In the shadow of the Federal Reserve’s latest temerity to slash interest rates, Bitcoin, that digital phoenix of hubris, plummeted for four days straight, its price now languishing at levels not seen since the autumnal chill of October 23. Such was the fate of the coin as Donald Trump, that master of theatrics, inked a trade pact with Xi Jinping, a moment so mundane it could only beget chaos.

- The Bitcoin price, once bold, now crumbles beneath the weight of Federal Reserve rate cuts. 🎭

- The Fed’s “hawkish” stance-a cruel jest-sent analysts scurrying like frightened rodents. 🐀

- Liquidations surged, and the “death cross” loomed, a grim omen for the unwary. 💀

Bitcoin’s Plunge: A Lesson in Selling the News

Two forces, like twin wolves howling in unison, drove Bitcoin’s descent. First, the Federal Reserve’s 0.25% rate cut, a move so predictable it might as well have been written in the stars-or at least in the tea leaves of Wall Street analysts. For what is an expected event but a prelude to betrayal? Investors, ever the opportunists, bought the rumor and sold the reality, their wallets clinking with hollow triumph. 🛍️

Second, the trade deal between Trump and Xi, a fragile truce as fleeting as a candle in a storm. Scott Bessent’s words, those hollow promises, were met with glee by some and dread by others. Yet the market, ever the cynic, saw through the charade. “A tactical de-escalation,” quoth Mohamed El-Erian, as if peace were but a chess move in a game of economic chess. 🏰

Thus, Bitcoin’s price fell, not from fear, but from the cold calculus of investors who had already cashed in their chips. A masterclass in greed and timing, or perhaps a parable for the ages. 🎓

The Liquidation of Dreams

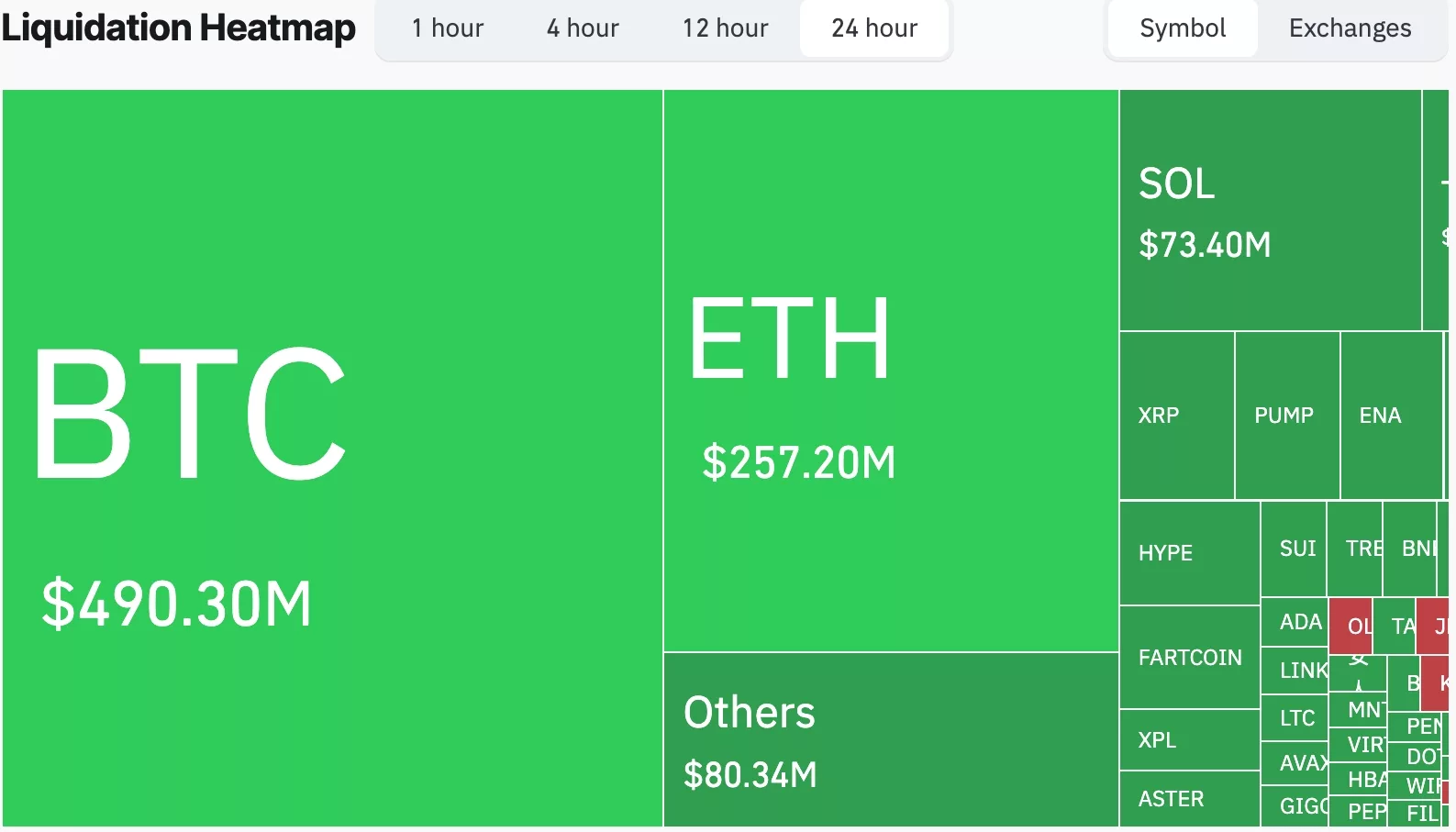

As the Fed’s cuts reverberated, Bitcoin’s price was further battered by the relentless tide of liquidations. $483 million in 24 hours-what a spectacle! One trader, on Hyperliquid, watched their $21.4 million vanish like smoke, a modern-day Icarus who flew too close to the sun of leverage. 🔥

For what is a liquidation but the market’s way of saying, “You’ve gone too far, my friend”? As open interest in Bitcoin futures dwindled from $94 billion to $73 billion, the air grew thin for the bullish. Deleveraging, that merciless taskmaster, reigned supreme. 💸

ETFs: The Great Exodus

The spot Bitcoin ETFs, once the darlings of the crypto world, now faced their reckoning. $470 million in outflows-Fidelity’s FBTC, Ark’s ARKB, BlackRock’s IBIT-each shedding assets like a serpent shedding its skin. A dance of despair, as investors fled the sinking ship. ⛵

The Death Cross: A Tragic Omen

And lo, the death cross approached, a grim crossroads where the 50-day and 200-day moving averages converged. A symbol of doom, whispered of in darkened trading rooms. Would Bitcoin fall to $100,000? Perhaps lower still, like a soul descending into the abyss. 🌑

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Mario Tennis Fever Review: Game, Set, Match

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Brent Oil Forecast

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- All Itzaland Animal Locations in Infinity Nikki

2025-10-30 18:22