Ah, the fickle nature of bitcoin! Just as it seemed to be basking in the warm glow of Friday’s $84,000, it took a nosedive into the abyss, plummeting below the $80,000 threshold by Sunday. A mere weekend’s frolic resulted in a loss of $4,600—truly a modern tragedy worthy of Shakespeare! 🎭

Bitcoin’s Sunday Decline Triggers Deep Losses Across Digital Assets

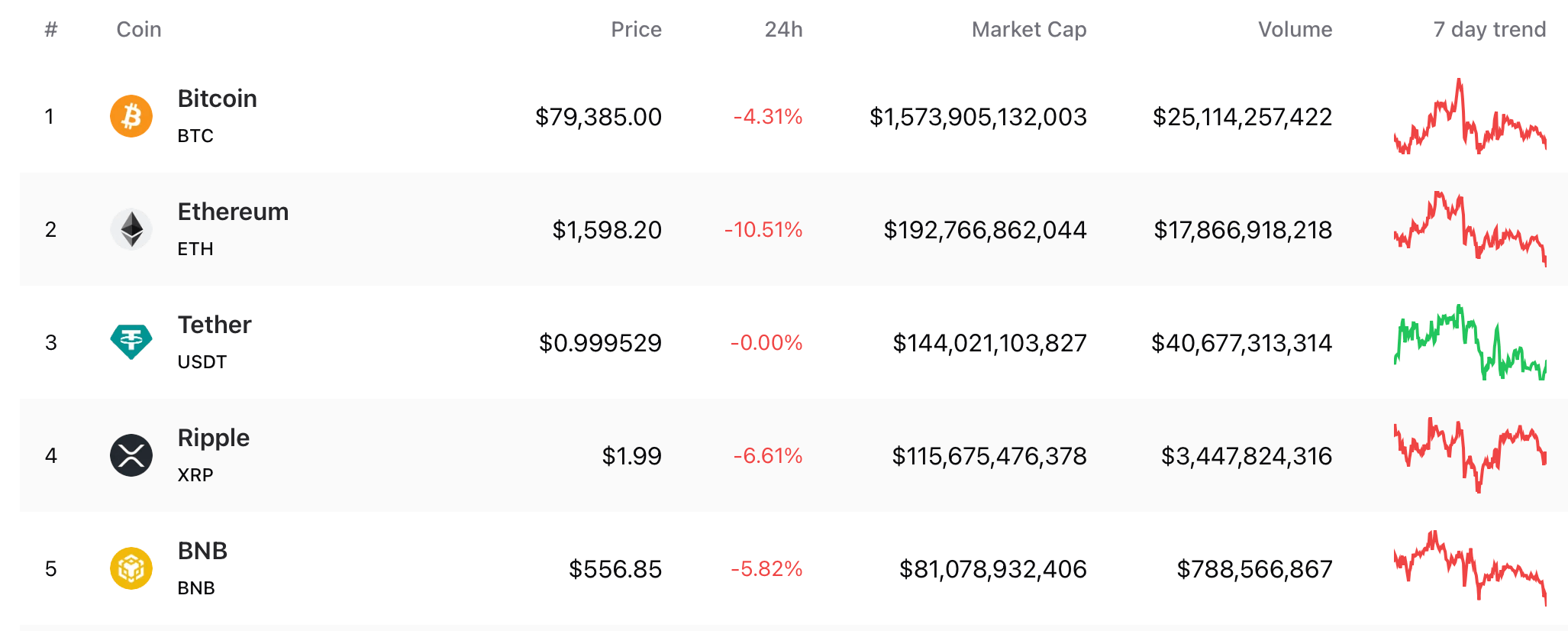

By the time the clock struck five on Sunday evening, bitcoin ( BTC) was trading at a paltry $79,385 per coin, having earlier flirted with an intraday low of $78,639. As of this moment, BTC had declined 4.3% against the U.S. dollar, with a 30-day contraction of 9.3%. The evening’s most popular trading partner? Why, it’s none other than USDT, followed closely by the usual suspects: USD, USDC, FDUSD, EUR, and KRW. Quite the soirée! 🎉

Bitcoin’s unfortunate tumble has sent shockwaves through the broader digital asset sector, with altcoins following suit like a gaggle of geese in a panic. Ethereum ( ETH) suffered a 10.5% drop today, while XRP is down 6.6%. BNB slipped by 5.8%, and SOL has relinquished approximately 9.5% of its value in the past 24 hours. Even DOGE, that once-mighty meme coin, mirrored SOL’s retreat, losing 9.5% as well. Since Friday, the crypto market has experienced a staggering $160 billion contraction—most of which unfolded on Sunday, as if the universe conspired to ruin our weekend. 😱

In other corners of the sector, several tokens registered double-digit pullbacks. TAO dropped 14.7% today, WLD fell by 13.7%, and OP retreated 13% against the greenback. At 1:45 p.m. ET on Sunday, crypto derivatives markets recorded $252.79 million in liquidations. That figure soared to a staggering $603.08 million by 4:30 p.m. as BTC fell beneath the $80,000 line. Roughly $165 million of those wiped-out positions were BTC long positions, with an additional $148 million in ETH long bets facing similar fates. A veritable bloodbath! 🩸

Sunday’s volatility laid bare the delicate equilibrium within crypto markets, as bitcoin’s decline rippled through altcoins and derivatives with swift consequence. Widespread liquidations exposed the fragility of leveraged positions, intensifying the extent of losses as prices sank beneath $80,000 and even $79,000. These sudden reversals challenge investor conviction, compelling a fresh evaluation of risk in the face of unstable valuations. One might say it’s a lesson in humility, though I suspect many will simply blame the weather. ☔

At precisely 5 p.m. ET on Sunday, BTC was trading below the $79,000 mark at $78,770 per unit. A fitting end to a weekend of woe!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

2025-04-07 00:28