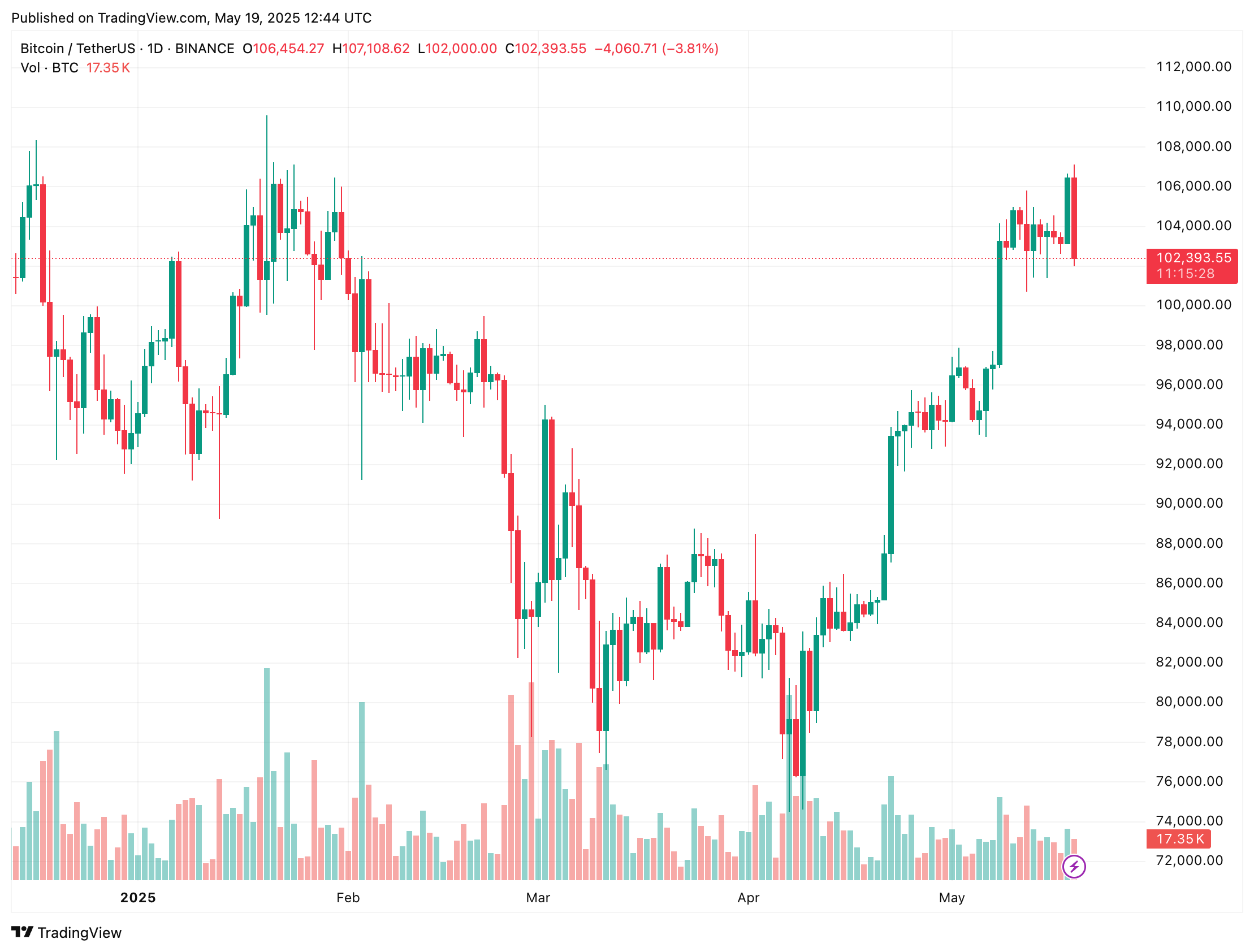

Unlike the previous market rallies, which were as predictable as a Vogon poetry reading, the latest rebound in Bitcoin (BTC) has been a bit more, well, sane. Pushing it from a potential cycle low of $74,580 on April 6 to slightly above $100,000 at the time of writing, this rally is characterized by healthier price movement. 📈

According to a recent CryptoQuant Quicktakes post by the ever-optimistic avocado_onchain, last year’s BTC bull cycle was a wild ride, with the leading cryptocurrency creating and breaking multiple all-time highs (ATHs) like a hyperactive toddler in a candy store. 🍭 This was accompanied by sharp spikes in Binance market buy volume and funding rates, which is a bit like a rollercoaster with no brakes. 🎢

Notably, a sudden increase in funding rates was twice followed by a sharp price pullback due to overheating. In this context, overheating refers to excessive bullish leverage in futures markets that drives up the cost of long positions, signaling overly aggressive sentiment that often precedes a market correction. It’s like trying to drink a smoothie through a straw that’s too small – eventually, it just stops working. 🥤

The following chart illustrates these corrections triggered by excessive leverage in BTC futures. Specifically, boxes 1 and 2 show sharp rises in Binance funding rates, initially accompanied by price increases, then extended periods of correction. It’s a bit like a yo-yo, but with more financial pain. 😖

However, the current rally appears different. According to avocado_onchain, Bitcoin’s ongoing rebound is occurring without an overheated funding rate. In fact, Binance market buy volume is trending downward – as shown in box 3 of the chart – which contrasts with previous bull cycles. It’s like the market has finally learned to walk before it runs. 🚶♂️

The analyst argues that these are signs of a healthier rally, as earlier bull runs were marked by overheated funding rates and abrupt corrections, which weakened investor sentiment. In contrast, the current rally has maintained relatively stable funding rates, suggesting more cautious and sustainable market behavior. It’s like the market is finally taking a deep breath and thinking, “Maybe I shouldn’t eat all the cake at once.” 🍰

Despite short-term price fluctuations, market buy volume has shown a steady upward trend since 2023, as marked by the yellow arrow in the chart. The analyst notes:

This indicates that buying sentiment remains favorable for further upside, suggesting that it’s not yet time to consider an exit. We can’t predict exactly when Bitcoin will break its previous high, but current on-chain and market data signals remain very constructive. 🌟

Besides the stable funding rates and encouraging market buy volumes, BTC is also showing several other positive signs pointing toward a new ATH for the flagship digital asset in the near future. For example, on-chain data shows that long-term holders are not selling, even as BTC trades near its previous ATH of $108,786, recorded in January. This behavior suggests that these investors anticipate further upside. It’s like they’re holding onto their tokens tighter than a Gargraffle holds onto its lunch. 🤔

That said, analysts caution against overly optimistic expectations, noting that Bitcoin may still be far from experiencing a true supply shock. At press time, BTC is trading at $102,393, down 1.4% in the past 24 hours. It’s a bit like the stock market equivalent of a Monday morning after a wild weekend. 😴

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

2025-05-20 03:06