Darling, it appears that a whopping 87% of Bitcoin holders are currently sashaying in profit — quite the fete, considering the usual market rollercoaster. One must say, the optimism is simply infectious, despite Bitcoin’s occasional temper tantrums.

Let us dive, with all the delicate finesse of a debonair swimmer, into the curious case of Bitcoin holders’ profit shares, market gambols, and transaction dalliance to unravel where this merry market affair is heading.

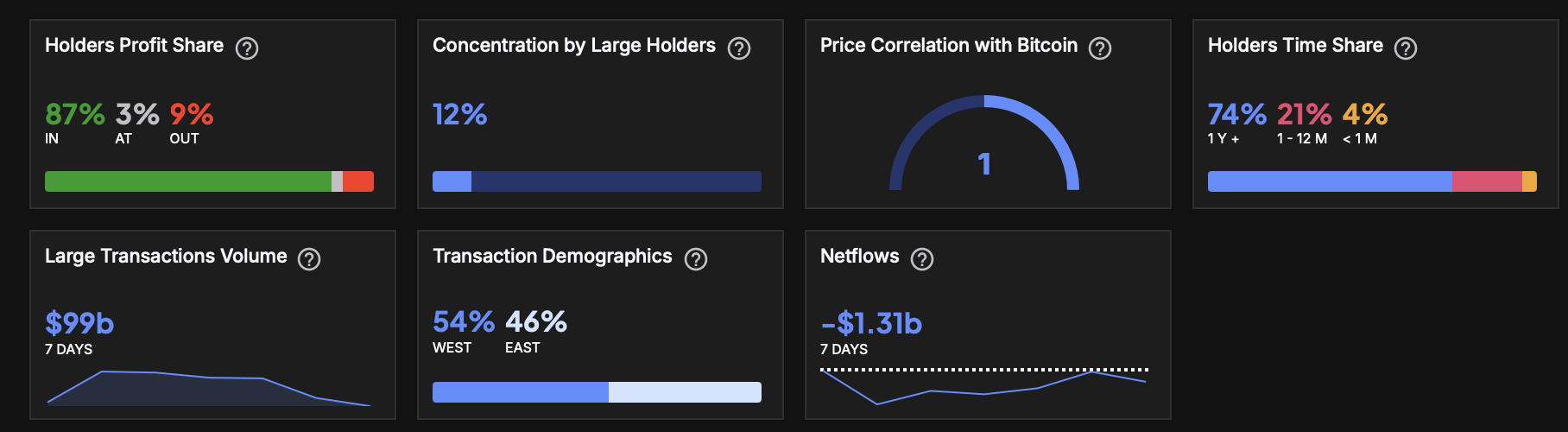

1. Holders Profit Share

Brace yourself: 87% of Bitcoin aficionados are currently sporting green numbers like they’ve just found a pot of gold at the end of the blockchain rainbow. A modest 9% are sulking in the red, and a mere 3% hover around the dramatic “breaking even” tightrope. It seems BTC has decided to be the belle of the ball rather than the wallflower.

2. Concentration by Large Holders

Only 12% of the entire Bitcoin banquet is being dined upon by the grandiose large holders. Not exactly a monopoly on the caviar of cryptocurrencies, suggesting that the market remains ‘decently’ decentralized—which is a polite way of saying the fat cats haven’t quite gobbled it all up yet.

3. Holders Time Share

How long do these lovers of Bitcoin cling to their digital romances? A splendid 74% have been betrothed to their coins for over a year. 21% are the impatient flirts of 1–12 months, and a shy 4% are the fresh-faced debutantes with less than a month under their belts. Commitment? Oh, it’s positively the season for that!

4. Large Transactions Volume

In the past week, a staggering $99 billion sashayed through the market in large transactions, no less. This lavish spending binge suggests that the high rollers and institutions aren’t just twiddling thumbs—they’re throwing down chips with dazzling confidence.

5. Transaction Demographics

The world stage remains fairly well balanced, with transaction action flirting slightly more in the West (54%) than the East (46%). It seems Bitcoin enjoys a global ballroom, with everyone invited to dance this rather sophisticated financial fandango.

6. Netflows

Alas, a slight party pooper: the market saw a net outflow of $1.31 billion last week. Quite the “who’s leaving the soirée early?” moment. Perhaps a few profit takers or those tired of the crypto cha-cha decided to sip cocktails elsewhere.

Conclusion

In sum, our beloved Bitcoin market is currently strutting with the confidence of a debutante at her first ball—most participants are smiling profitably, and the big spenders are wagging their tails with glee. Sure, a few are slipping out the back door, but the long-term romantics and high rollers keep the party alive and kicking. So, keep your wits sharp and your champagne glass fuller; the crypto cabaret is showing no signs of curtains just yet.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-04-20 17:34