What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

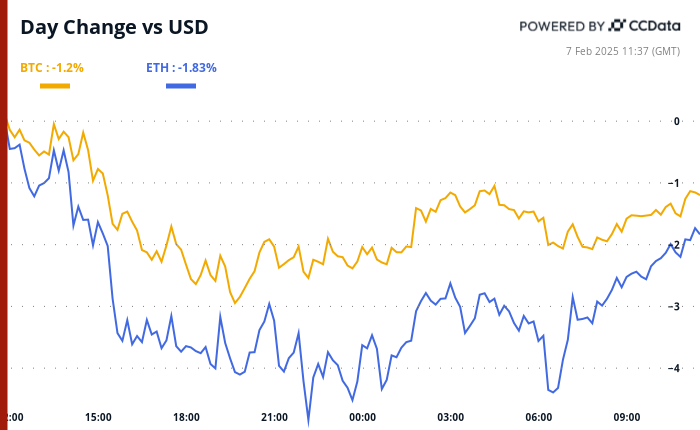

Ah, the crypto market, a veritable circus where Bitcoin (BTC) finds itself languishing below the illustrious $100,000 mark, much like a weary traveler waiting for a bus that never arrives. The U.S. jobs report looms like a dark cloud, and one can’t help but wonder if the prices are simply playing hide and seek. It’s almost comical that they haven’t crossed that threshold yet, especially after Eric Trump, in a moment of familial loyalty, urged the family-linked WLFI to invest in BTC on X. One might think that such endorsements would send prices soaring, but alas, the market seems to have developed a rather stubborn case of indifference. 🤷♂️

In the past, such endorsements during a bull run would have sent prices skyrocketing, but now it appears that mere words are not enough. It seems the market has grown weary of talk and is demanding action. Perhaps Trump should consider a more hands-on approach? Earlier this week, the administration hinted at evaluating the feasibility of a strategic BTC reserve, which sounds impressive until you realize it’s just talk for now.

Perhaps the cautious sentiment ahead of the nonfarm payrolls is keeping the market in check. If that’s the case, we might see a breakout once the data is released, especially if the figures disappoint, potentially sending Treasury yields and the dollar index into a downward spiral. It’s like waiting for a bad punchline that never comes. 😅

Meanwhile, the LondonCryptoClub newsletter suggests keeping an eye on revisions of previous figures. “Bloomberg Intelligence expects some large downside revisions, suggesting the labor market is not as robust as it once appeared,” they quipped on X. It seems the market (and even the Fed) are underestimating the rate cuts that will inevitably come. Who knew economics could be so entertaining?

At press time, Volmex’s one-day bitcoin implied volatility index stood at an annualized 51%, suggesting a daily price swing of $2,600. In layman’s terms, that means the price could dance around like a drunken ballerina, moving $2,600 in either direction. Notably, some traders are buying put options, preparing for potential downside volatility should the data come in strong. It’s like preparing for a storm that may or may not arrive. 🌩️

In other news, the “Strategic Bitcoin Reserve” bill has passed the House in Utah and is now headed for the Senate. Bloomberg ETF analyst James Seyffart reported that the U.S. SEC has acknowledged Grayscale’s Solana 19b-4 filing. And VanEck, in a moment of optimism, predicted a $500 price for SOL, more than double its current value of around $180. One can only hope they’re not just throwing darts at a board.

Additionally, FOX reporter Eleanor Terrett shared that U.S. House Financial Services Committee Chairman French Hill and Digital Assets Subcommittee Chairman Bryan Steil have released a stablecoin regulation discussion draft, proposing a two-year ban on stablecoins backed solely by self-issued digital assets. It’s like trying to regulate a wild horse that refuses to be tamed.

And finally, Berachain’s BERA token, which debuted yesterday, has already recorded a staggering perpetual trading volume of $4.8 billion, with its price currently sitting at $7.60, a significant drop from yesterday’s peak of $14. Stay alert, folks! The crypto world is nothing if not unpredictable. 🥳

Conferences

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Feb. 7: Solana APEX (Mexico City)

- Feb. 13-14: The 4th Edition of NFT Paris.

- Feb. 18-20: Consensus Hong Kong

- Feb. 19: Sui Connect: Hong Kong

- Feb. 23 to March

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-02-07 15:17