Bitcoin, like any bewitched figure in the infernal ballet of markets, has found itself waltzing towards a precipice of both anticipation and dread. It teeters on a key resistance point, audaciously posturing for a grand leap that could orchestrate its next market cycle coda. Meanwhile, on the broader stage of financial machinations, gold persists in its enigmatic rise, whispering of strain in the old, rigid systems and seducing new suitors with its allure. In past performances, gold’s ascent often pirouetted in sync with Bitcoin, gallantly stealing the spotlight and signaling a dramatic shift of capital into the digital vaults of value.

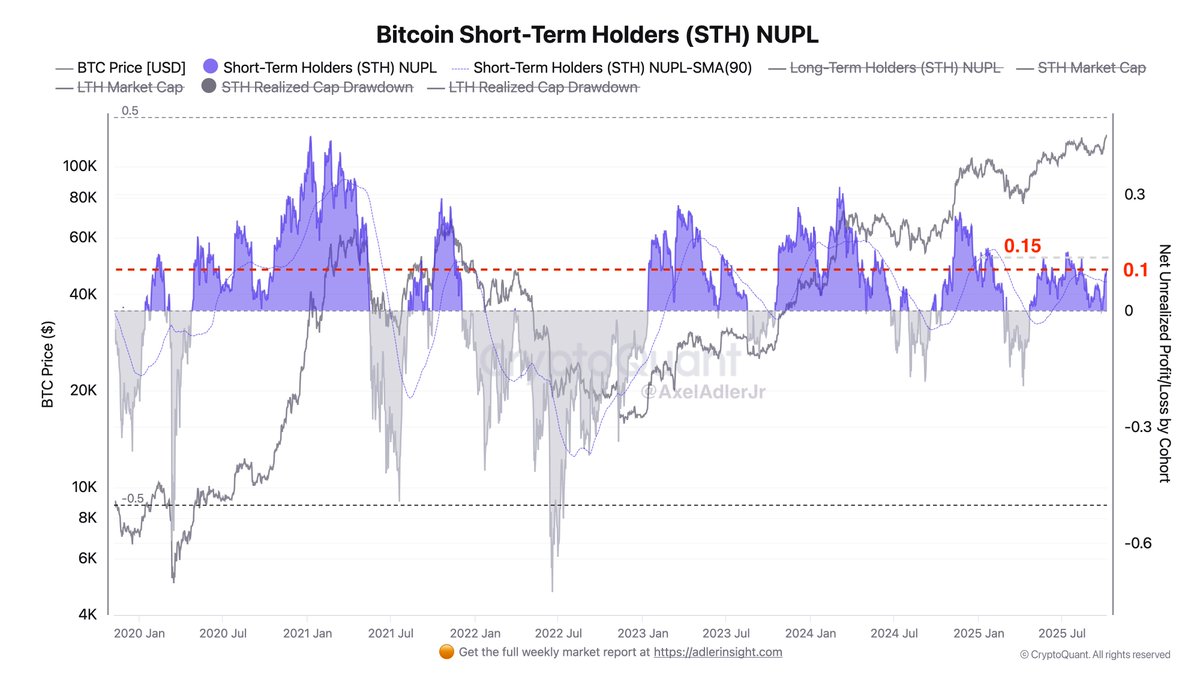

On the cryptic side, sleuths wielding CryptoQuant discover a tantalizing subplot. The Short-Term Holder Unrealized Profit metric, that most elusive beast, has begun to swagger with 10% burgeoning profits. A known precursor of heightened market tension, it portends either an enthusiastic rush to secure riches or the prelude to a frenzied bullish sprint.

Divisions abound among analysts, as though stepping onto the scene were chorus and principals of an avant-garde play. Some point to historical echoes of preparatory build-ups leading to exuberant rises, while others warn of potential pitfalls where dreams crumble into the reality of corrections. What’s clear is the play draws its audience closer, with every data point aligning, choreographing an unfolding drama worthy of Bitcoin’s most pivotal act since perhaps its last standing ovation.

Bitcoin’s Shortsighted Prophets: Envision $131K

Enter Axel Adler, the soothsayer of the crypto realm, declaiming his onchain auguries with the flourish of a seasoned bard. His narratives weave a tale of Bitcoin on the brink of another ambitious caper. Short-Term Holders, with their profit swelling to 10%, are said to embody burgeoning optimism. This crossroads of profit and potential volatility has historically danced hand-in-hand with either a rush to pocket the gains or an audacious push to ride the higher wave. Adler muses on past spectacles where unrealized profits strode to 15%, provoking a brief, sharp correction, before resuming their ascent.

According to Adler’s grand narrative, the next plot twist approaches around the $131.8K mark, where short-term holders may gracelessly bow out to lock in profits. Yet, this juncture could also serve as an accelerant if institutional demand and ETFs continue their unrelenting embrace of supply. The stage appears set for a breakout worthy of a sudden curtain raise from the $125K backdrop of recent days.

Exercise caution, warns the narrative, given the sticker shock of unrealized gains. However, with gold glittering seductively and liquidity slipping into riskier havens, the story suggests a seemingly perpetual bullish cycle. Analysts envision fortunes being rewritten in the coming acts, provided momentum remains strong and short-sighted sellers learn to restrain their hands.

Bullish Ballad at the Cusp of History

At present, Bitcoin twirls around $124,316, barely recoiling beneath its record-settling heights near $126,000, after a pronounced performance scaling from $109,000. The chart displays BTC poised gracefully above its $117,500 anchor-a level that tested resistance with the persistence of an unwanted suitor throughout August and September. The recent successful ascent and ensuing retry transacted a shift in the market choreography that leans irreducibly towards the bullish.

With its moving averages ascending as if to join the flock, the market outlook glistens with positivity. The intricacies of the chart manifest as tightening candles, a balance of negotiation between those annexing profit and soothsayers pointing towards triumphs ahead. Should BTC secure a resolute position above $125,000, it may well spring toward the $130,000-$132,000 heights, where Fibonacci promises extension levels of further mystery.

However, a brief pause seems appropriate, hinting at a necessary quietude after a protracted race. While the marionette strings suggest slight fatigue, so long as the price avoids plunging below $120,000, the bullish structure maintains its grandeur. The narrative persists, fueled by the enigmatic strength in gold and increasing ETF inflows-a grand macro backdrop serenading Bitcoin into next discovery if, of course, the bulls do not succumb prematurely to the allure of short-term jubilation.

💵🔍📈

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Gold Rate Forecast

- Train Dreams Is an Argument Against Complicity

- The Abandons: Netflix Western Series Disappoints With Low Rotten Tomatoes Score

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-10-08 03:19