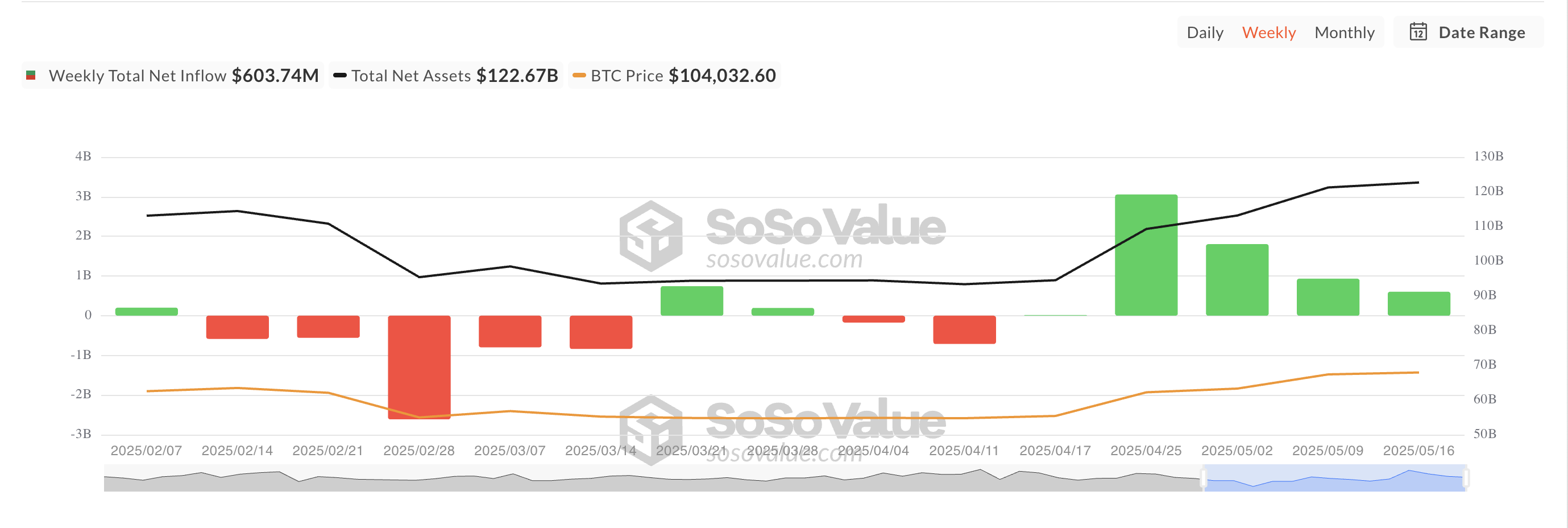

Last week, those rather vulgar US-listed spot Bitcoin exchange-traded funds (ETFs) 🤑 managed to scrape together a net inflow exceeding $600 million. A sum, I suppose, that would impress the nouveau riche.

While this charade of positive capital movement into these digital baubles continued, it also represented the feeblest weekly inflow in a month. One begins to suspect even these digital enthusiasts are capable of a modicum of caution, or perhaps, the unspeakable act of profit-taking. 🧐

ETF Inflows Slow, Darling, as Price Consolidation Dulls the Senses

Between the 12th and 16th of May, a sum of $603.74 million trickled into these spot BTC ETFs. A net positive, yes, but hardly the sort of figure to set the pulse racing. It merely highlights a more circumspect, albeit sustained, capital movement. One might even call it… boring. 😴

This glacial pace of ETF inflows can be attributed to BTC’s rather tedious price consolidation. A week of sideways shuffling, bumping against a resistance of $104,971 and finding solace at $102,711. The drama! 🙄

This lack of any discernible movement likely prompted investors to adopt a more… let’s say, ‘measured’ approach. The result? Reduced capital inflows. One shudders to think of the boredom.

BTC Eyes Fresh Highs (or Does It?)

Still, a certain bullish momentum, however misguided, persists. The “king coin” (as they so quaintly call it) briefly surged to a three-month high of $107,108 during Monday’s early Asian trading session. A fleeting moment of excitement before correcting to a more pedestrian $104,956. The bullish bias, however, remains stubbornly significant. 🤪

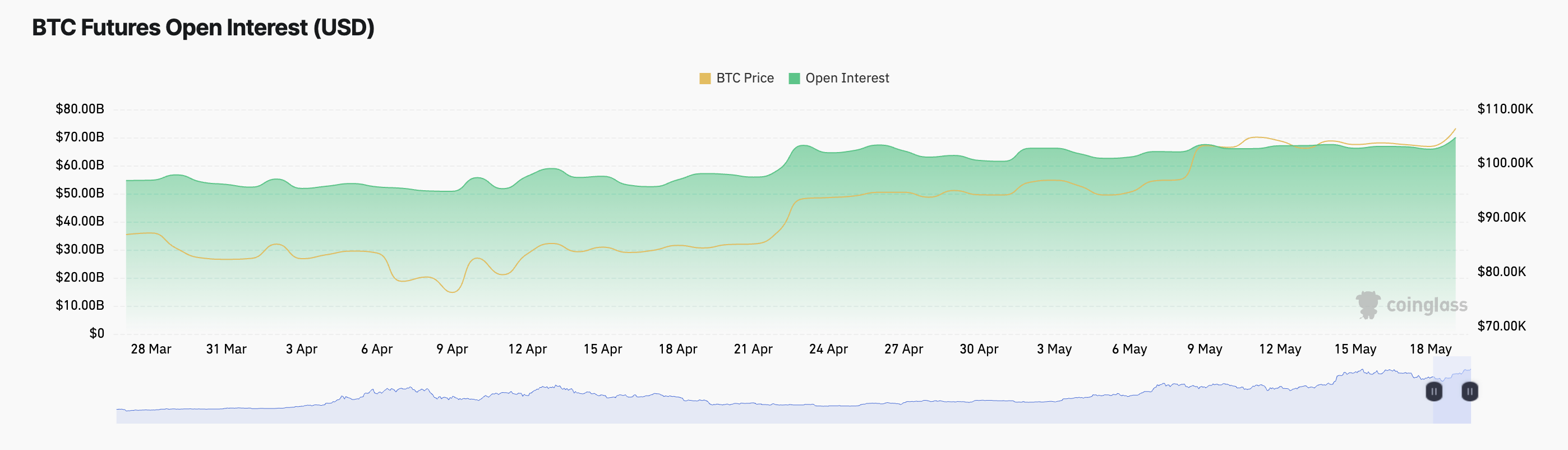

BTC’s little price dance is accompanied by a rise in its futures open interest. A staggering $70.03 billion at the time of writing, a 7% climb over the previous day. One almost feels sorry for those poor souls managing such sums.

Open interest, for those unfamiliar with such vulgarities, refers to the total number of outstanding derivative contracts. When this rises alongside price, it supposedly signals new money entering the fray. This, we are told, supports the strength of BTC’s “ongoing trend” and could trigger a “sustained price uptick.” One remains skeptical. 😒

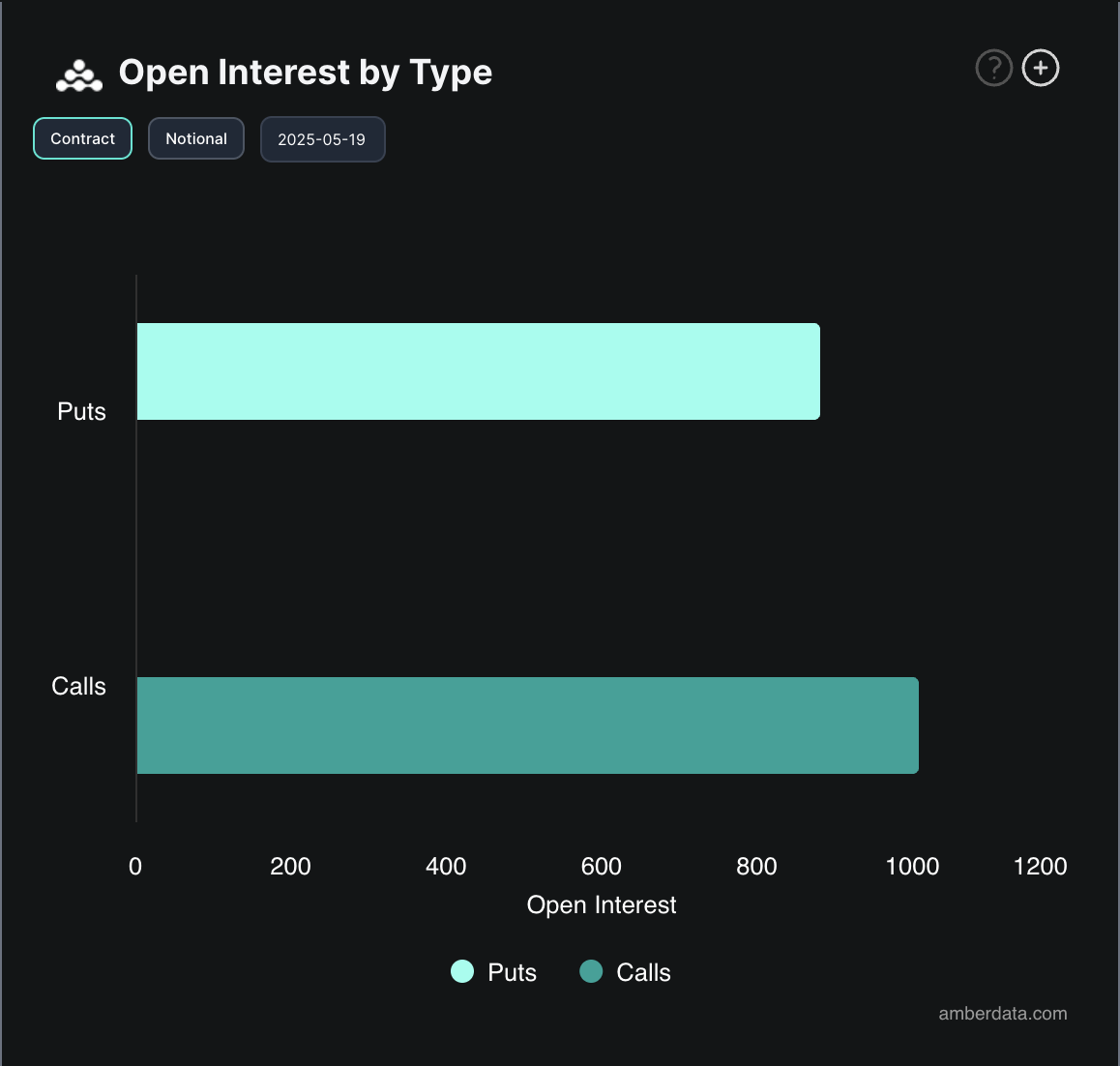

Moreover, options market data further emboldens this optimistic drivel. The demand for call options has outpaced puts, suggesting a growing appetite for bullish positioning. How utterly predictable.

Nevertheless, with derivatives activity surging and BTC reclaiming higher price levels, the coin may, possibly, perhaps, reach new highs in the short term. One wouldn’t hold one’s breath. 😌

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-19 10:40