release] (May 2025)

- MrBeast removes controversial AI thumbnail tool after wave of backlash

2025-04-09 20:15