This week, Bitcoin (BTC) is practically holding its breath, waiting for key US economic reports. Apparently, President Trump’s economic decisions have made Bitcoin more sensitive than a cat to loud noises when it comes to macroeconomic data. And if you’re wondering why crypto traders are so anxious, it’s because Trump’s policies are making the crypto market jittery with fear and excitement, all at once.

With Bitcoin still lounging above $100,000 (for now), its fate for the coming week depends on a few crucial US economic reports. Will it soar, or will it get swept under the rug? Keep reading for the juicy details.

US Economic Data To Watch This Week

If you’re a crypto trader with a pulse, these are the indicators you need to keep an eye on.

CPI – The Hottest Indicator of the Week

So, we’re starting the week with a no-news Monday—hooray for Mondays, am I right? But then, the Consumer Price Index (CPI) arrives on Tuesday, and boy, is it going to make waves.

The April CPI is more important than your morning coffee, especially for Bitcoin and crypto fans. The CPI reflects inflation, and with the US CPI arriving just after the Fed’s meeting, things are about to get spicy.

Jerome Powell, the man of the hour, made his concerns clear: the economic outlook is as uncertain as a toddler in a candy store. And let’s face it, we all know how much that can shake up the market.

“CPI is one of the main indicators for the Fed, and this release could show whether tariffs are pushing inflation higher,” a user pointed out on X (Twitter). You don’t want to miss this one!

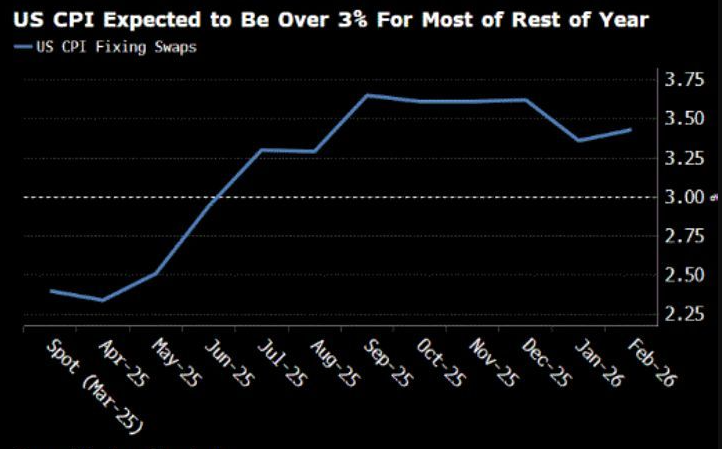

But hold your horses, because some say US CPI could stay above 3% for most of the year. Will it? Who knows! The suspense is killing us.

Experts are predicting a CPI of 2.3%, down slightly from 2.4% in March. If it shows easing inflation, we might see the Fed cutting rates soon. That could weaken the dollar but give Bitcoin a boost. But if inflation spikes, we’re looking at a more hawkish Fed and a stronger dollar. Yikes!

Initial Jobless Claims – The Unemployment Drama

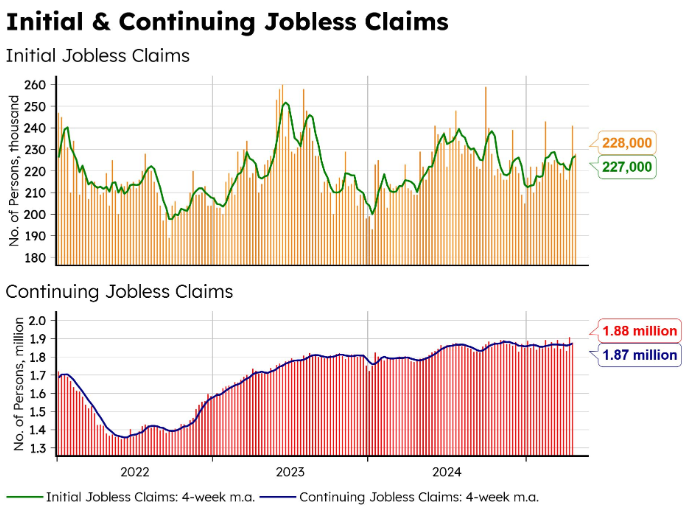

Next on the list: jobless claims. Will Americans keep their jobs, or will they be looking for work? Last week’s initial jobless claims were surprisingly low at 228,000, beating expectations. Can we say… recovery?

“No signs of labor market stress in the last week of April. Jobless claims—both initial and continuing—are steady,” a global macro researcher said. Well, steady is better than shaky, right?

But here’s the kicker: a low jobless claim is bad news for Bitcoin. A healthier labor market could mean less volatility for the dollar but more bearish pressure on crypto. Ain’t that just the way?

PPI – Producer Price Index, aka the Price of Everything

Ah, the PPI. It’s like the CPI, but it’s for businesses. It tracks the prices that companies pay for goods and services. March’s PPI dipped by 0.4%, which is basically the economic equivalent of a deep breath after running a marathon.

But beware—Trump’s tariffs add an element of chaos, and that could stir up disinflationary trends. In other words, we’re walking a fine line between stability and a wild ride.

“Hot CPI and PPI data this week could likely trigger short-term downside for the S&P 500 (2–5% pullback) and Bitcoin (5–10% decline) due to fears of tighter Fed policy and rising yields,” an analyst warned. Don’t panic… yet.

Consumer Sentiment – The Mood of the Market

And last but not least, we have the Consumer Sentiment report. It’s a measure of whether people are feeling good about the economy—or whether they’re about to hide under their blankets.

The University of Michigan’s latest consumer sentiment report showed a sharp drop in April, falling to a five-year low. Ouch! This could mean that consumers are about to tighten their belts, reducing liquidity for risk assets like crypto.

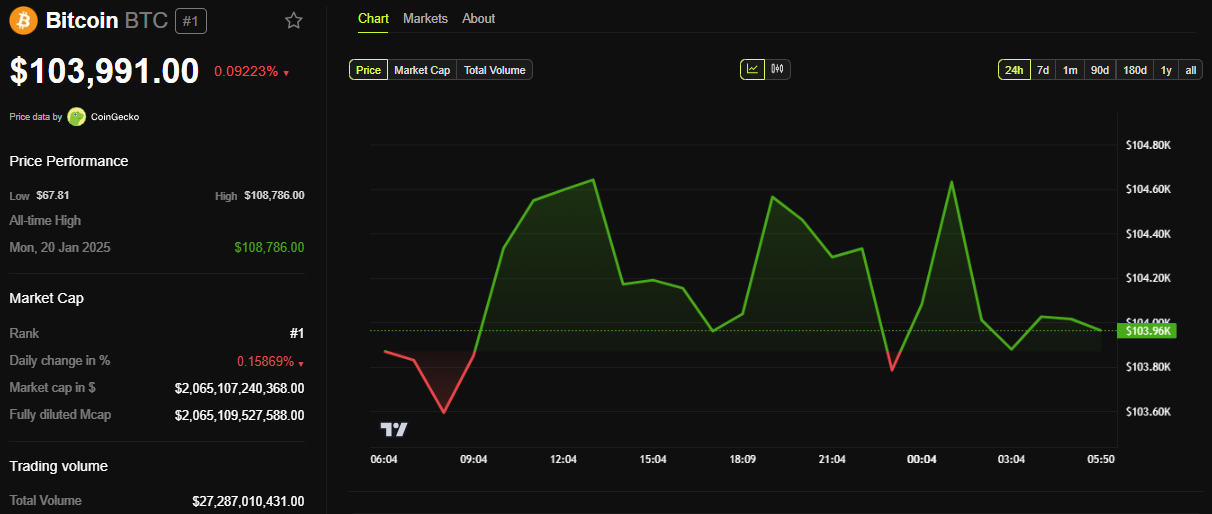

As of this moment, BTC is trading at $103,991, a modest dip of 0.09% in the last 24 hours. It seems like the market’s on edge—better hold onto your hats.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- KPop Demon Hunters: Real Ages Revealed?!

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- How to Cheat in PEAK

- Death Stranding 2 Review – Tied Up

2025-05-12 14:29