So, Bitcoin’s trying to reclaim higher prices, huh? Good luck with that! 🍀 It’s like watching a guy try to parallel park a semi-truck in a compact spot. After multiple failed attempts to push above key resistance levels, BTC’s just sitting there, sideways as a sidewalk. Momentum? Declining faster than my interest in a second date with a vegan who brings up their diet within the first five minutes. 🚗💨

Axel Adler, the guy who probably has more charts than friends, says we’re in for more bearish times. Weakening demand, sell pressure that won’t quit, and liquidity drying up like my sense of humor at a family reunion. 🎭 Apparently, these are the signs of a prolonged corrective period. Who knew? Not me, I was too busy wondering why my Netflix subscription costs more than my gym membership, and I only use one of those.

Bitcoin’s holding above critical support zones, sure, but it’s like that one friend who says they’re “fine” after a breakup. We all know they’re not fine. Buyers? Cautious. Defensive. Basically, they’re hiding in the financial equivalent of a bomb shelter. 🧑🚀🛡️

And let’s not forget the broader market. Derivatives positioning? Fragile. Stablecoin flows? Meh. Long-term holder behavior? Signals reduced conviction. It’s like everyone’s waiting for the other shoe to drop, but the shoe’s been dangling for so long, it’s starting to look like modern art. 🖼️

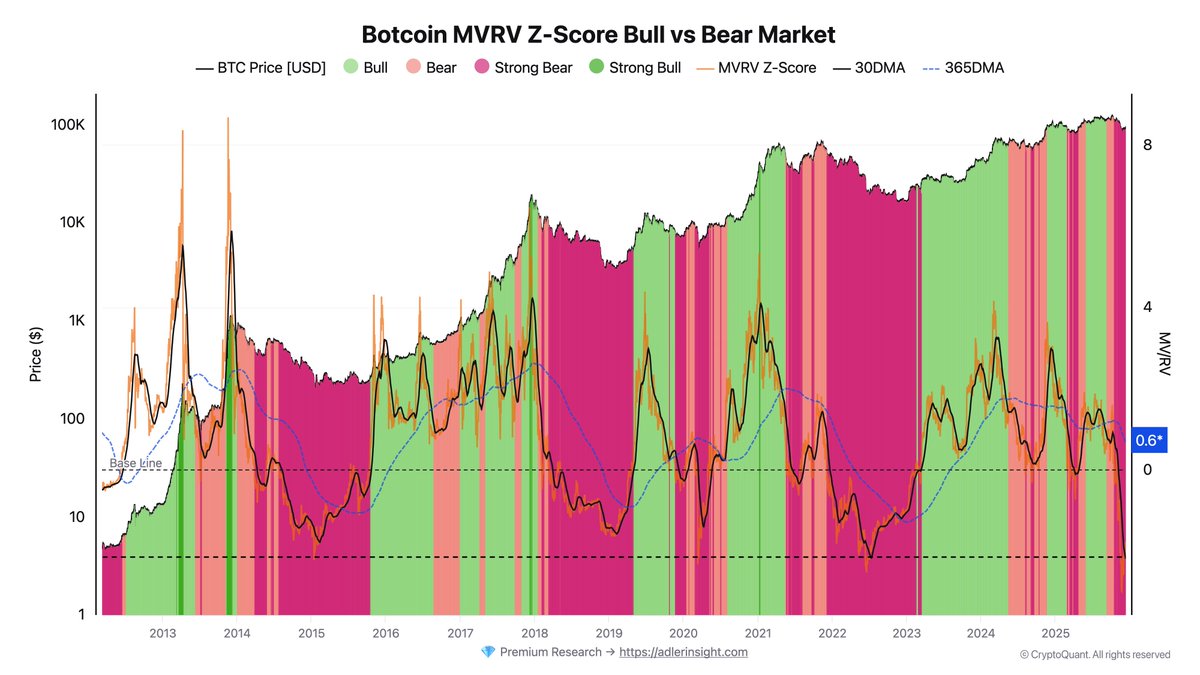

Bitcoin MVRV Spread: The Bear’s Best Friend 🐻📉

Adler’s got this MVRV Z-Score model, which sounds like something I’d fail in college. The 30-day to 365-day MVRV spread is deeply negative, and it’s getting worse. Short-term holders are underperforming like a reality TV star trying to act. 🎭 When this happens, it’s risk aversion city, population: everyone. Demand? Weakening. Exhaustion? Setting in. It’s like the market’s on a treadmill that’s slowly increasing speed, and everyone’s just waiting to faceplant. 🏃♂️💥

A crossover, where the 30-day MVRV rises above the 365-day metric, is like the financial version of a unicorn. 🦄 Adler says it’s not happening anytime soon. The spread’s so far below the threshold, it’s in the financial basement. So, yeah, we’re still in a deep bear phase. Surprise, surprise. 🥱

Cycle analogs say the next crossover window is in the second half of 2026. That’s two years from now! By then, I’ll have forgotten what Bitcoin even is. Short-term rallies? Probably just counter-trend bounces. Sustainable bull market? Not on the menu. Until the MVRV structure improves, sentiment’s gonna stay bearish. 🐻

Price Action: Sideways Shuffle 🕺💤

Bitcoin’s moving sideways like it’s stuck in a never-ending game of limbo. Trading near $92,000 after falling from $120,000? Ouch. Recent candles forming a tight consolidation range? That’s not a reversal, that’s a nap. 🛏️ And with the 50-day moving average acting as resistance, short-term momentum’s still bearish. The 100-day and 200-day moving averages are trending downward, creating a compression zone that BTC can’t even look at without getting intimidated. 💪

Buying activity? Muted. Sell volume? Heavy. It’s like a party where everyone’s leaving, but no one’s arriving. 🎉 Lower highs, lower lows? Classic downtrend. If BTC breaks below $90,000, it’s heading for $86,000-$84,000 faster than I can say “I told you so.” Reclaiming $96,000 would be a sign of strength, but let’s be real, that’s not happening anytime soon. 🏋️♂️

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- All Itzaland Animal Locations in Infinity Nikki

- Mario Tennis Fever Review: Game, Set, Match

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- EUR INR PREDICTION

2025-12-13 06:14