Across Myriad, Kalshi, and Polymarket, prediction traders are playing a cheeky game of guess the number-bitcoin looks far more likely to flirt with six figures than collapse into deep drawdown territory anytime soon.

The $100K-or-Bust Framing Takes Hold

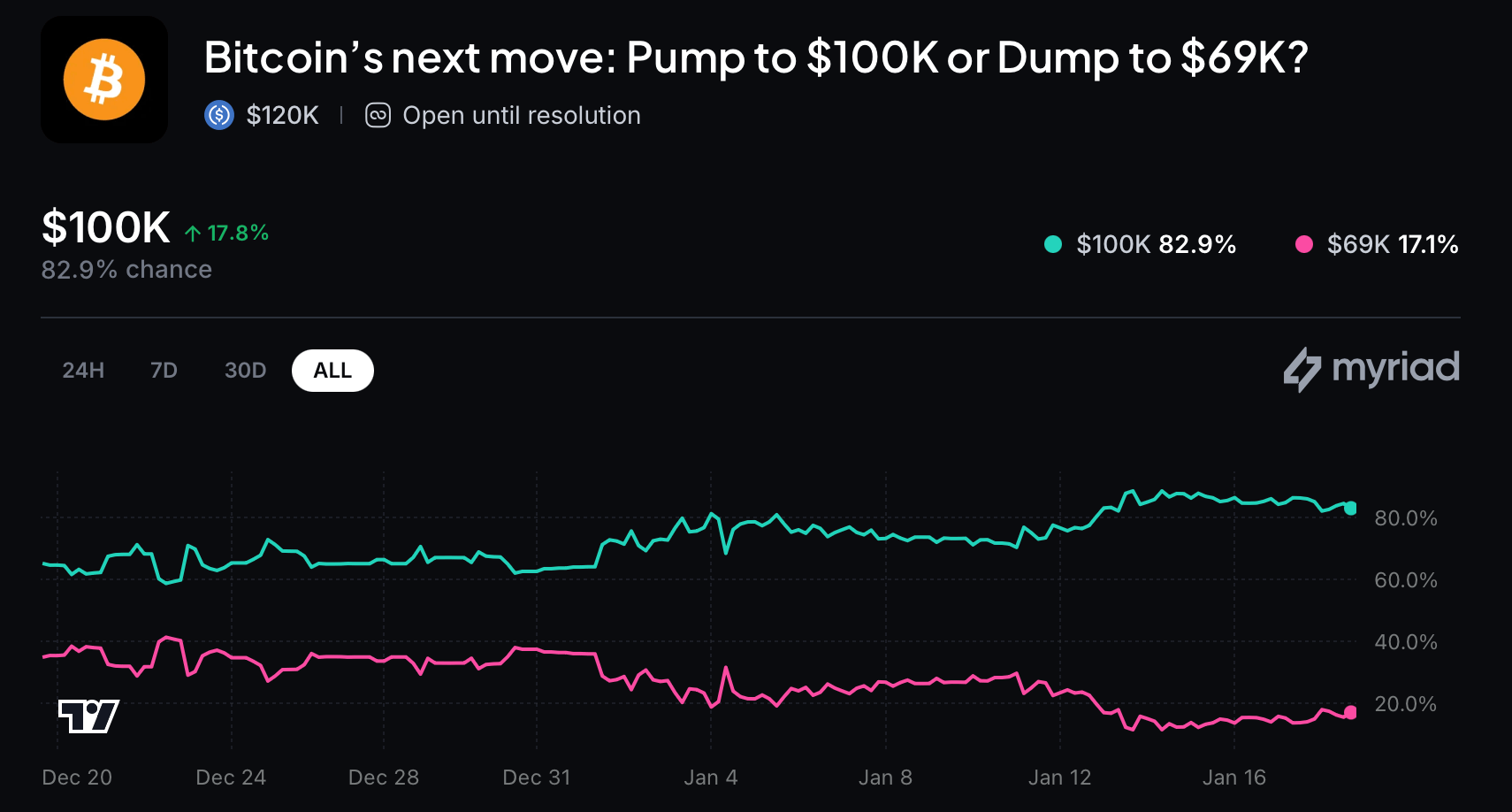

On Myriad, the market titled “Bitcoin’s next move: Pump to $100K or Dump to $69K?” is like a choose-your-own-adventure book, but with more crypto. Roughly 82.9% of participants believe bitcoin will tag $100,000 before it ever tests $69,000, leaving just 17.1% backing a sharp drawdown scenario. 🧙♂️

The market resolves strictly on Binance’s BTC/ USDT spot price using one-minute candle closes, making it a fast-moving barometer of sentiment rather than a long-horizon prophecy. 🕒

Kalshi’s Downside Debate Is a Coin Flip, Not a Collapse Call

On Kalshi, the question shifts from “if” to “how much.” The contract “How low will Bitcoin get this year?” prices a near-even chance-about 52%-that bitcoin dips below $70,000 at some point in 2026. Deeper pain is less convincing, with sub-$65,000 odds falling to roughly 47%, while a softer pullback below $72,000 carries a higher 55% probability. The takeaway is nuance: downside risk is acknowledged, but panic selling is not the base case. 🤷♀️

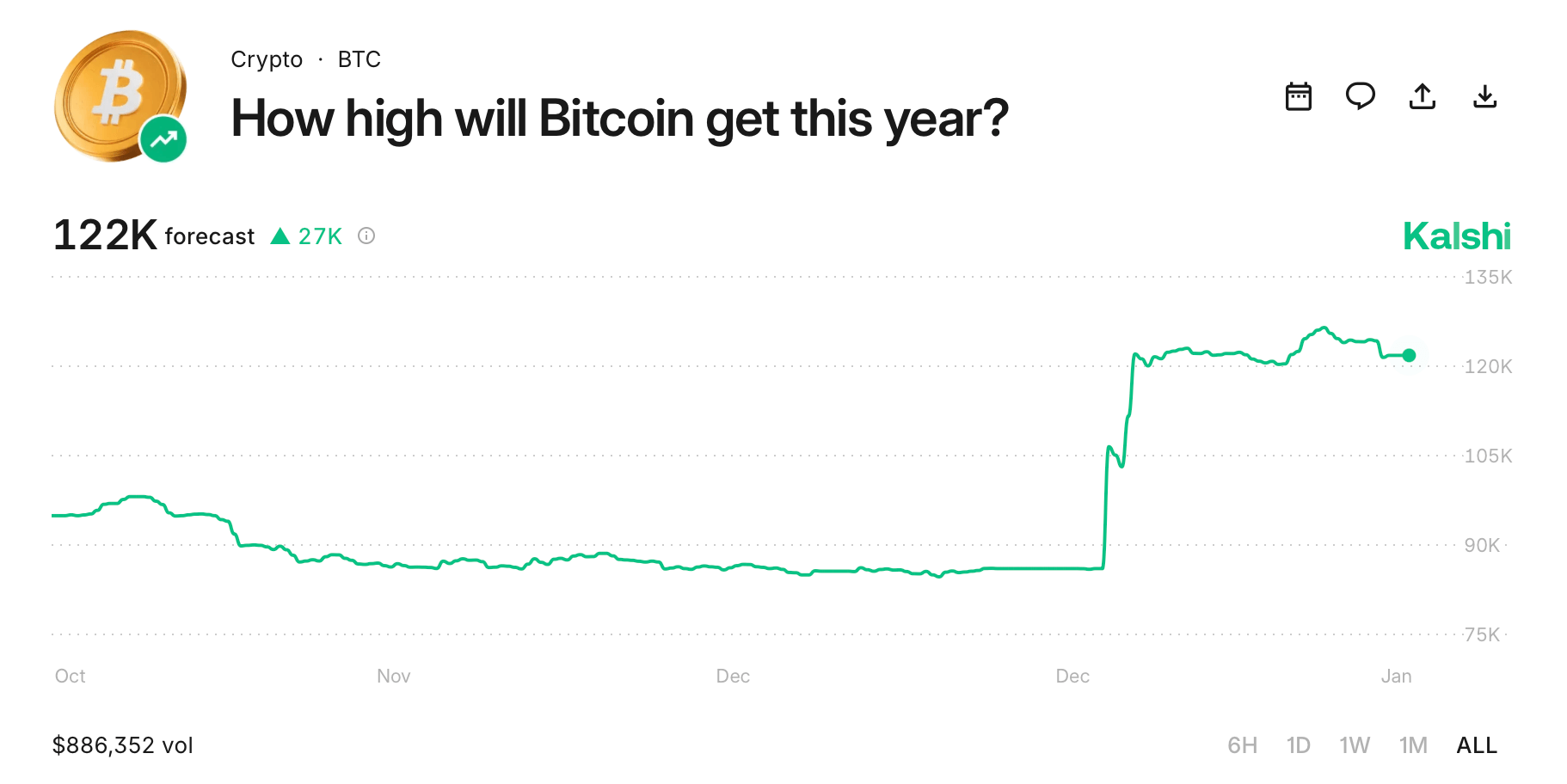

How High Is Too High? Kalshi’s Ceiling Comes Into View

Kalshi’s companion market, “How High Will Bitcoin Get This Year?”, sketches the upper bounds. Traders currently assign about a 52% probability that bitcoin clears $120,000 during 2026, using CF Bitcoin Real-Time Index data for settlement. Confidence improves at lower thresholds-around 68% for $110,000-but thins as expectations climb, with just a 41% implied chance of exceeding $130,000. Optimism is present, but it comes with measured restraint. 🚀

Polymarket’s Long-Term Vision Keeps the Moon at Arm’s Length

Over on Polymarket, the market “What price will Bitcoin hit in 2026?” paints a similar picture. Extreme targets remain fringe ideas, with just a 5% probability assigned to $250,000 and 10% each for $200,000 and $190,000. Sentiment firms up closer to earth: $150,000 carries a 25% chance, $140,000 sits at 31%, and $130,000 clocks in at 40%. The highest conviction clusters around $120,000, leading the board at roughly 51%. 🌌

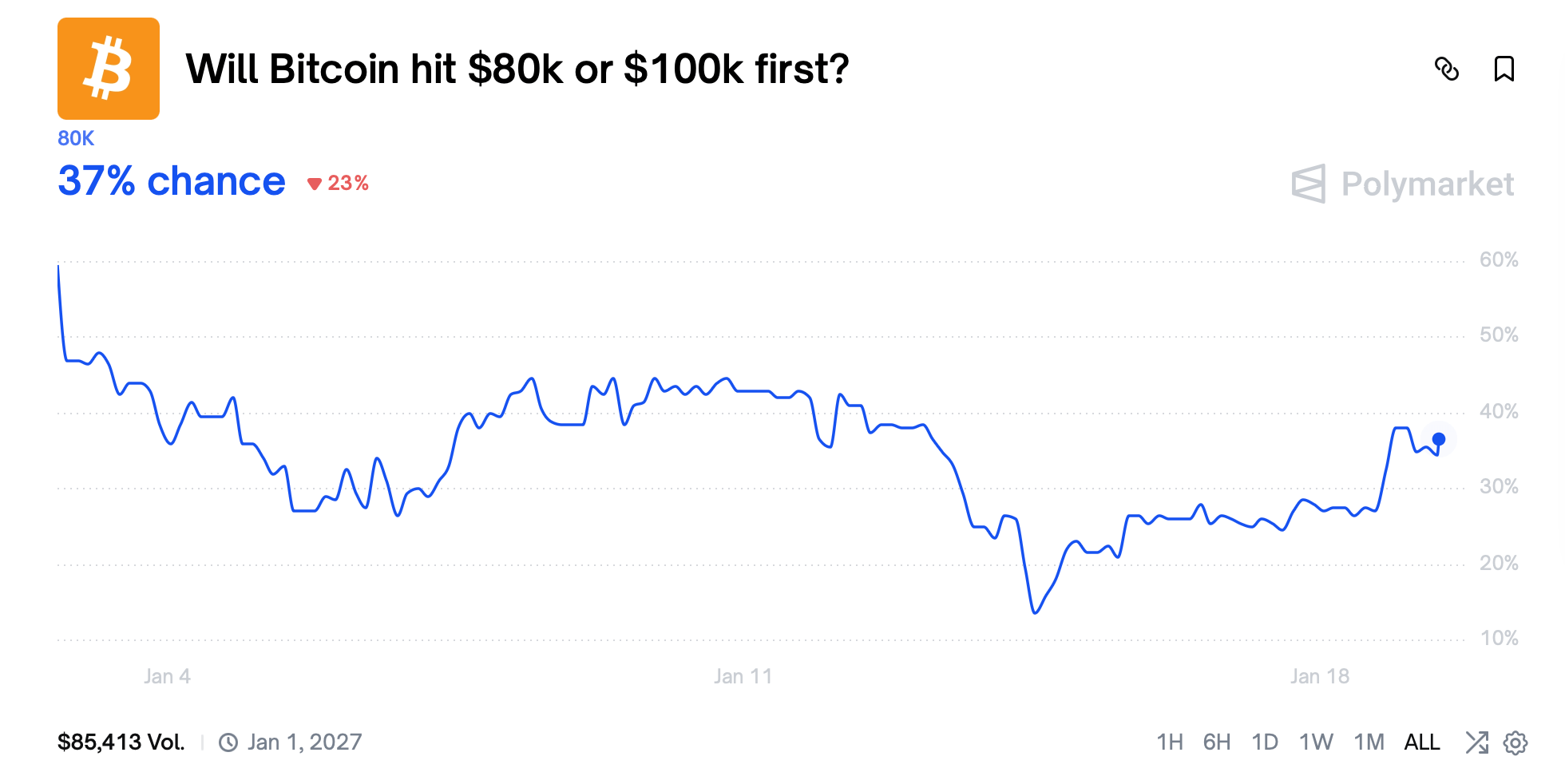

First Stop Matters: $100K Beats $80K in the Race

Another Polymarket contract asks which milestone bitcoin reaches first: $80,000 or $100,000. Traders favor the higher number, pricing a 63% probability that $100,000 prints before any dip to $80,000. The opposing outcome sits near 37%, reinforcing the broader theme that pullbacks are viewed as interruptions, not endings. 🏁

January Expectations Stay Grounded

Short-term optimism cools in Polymarket’s “What price will Bitcoin hit in January?” market. Here, traders overwhelmingly reject stretch targets. Odds for $150,000 sit below 1%, with $130,000 through $115,000 barely registering. The probability curve thickens at $100,000, which leads to January outcomes at roughly 25%, followed by $105,000 near 9%. On the softer side, an $85,000 ceiling carries an 18% chance, suggesting traders expect consolidation rather than fireworks. 🧨

Six Markets, One Consistent Signal

Taken together, these six markets tell a remarkably coherent story. Bitcoin’s downside is debated, but not feared. Its upside is capped, but not dismissed. And $100,000 has quietly become the gravitational center-less a fantasy target and more a working assumption shared across platforms, timeframes, and contract structures. 🌌

FAQ 🔮

- What price level dominates bitcoin prediction markets right now?

Most markets cluster around $100,000 as the most likely milestone. 🎯 - Are traders expecting a major bitcoin crash?

Downside risks are priced in, but deep collapse scenarios lack strong conviction. 😅 - Do markets expect bitcoin to hit $200,000 or more?

Extreme upside targets remain low-probability outcomes across platforms. 🙃 - Is short-term optimism as strong as long-term optimism?

January markets are notably more conservative than full-year forecasts. 🧠

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- Every Death In The Night Agent Season 3 Explained

- How to Repair the Bronze Gate in Starsand Island

2026-01-19 20:48