What to know:

- February’s $5 billion bitcoin options expiry is due Friday at 08:00 UTC.

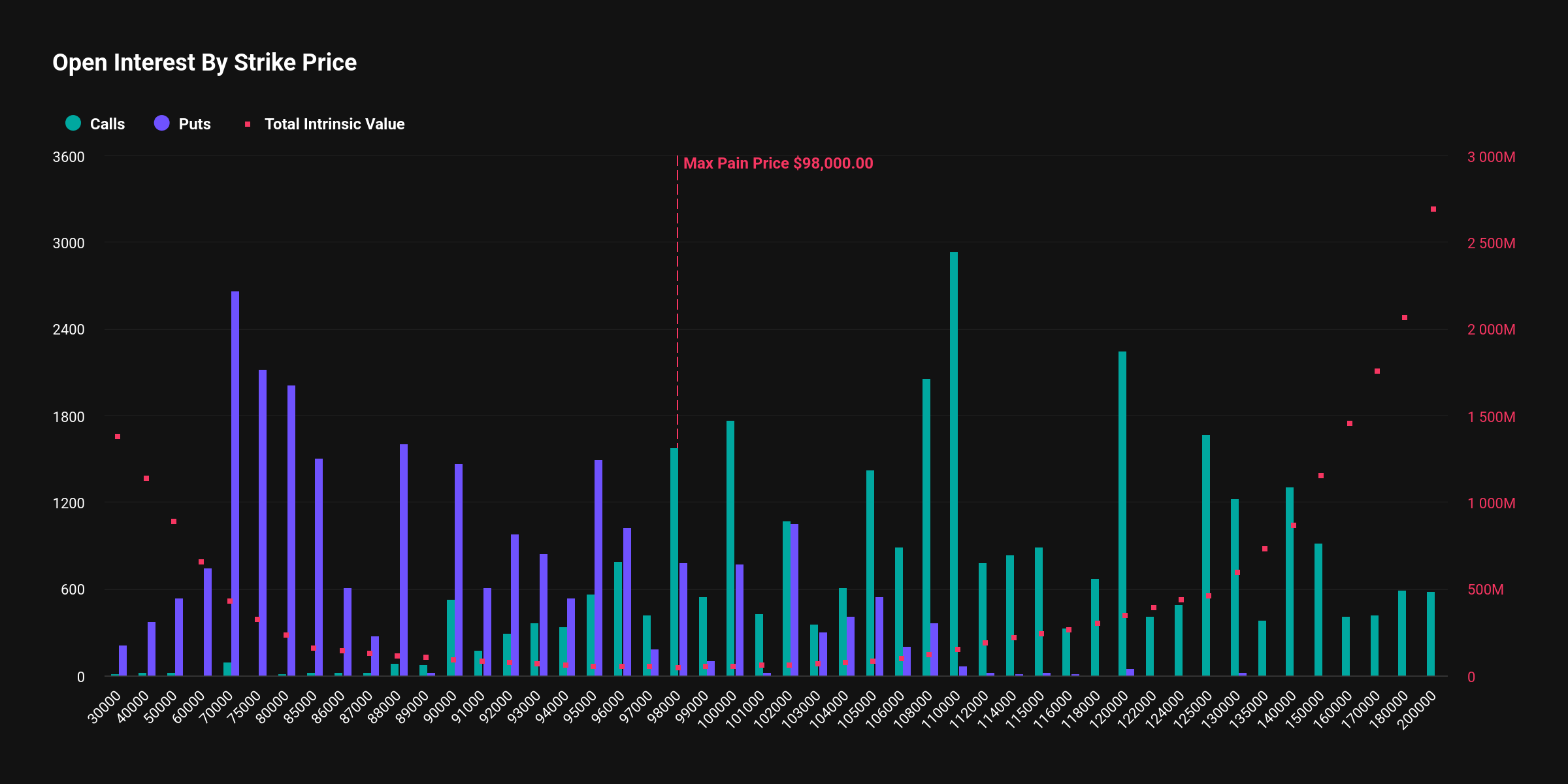

- Bitcoin’s max pain price is $98,000, significantly higher than the current spot price.

Ah, the grand spectacle of finance! Approximately $5 billion in bitcoin (BTC) options contracts are set to expire on Deribit this Friday at 08:00 UTC, adding a delightful twist to an already volatile crypto market. Who doesn’t love a good rollercoaster ride? 🎢

Bitcoin’s prolonged consolidation had kept Deribit’s volatility index (DVOL) in a downward trend throughout 2025. But lo and behold! After bitcoin’s sharp decline, DVOL spiked to 52 before retreating back below 50—like a cat that got scared by its own reflection. 🐱

The recent price drop below $90,000 has left a majority of options out-of-the-money (OTM), and traders are now facing significant unrealized losses. It’s like buying a ticket to a concert only to find out the band broke up! 🎤

An option, dear reader, allows the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain time period. A bit like having a coupon for a pizza that you never use. 🍕

According to Deribit data, out of the $5 billion of notional value that is due to expire, a staggering $3.9 billion (78%) is set to expire out-the-money (OTM). These contracts will expire worthless, much like my hopes of winning the lottery. 💔

Almost 100% of calls are OTM, which are bullish bets, as the bitcoin price dropped significantly over the past few days, leaving investors with a significant amount of unrealized losses. It’s a real tragedy, akin to a Shakespearean play gone wrong! 🎭

Meanwhile, the remaining $1.1 billion (22%) was in-the-money (ITM), dominated by puts. ITM puts are like the wise old owl, having their strike prices above the spot price, meaning they hold value. 🦉

However, max pain is at $98,000, which is $10,000 higher than the current spot price. Max pain is the price at which option sellers, typically institutions, achieve maximum profit, while buyers experience the greatest amount of losses. It’s a classic case of “you win some, you lose some.” 🎲

As the max pain price is so much higher than the spot price, this could incentivize options sellers to push bitcoin price higher closer to the pain level, according to PowerTrade. It’s like trying to convince your friend to go to that awful movie just because you bought the tickets! 🍿

“With the end of the month approaching, bitcoin options traders should take note. Max Pain for Feb. 28 sits at $98,000, with a massive $5 billion notional value. This means the highest open interest is clustered here, incentivizing market makers to keep bitcoin close to this price. Expect increased volatility and potential price gravitation toward this level,” PowerTrade said on X. 📈

Let’s see if the so-called max pain theory holds true, or if it’s just another tale of woe in the land of crypto! 🏰

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-02-26 14:53