In a twist that could only be described as a cosmic joke, Bitcoin (BTC) decided to perform a rather spectacular 346% liquidation imbalance today. Picture this: $52 million in longs were unceremoniously flushed down the digital toilet, while a mere $15 million in shorts stood there, bewildered and slightly damp. All of this occurred without so much as a macroeconomic sneeze or a breaking news alert — just a correction that seemed to have been born from the market’s overzealous enthusiasm for one direction. Talk about a dramatic plot twist! 🎭

Now, the initial result might not have looked like the end of the world, but oh, the implications were as clear as a Vogon poem: prices dropped, leverage reset, and Bitcoin wobbled above $86,000 before deciding it was too hot up there and plummeting back below $84,000. It was less of a collapse and more of a mechanical reset, as bearish traders found themselves caught in a narrative that had all the momentum of a three-legged sloth. 🦥

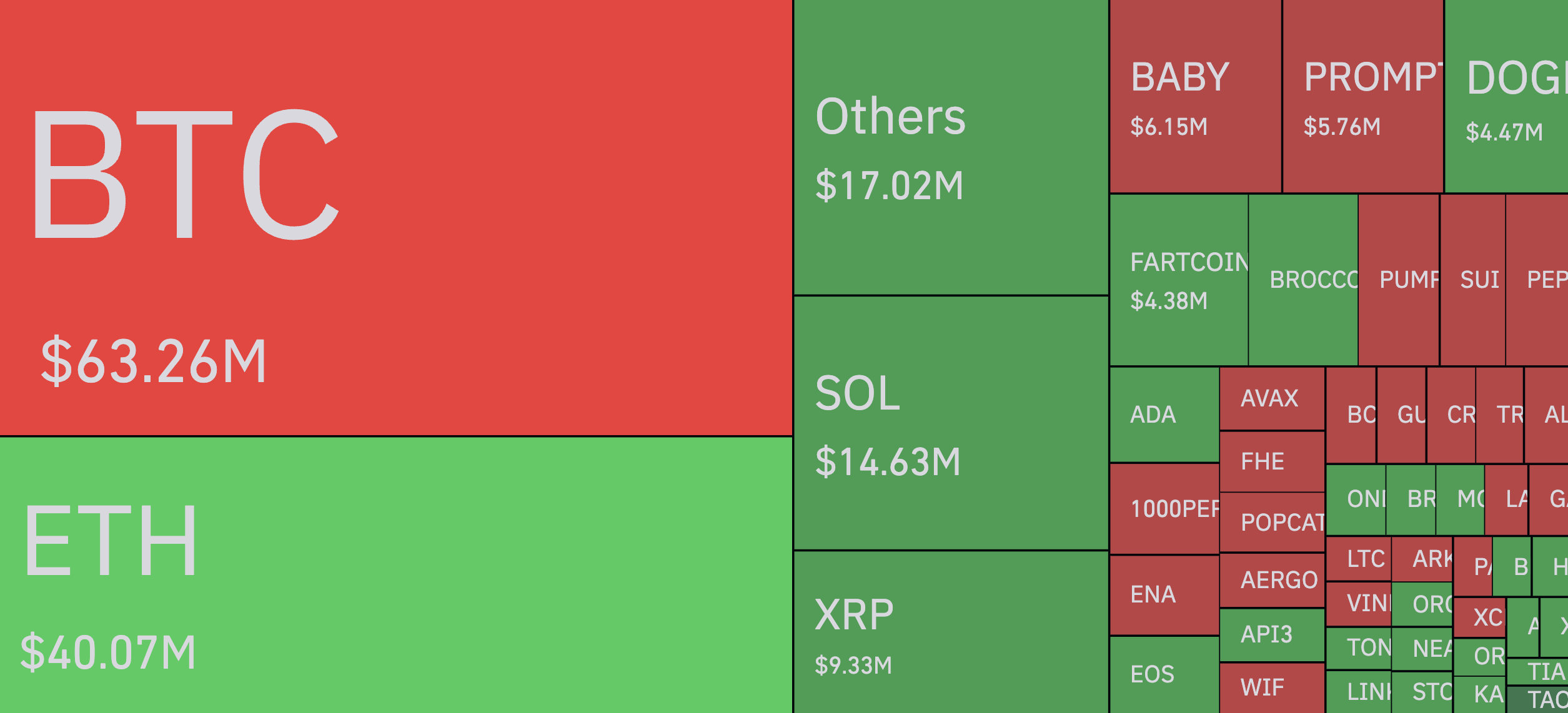

This wasn’t a moment of FOMO or euphoric dancing in the streets; no, it was a reality check of epic proportions. An over-leveraged market quietly tipped over, like a toddler with too many cookies, forcing liquidations to tidy up the mess. While $67 million in total liquidations might not sound like a lot in isolation, the real kicker is the ratio — it reveals just how concentrated sentiment had become and how little downside buffer existed once the tide decided to turn. 🌊

And let’s not forget: there was no CPI data, no Fed minutes, and certainly no sudden moves in interest rates. Just the natural consequence of leverage-heavy setups overstaying their welcome. You can see the results on the chart, which illustrates how quickly prices bounce back once the weak positions are cleared, like a catapulting rubber band of financial absurdity. 🎢

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- KPop Demon Hunters: Real Ages Revealed?!

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- How to Cheat in PEAK

- Death Stranding 2 Review – Tied Up

2025-04-13 18:41