- Falling Bitcoin Net Delta suggests buyer momentum weakened despite aggressive long exposure above $88,000. (I think I saw Net Delta at that weird health food store. Is it supposed to smell like that?)

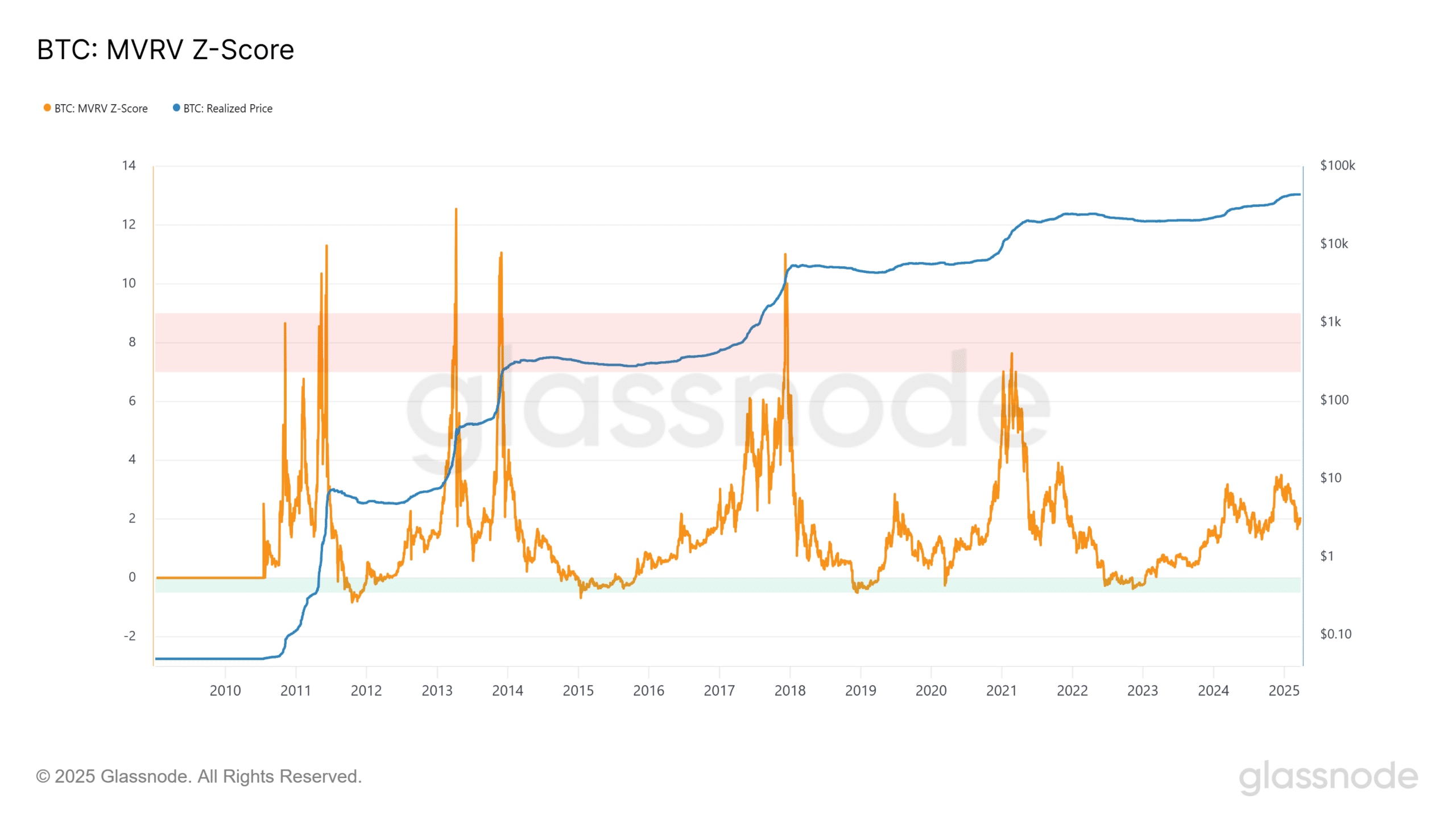

- Realized Price continues rising, but MVRV Z-Score suggests market is cooling, not capitulating. (MVRV Z-Score? Sounds like something my doctor yells at me about.)

Bitcoin’s [BTC] recent market activity highlighted a growing risk for traders holding long positions as price action tightened near a critical level. It’s like that feeling when you’re wearing Spanx and you know, just *know*, they’re about to give way. 😬

The $84,000 zone has become the focal point for institutional positioning and derivative buildup. If breached, it may trigger a rapid sell-off. Think of it as the financial equivalent of a polite cough before someone delivers really bad news.

Warning signs on the horizon (or, things that make you go “Hmmmm…”)

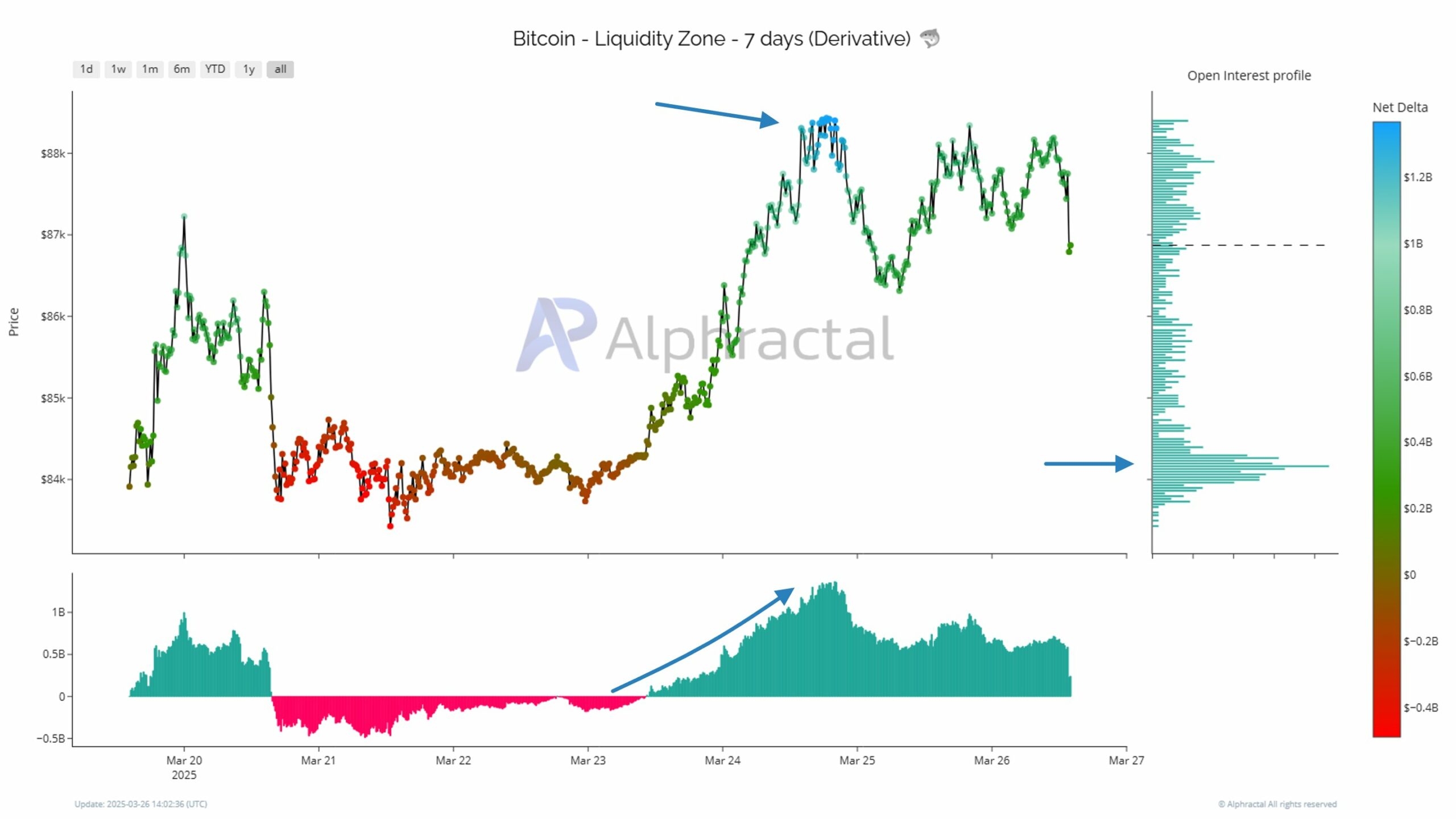

Data from Alphractal show rising Open Interest and increasing inflows into exchanges, pointing to elevated liquidation risk. Alphractal? Is that even a real word? It sounds like something a toddler would make up.

As illustrated in the chart, we can see how Bitcoin’s price rose above $88,000 before stalling. It’s like when you’re trying to parallel park and you think you’ve nailed it, but then you realize you’re still half a car length from the curb.

Many traders entered long positions during this move, expecting continuation. The Open Interest profile shows a buildup of leveraged positions near that price. Oh, the optimism! Bless their little, financially-vulnerable hearts.

Buyers showed up—but then backed off (like me at a karaoke night)

As prices slowed above $88K, Net Delta began falling. This hints at buyers losing control despite continued long exposure. It’s like when you try to convince yourself that third donut is a good idea, but your pants disagree.

If price reverses sharply, the $84,000 zone will become a battlefield. Traders who entered longs above $88K could face liquidation if prices fall below this level. A financial bloodbath, you might say. Pass the popcorn! 🍿

The $84K level holds the highest concentration of contracts, making it a prime liquidity zone. It’s the place where fortunes are made and dreams are dashed. Mostly dashed, if we’re being honest.

This zone functions as both a technical support and a potential liquidation trigger. If prices dip below it, market makers may accelerate the move by exploiting trapped longs. It’s like kicking someone when they are down, but with algorithms.

That breakdown could result in a wave of forced selling. Cue the violins! 🎻

These events happen when leveraged long positions hit stop losses or liquidation thresholds. Such activity often benefits traders holding short positions, especially if entered at higher levels. One person’s financial misfortune is another’s yacht-buying opportunity.

Selling signals are creeping in (like those gray hairs I refuse to acknowledge)

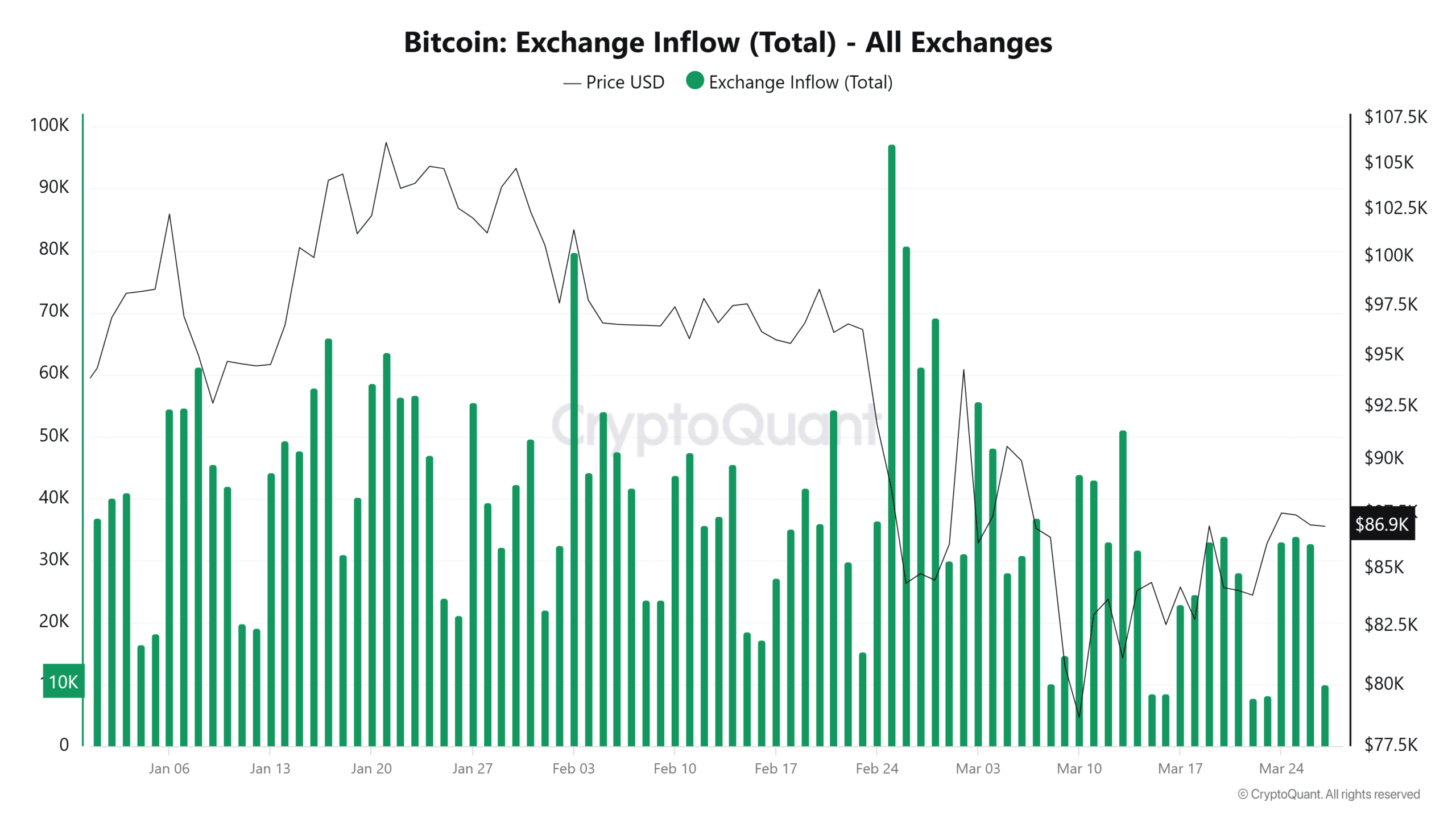

Complementing the structural risk is data from CryptoQuant, which shows a rise in Bitcoin transferred to exchanges in March. These inflows historically signal intent to sell. CryptoQuant? More like Crypto-Panic, am I right?

Between January and March 2025, price moved from a high of $105,000 to $86,911. In that time, major inflow spikes occurred on days with increased volatility. In other words, chaos reigned supreme. 🎉

For example, the 3rd of March saw 31,152 BTC transferred to exchanges when Bitcoin was priced at $84,311. This reinforces the significance of the $84K zone. See? We told you it was important!

By the 27th of March, inflows dropped to 10,053 BTC. While lower, this signals hesitation rather than renewed optimism. A failure to break higher could trigger fresh inflows. It’s like the financial equivalent of writer’s block…but with more zeros involved. 💸

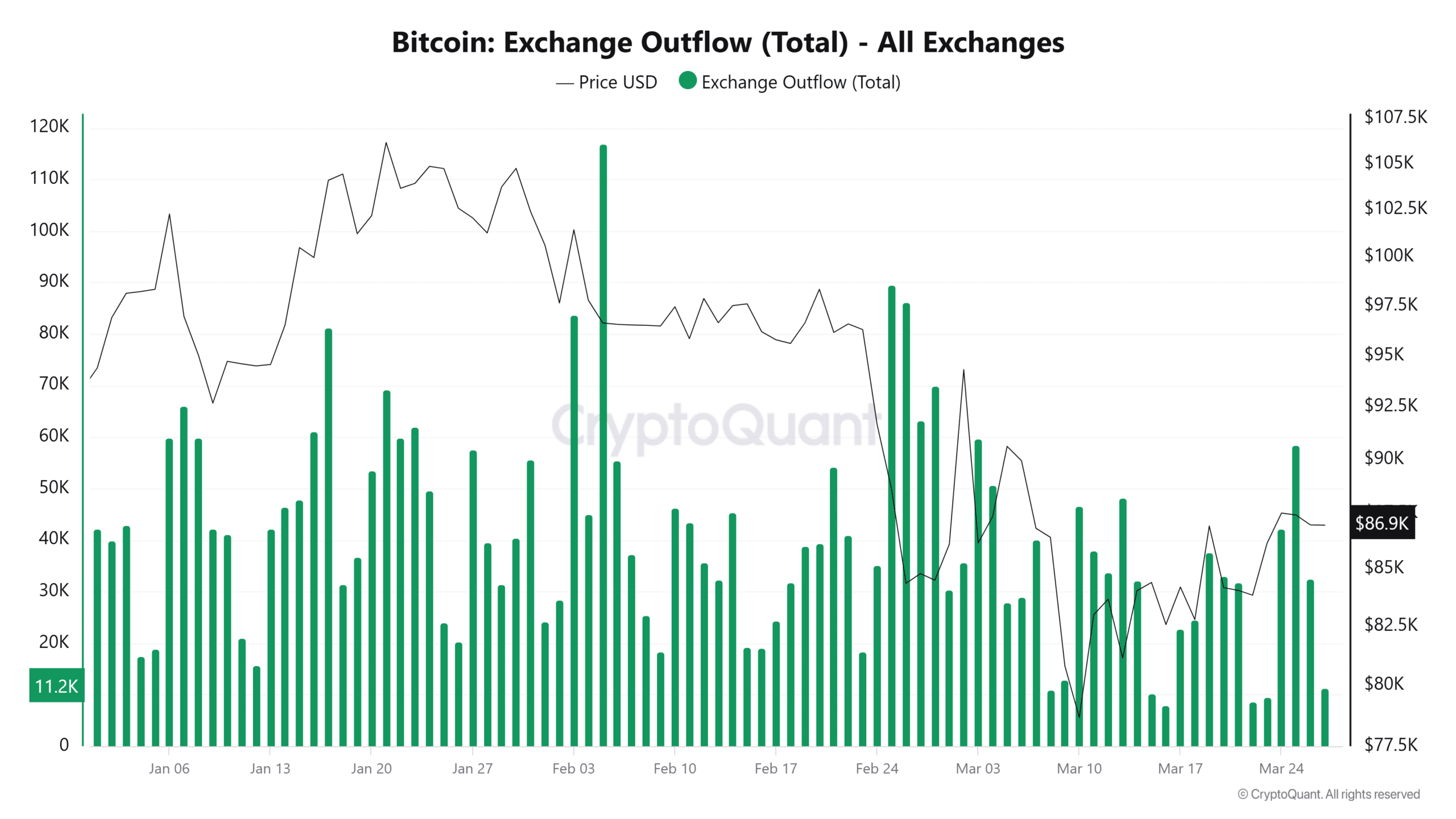

Meanwhile, outflows declined from 86,230 BTC in February to 10,186 BTC by the 27th of March. This suggests reduced accumulation and growing caution. Everyone’s suddenly developed a healthy sense of self-preservation, how novel.

With long-term holders pulling back, bullish support may be weakening. The lemmings are starting to reconsider their life choices.

Bitcoin HODLers hit the brakes (and probably regret that tattoo)

Charts from Glassnode show Bitcoin’s Realized Price increased steadily from $33,149 in November 2024 to $43,696 in March 2025. Glassnode? Sounds like a villain from a bad sci-fi movie.

However, the MVRV Z-Score fell from 3.42 to 1.99 during the same period. The divergence suggests reduced speculative excess, not full capitulation. Historically, scores above 5 mark tops; 2 implies mild overvaluation. Mild overvaluation? That’s like saying my collection of Beanie Babies is “mildly” valuable. 🤔

This is the line—who blinks first? (Spoiler: It’s probably me)

Bitcoin trades near $86,000, holding above the $84,000 support. Exchange data shows cautious accumulation, while derivatives reflect heavy long exposure. The tension is thicker than my Thanksgiving gravy!

On-chain indicators point to weakening momentum. A break below $84,000 could trigger liquidations. Shorts above $88,000 may benefit. So, basically, everyone’s playing a very high-stakes game of chicken. 🐔

But a strong defense could maintain the bullish structure of higher lows. Markets now eye this zone for the next major move. All eyes are on the $84,000 line. Will it hold? Will it crumble? Stay tuned for the next thrilling episode of “As the Crypto Turns!”

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- KPop Demon Hunters: Real Ages Revealed?!

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- How to Cheat in PEAK

- Death Stranding 2 Review – Tied Up

2025-03-27 20:13