Ah, the week that Bitcoin decided to throw a tantrum! The cryptocurrency’s sharp sell-off has sent ripples of concern through the market, with many attributing the chaos to the escalating tensions between Israel and Iran. Who knew geopolitical drama could affect digital coins? 🎭

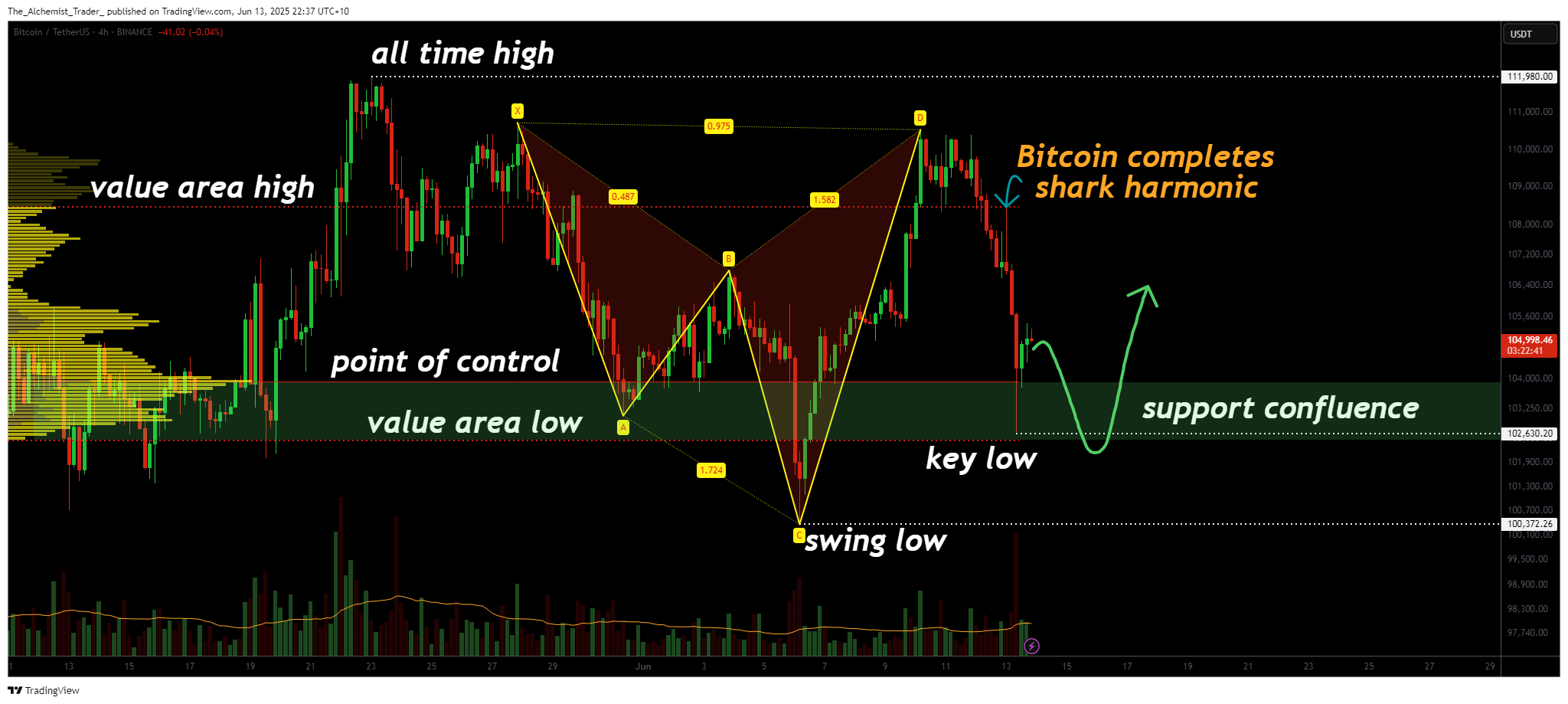

While the headlines screamed panic, the charts were quietly sipping tea, having already laid out the roadmap to disaster. A bearish shark harmonic pattern, paired with a breakdown from key volume levels, suggested that a corrective move was not just probable, but practically guaranteed. It’s almost as if the charts were saying, “I told you so!” as Bitcoin (BTC) was consolidating near the value area high, blissfully unaware of the brewing storm in the Middle East.

As news of military confrontations broke, global risk sentiment took a nosedive, leading to a crypto market liquidation frenzy. But let’s not forget, the technical structure had already shown signs of exhaustion. As predicted on June 10 in this analysis article, the shark harmonic pattern hinted at a full market rotation, which, in true dramatic fashion, played out like a well-rehearsed tragedy.

Key technical points

- Bearish Shark Harmonic Completed: The pattern projected a retracement from VAH to VAL, like a well-timed plot twist.

- Breakdown of Value Area High: Confirmed technical weakness, leading to an impulsive sell-off that could make even the most stoic investor weep.

- News of Israel-Iran Tensions Added Volatility: Macro uncertainty accelerated the move but didn’t initiate it—like a bad sequel that no one asked for.

- Value Area Low and Key Low Now in Focus: Price has tapped into strong support—a possible bounce zone, or a trapdoor waiting to open.

The move began with price consolidating above the value area high (VAH), a level that had acted as resistance throughout recent trading sessions. The confirmation of the shark harmonic came when Bitcoin lost the VAH, triggering a technical breakdown faster than you can say “market correction.” From there, price moved quickly toward the point of control and then into the value area low, completing the harmonic structure like a well-executed heist.

While the drop coincided with rising geopolitical tension, particularly the developing military standoff between Israel and Iran, it’s crucial to note that this was not a random crash. The technical structure had already forecast a bearish expansion, and the news simply added speed and volatility to a move that was already in motion—like a catapult launching a boulder down a hill.

Price has now wicked into the VAL, establishing a key swing low. This level is a critical support area. Holding above it may trigger a relief rally or even a full rotation back toward the VAH, provided short-term price action confirms stability. Fingers crossed! 🤞

What to expect in the coming price action

If Bitcoin holds above the value area low and builds support here, a recovery toward the POC and VAH is technically reasonable. But beware! If this key swing low is lost with momentum, further downside may unfold, like a plot twist no one saw coming. While the news shook the market, the chart had already warned, and this drop may ultimately serve as another long-term buying opportunity within Bitcoin’s broader trend. Stay tuned! 📈

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lottery apologizes after thousands mistakenly told they won millions

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-06-13 16:27