Oy vey! Bitcoin, that digital dreidel, shot up to $89,292 today! The highest since April 2nd, which, let’s be honest, isn’t saying much. But who cares? Traders are throwing money at it like it’s a Bar Mitzvah! Up 3.0% in 24 hours, folks. It’s a miracle! Or maybe just market manipulation. 🤔

Market Schmobservers Notice Something or Other in Bitcoin Activity

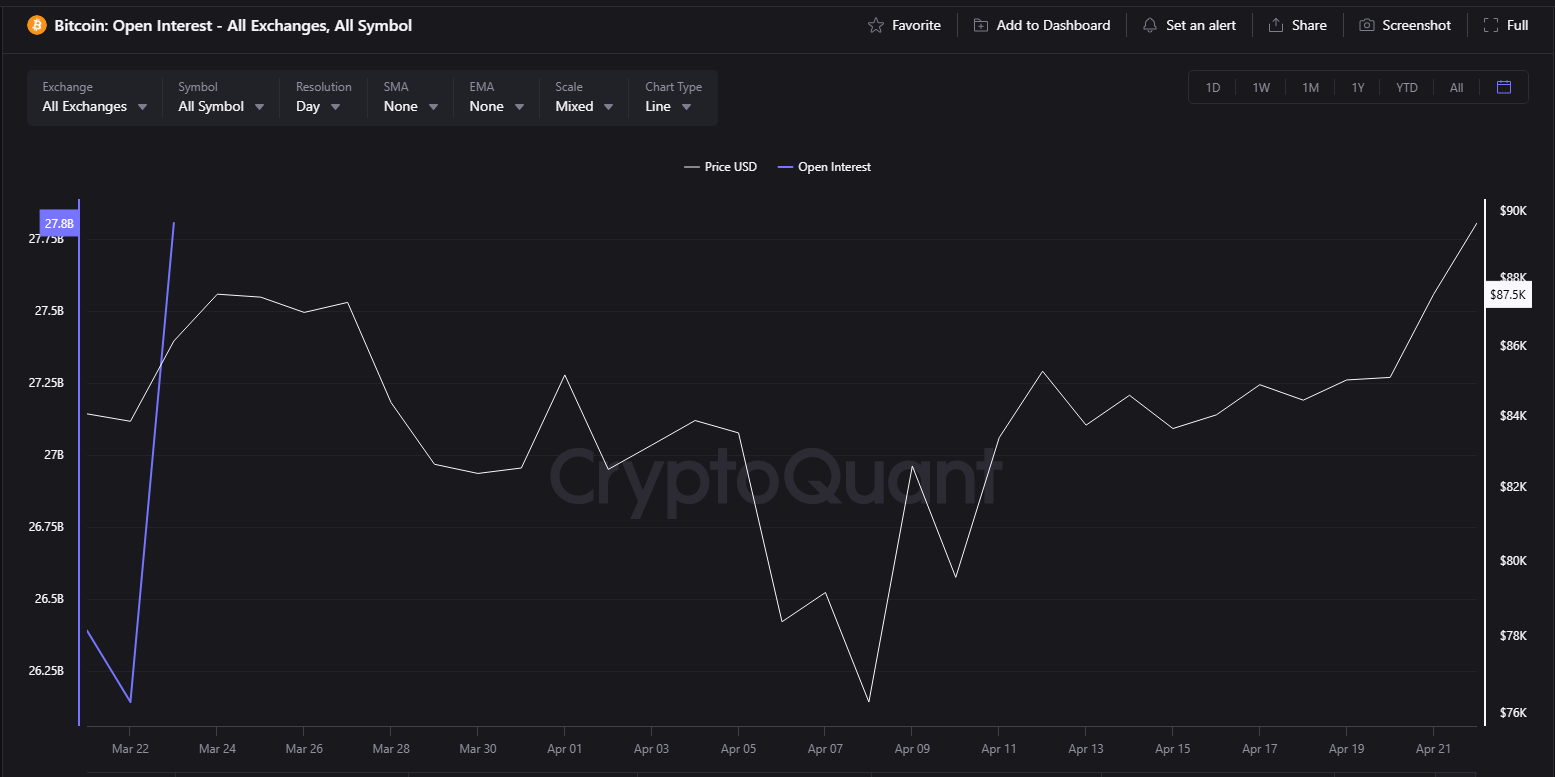

According to CryptoQuant’s fancy-shmancy data, this price jump happened at the same time as a $3.1 billion explosion in open interest. Sounds impressive, right? It probably means nothing. 🤷♂️

This “open interest” thingamajig means a lot of people are betting big on Bitcoin going even higher. Risky, risky! Like investing in a Yiddish theater production. 🎭

Remember that little dip earlier this month? Open interest went from $29 billion to $24 billion. Everyone was kvetching! But now? BAM! Back up to $30 billion! It’s like magic, or maybe just a pump-and-dump scheme. 💸

Options Trading Volume Goes Crazy – Over 300%!

The options market went meshuga! Up 347% to $3.57 billion! And open interest? Up 3.80% to $32.30 billion! It’s all numbers, folks! Meaningless numbers! 🤪

These numbers supposedly mean traders are either covering their tuchuses or betting on wild price swings. The long to short ratio is 1.06, meaning slightly more people are optimistic. But don’t get your hopes up! It could all crash tomorrow! 📉

Whale Investors Keep Buying and Buying

While we’re all distracted by the shiny numbers, the “whales” (rich guys with too much money) are quietly gobbling up more Bitcoin. They went from 3.38 million BTC on January 1st to 3.50 million BTC as of April 20th. Sneaky! 🐳

That’s only a 0.62% increase in the last month. But hey, it’s something! These big shots still believe in Bitcoin, even if it’s just to manipulate the market for their own amusement. 😈

Price Recovery – A Mazel Tov Moment?

This jump to over $89,000 is a good sign, allegedly. It was only around $84,400 the day before. A 3.60% weekly increase! Maybe the buyers are back! Or maybe it’s just a temporary blip. 🤷

Market analysts (who are always right, of course) say that rising open interest and rising prices are a good thing. It means people have confidence! Or they’re just reckless. 🤑

But all this borrowing and speculating could lead to a big disaster. Like a borscht belt comedian bombing on opening night. 🍅

If the market changes its mind, all these leveraged positions could cause a massive sell-off! A financial tsunami! So, you know, be careful. Or don’t. What do I know? 🤷♀️

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Tainted Grail The Fall of Avalon: See No Evil Quest Guide

2025-04-23 10:24