What to know:

- Bitcoin exceeded $100,000 for the fourth time.

- The U.S. presidential inauguration on Jan. 20 could be the catalyst for bitcoin to break out of its channel.

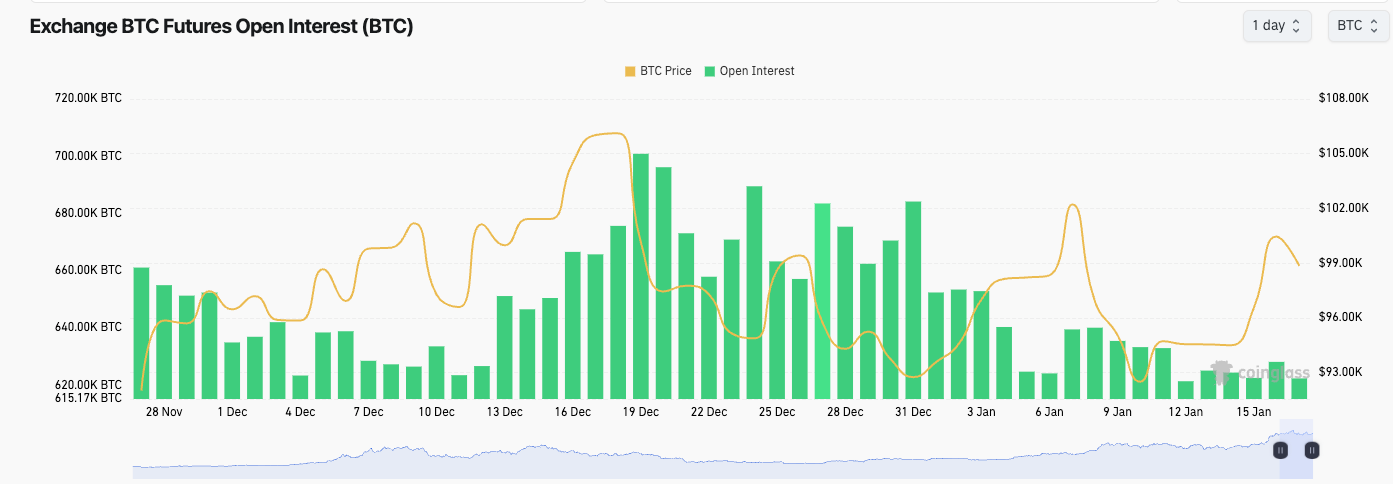

- Futures open interest continues to drop for bitcoin from the Dec. 19 high.

On a Wednesday, the value of Bitcoin (BTC) momentarily surpassed $100,000 for the fourth occasion. Traders’ emotions shifted from apprehension to greed, given the fluctuation in prices between $90,000 and the significant figure mark.

It could require multiple attempts for the leading cryptocurrency to break through the $100,000 mark, given that past CoinDesk findings indicate this pattern. Following its peak of approximately $108,000 on December 17, Bitcoin has been establishing progressively lower peaks, much like it did during the seven-month consolidation period in 2024.

Nevertheless, the $90,000 price mark remains steadfast. It serves as a significant foundation, with Bitcoin staying above it since November 18, except for a brief dip below on January 13. The event that could potentially trigger a shift in either direction might be Donald Trump’s inauguration on January 20.

As an analyst, I closely monitor leverage levels within the market to gauge the prevailing sentiment. One effective way to do this is by examining futures open interest (OI), which serves as a reflection of market euphoria or greed.

The term “Open Interest” represents the current count of active Bitcoin future contracts available in the market. As per data from Coinglass, this number has reached its smallest point since early November, coinciding with Donald Trump’s victory in the U.S. election.

According to the graph, the open interest in Bitcoin has decreased from 700,000 BTC ($61.6 billion) on December 19th to 621,000 BTC currently. This suggests that the recent market activity is less influenced by leveraged trading and more by spot trading.

To ensure a balanced comparison, it’s crucial to focus on open interest measured in bitcoins since the measurement remains consistent, unlike nominal value that varies with the changing price of bitcoin.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-16 17:37