What to know:

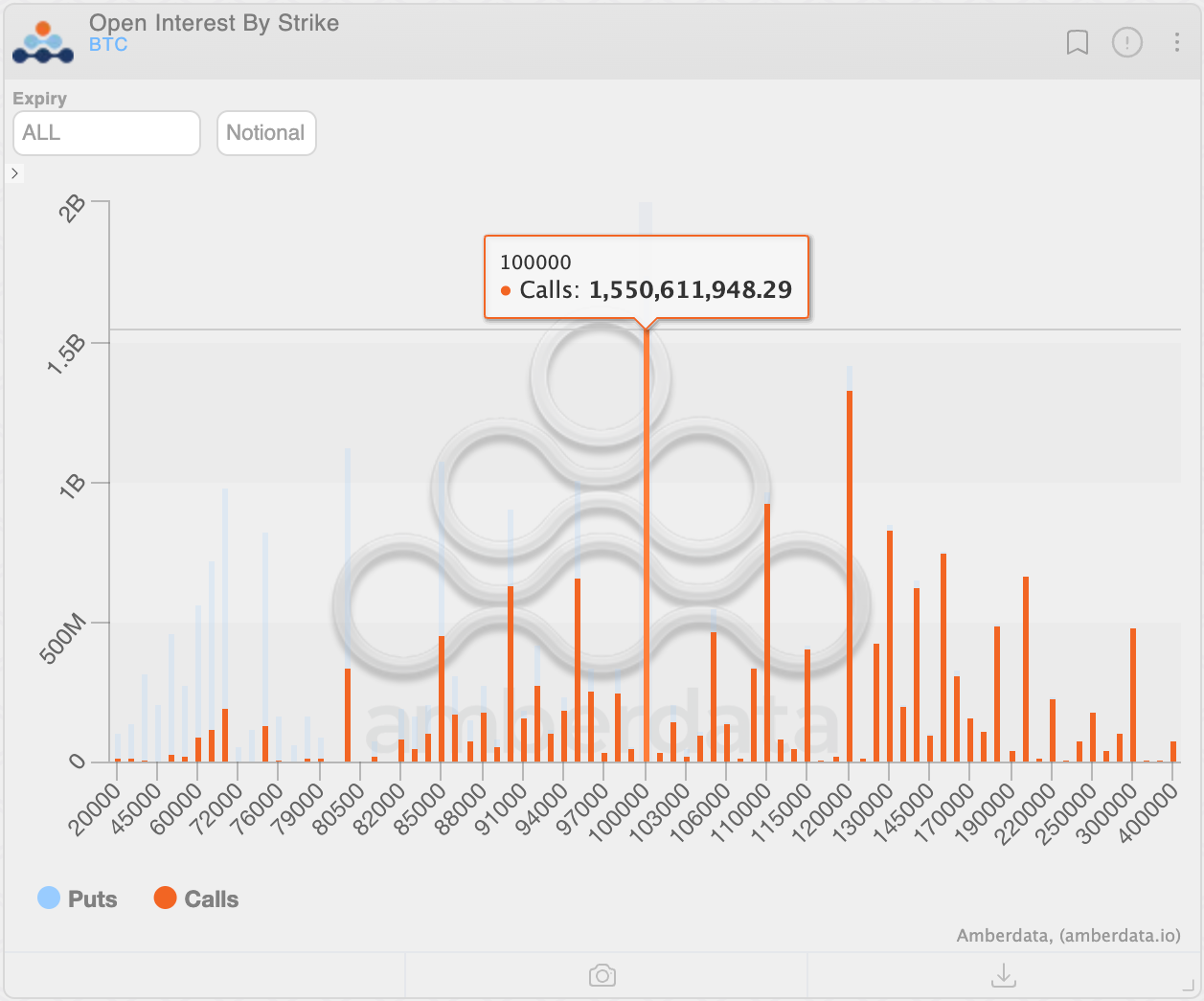

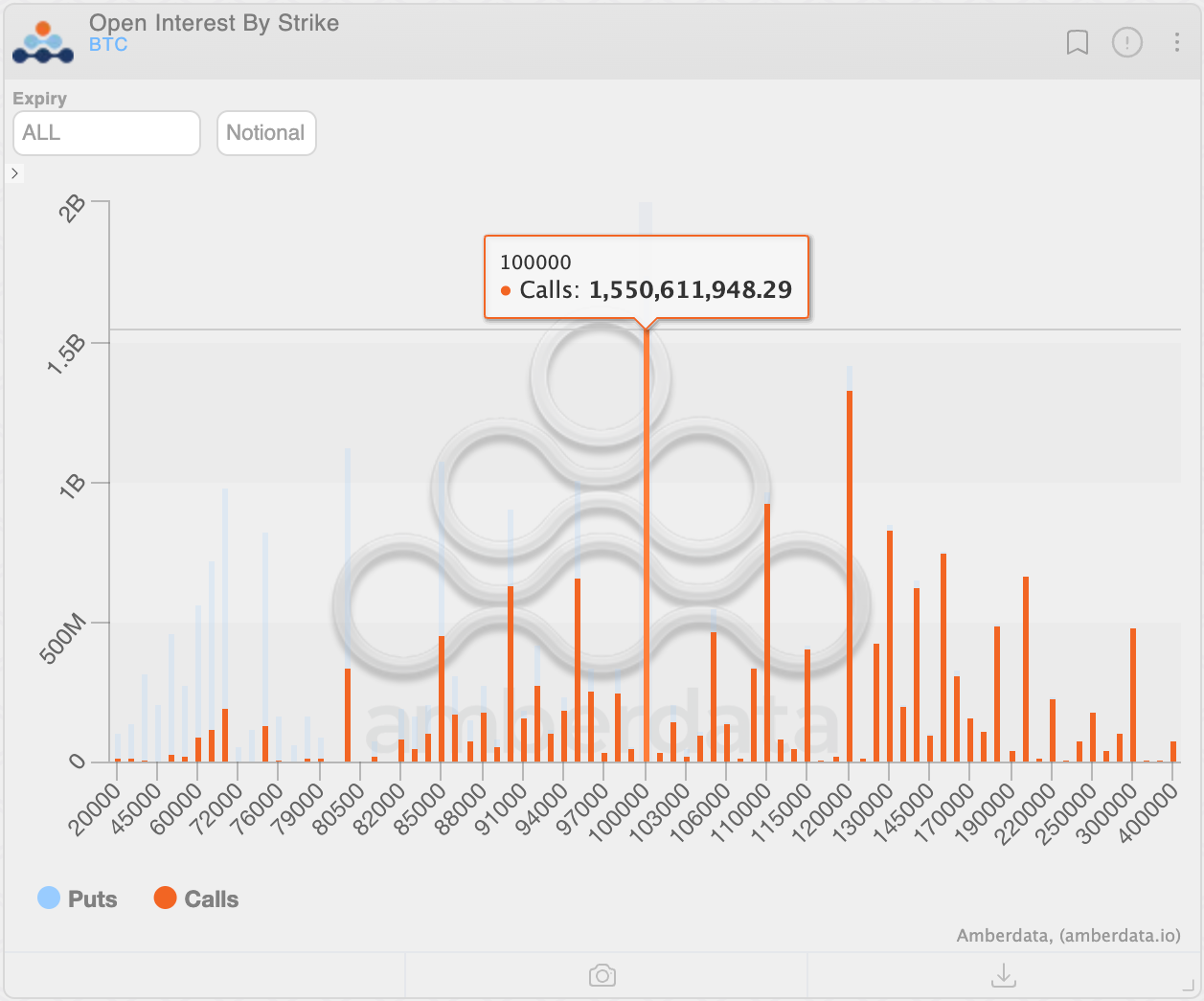

- In a most unfortunate turn of events, the recent crypto market downturn has compelled traders to reconsider their once-optimistic expectations, thus transferring the crown of popularity from the $120K call to the $100K call. How very dramatic! 🎭

- The $100K call now boasts a notional open interest of $1.55 billion, triumphantly surpassing the $1.33 billion of its predecessor, the $120K call. A true Cinderella story! 🥳

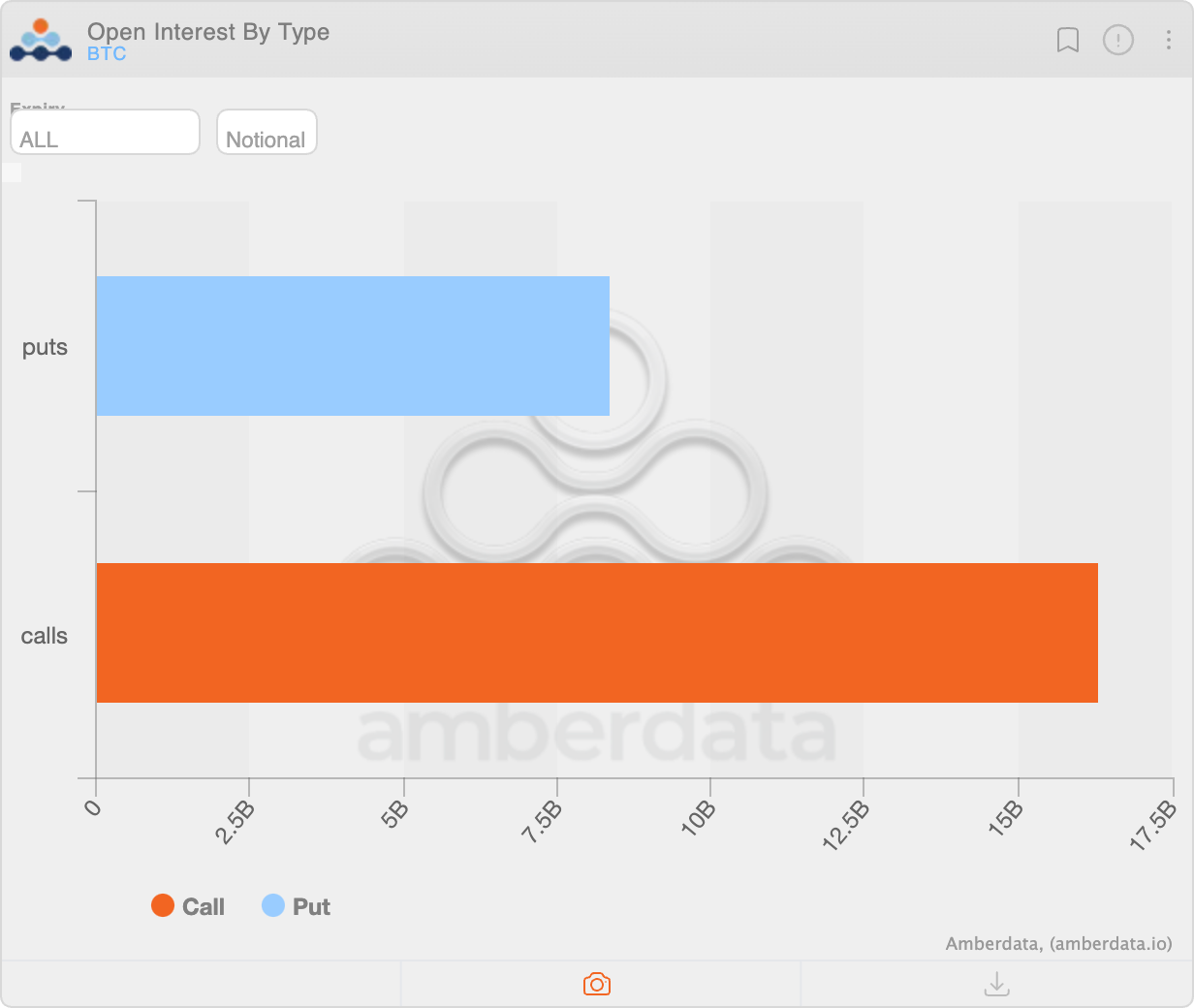

- Despite the tumult, the pricing remains decidedly bullish in favor of call options post-May, with the total dollar value of open calls exceeding a staggering $16 billion. Quite the fortune, indeed! 💸

Alas, the recent crypto market downturn has led to the dethroning of the once-beloved $120,000 bitcoin (BTC) options bet, now relegated to the shadows by the $100,000 bet. Traders, it seems, are reassessing their bullish expectations with a touch of trepidation. 😬

At this very moment, the $100,000 call reigns supreme as the most favored BTC options contract on the exchange, flaunting a notional open interest of $1.55 billion. This figure, dear reader, represents the dollar value of the active option contracts at this juncture. Quite the impressive feat! 🎉

Meanwhile, the $120,000 call, once the darling of the market, now languishes in the second position, with a notional open interest of $1.33 billion. How the mighty have fallen! 😅

A call, as one might know, grants the purchaser the right, though not the obligation, to acquire the underlying asset at a predetermined price at a later date. A call buyer, therefore, is implicitly bullish on the market. Thus, the significant accumulation of open interest in higher strike out-of-the-money calls, such as $100,000 and $120,000, reflects a rather optimistic outlook. Or perhaps just wishful thinking? 🤔

The recent shift in preference towards the $100,000 strike suggests that traders are opting for a more prudent wager in light of the recent price plunge below $80,000. It may also indicate a broader reassessment of bullish sentiment. How very sensible! 🧐

The 25-delta risk reversals, which measure the disparity between implied volatility (demand) for higher strike calls relative to lower strike puts, reveal negative readings or a bias towards protective put options leading up to the May expiry. This, dear friends, is indicative of fears regarding a prolonged price decline in the market. A rather gloomy forecast, I must say! ☔️

Nevertheless, the pricing remains bullish in favor of call options beyond May. Furthermore, the dollar value of the total number of calls open at this moment exceeds $16 billion—nearly double the $8.35 billion in put options. A most curious state of affairs! 🤑

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-03-11 15:06