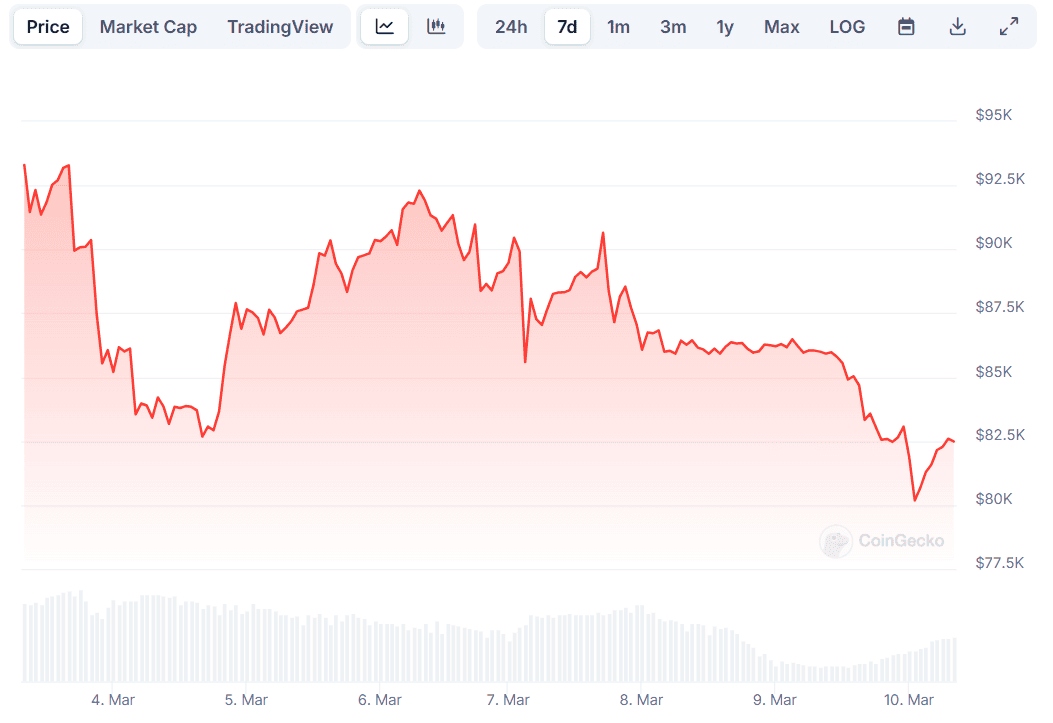

Ah, the weekend passed with Bitcoin (BTC) basking in the serene glow of $86,000, a tranquil oasis in the tumultuous desert of cryptocurrency. Yet, as if summoned by some unseen hand, the bears, those ever-persistent creatures of the night, seized control, dragging our dear asset down to a disheartening $80,000. How poetic! 🐻

In this latest tragicomedy, over 220,000 traders, perhaps too enamored with their own bravado, found themselves ensnared in a web of over-leverage. The figures, as reported by the ever-reliable CoinGlass, reveal a staggering $620 million in liquidations over the past 24 hours. A veritable feast for the bears! 🍽️

Of this grand total, Bitcoin trades accounted for a princely sum of $240 million, while Ethereum (ETH) contributed a modest $108 million, and Ripple (XRP) chimed in with a mere $30 million. Such is the nature of the market, where fortunes are made and lost in the blink of an eye! 💰

In a particularly dramatic twist, the largest single liquidation order occurred on Binance, involving the BTC/USDT trading pair, costing one unfortunate soul a staggering $32.09 million. One can only imagine the lamentations echoing through the halls of their financial abode! 😱

Yet, as fate would have it, our beloved cryptocurrency managed a slight recovery, now hovering around $82,500. Alas, despite this flicker of hope, BTC remains ensconced in the depths of despair on both weekly and monthly scales. A true tragedy! 📉

Many in the industry, with eyebrows raised in disbelief, ponder the reasons behind this dismal performance, especially in light of the recent favorable news from the White House. One might say it’s a classic case of “sell the news.”

Recall, if you will, that President Donald Trump, in a moment of rare clarity, signed an executive order to establish a strategic Bitcoin reserve and a Digital Asset Stockpile. However, this noble initiative requires the government to hold onto previously seized cryptocurrencies rather than directly investing in new ones. A curious strategy, indeed! 🤔

As we look to the week ahead, marked by the impending release of CPI data on March 12, one can only brace for the volatility that lies in wait. The Federal Reserve, ever the vigilant guardian, will scrutinize this report, using it to determine the fate of interest rates. Historically, such decisions have sent BTC on wild price swings, akin to a dramatic ballet! 💃

Read More

- How to use a Modifier in Wuthering Waves

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mistfall Hunter Class Tier List

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- WIF PREDICTION. WIF cryptocurrency

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- Ultimate Half Sword Beginners Guide

2025-03-10 09:19