So, Bitcoin decided to take a little nap—an *emotional* one—dropping 2.48% and triggering a *fiery* liquidation meltdown across the crypto world. Nearly $986 million vanished into thin air. Poof! Gone. 💸

Liquidations Galore: Who Got Burned?

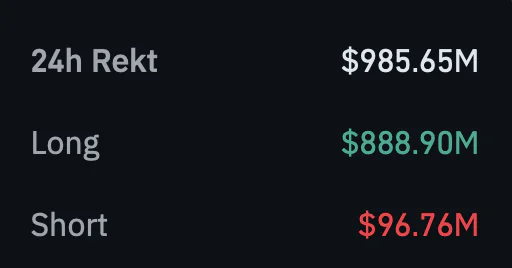

Well, it wasn’t pretty. Over 227,964 traders felt the sting of being liquidated within a single 24-hour period. We’re talking $985.58 million in losses—$888.83 million of which came from poor souls holding longs. Ouch. 🥴 The biggest liquidation? A cool $10 million on BitMEX. No big deal. (But, like, actually huge.)

Why the Panic? Blame Musk and Trump (Obviously)

Several things came together like a messy reality TV reunion:

- The U.S.-China trade war is back in action, throwing global markets into chaos. Risk assets? Bye bye. 😬

- And then, the big shocker: Elon Musk and Donald Trump, two titans of drama, had a *public fallout*. Musk dropped a bomb, accusing Trump of being in the infamous Epstein files. Can you hear the popcorn crunching? 🍿

Volume Skyrockets (Because Why Not?)

Despite Bitcoin’s little hiccup, trading volume saw a surge of 36.24%, landing at $60.39 billion. So yeah, even though people are losing their shirts, they’re still hitting that buy/sell button like it’s going out of style. 😅 Bitcoin’s market cap? A casual $2.03 trillion, with a circulating supply of 19.87 million BTC.

What’s Next? More Drama, Probably

So, $1 billion in leveraged trades evaporated, and the macro drama doesn’t seem to be slowing down. With Bitcoin still clinging to the $100K mark (just barely), traders are holding their breath. Caution is the word of the day. Will Musk and Trump stop their spicy back-and-forth? Will the U.S.-China trade war call a truce? No one knows. Buckle up—this rollercoaster isn’t stopping anytime soon. 🎢

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Death Stranding 2 Review – Tied Up

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

2025-06-06 11:50