In a move that would make even the most optimistic fortune-teller blush, Bitcoin futures and options have smashed records this week, with open interest ballooning like a wizard’s hat in a gale. Traders everywhere are piling in, some even waving tickets for the $300,000 express—because why not bet on a unicorn if you’re already at the races?

When Everyone’s a Genius: Bitcoin Derivatives Go Bananas 🍌

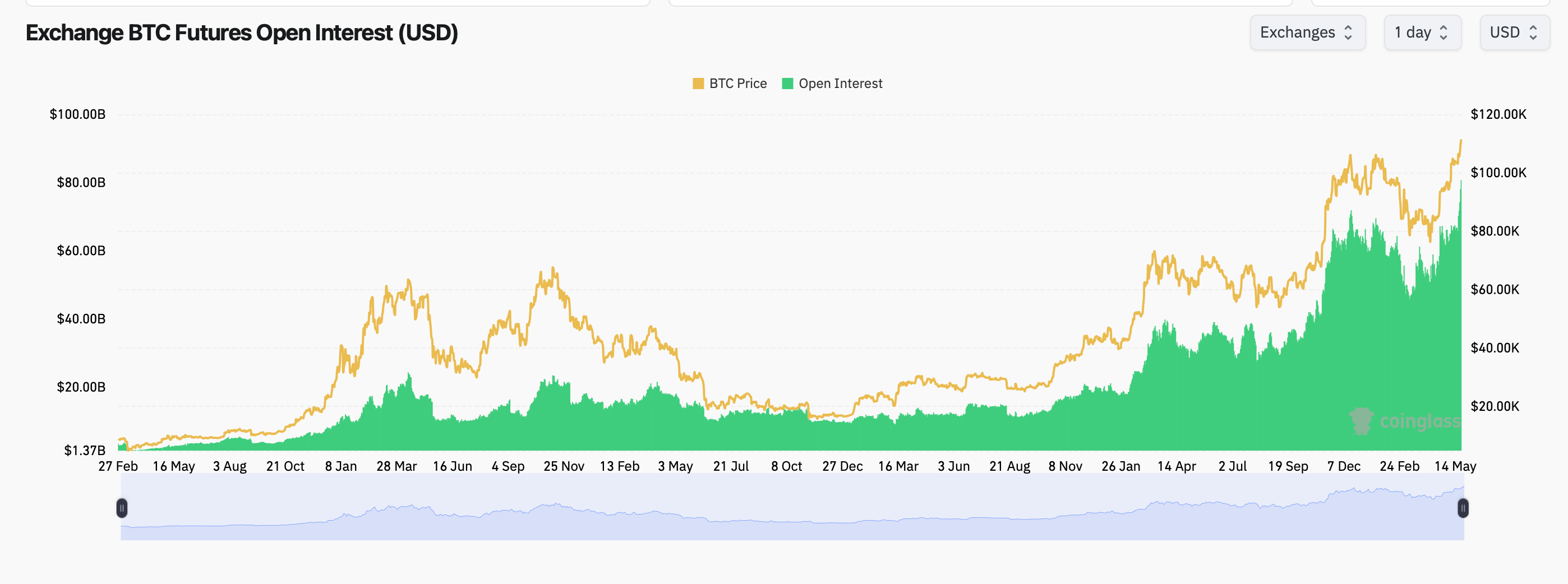

The total open interest in bitcoin futures has soared to an eye-watering $80.73 billion, which is 723,990 BTC in contracts—enough to buy several small countries or one very large dragon. According to coinglass.com’s data, this surge is mostly thanks to speculators and institutions who’ve decided that owning actual bitcoin is so last century. The Chicago Mercantile Exchange (CME) alone holds $18.28 billion in open interest, which is 22.64% of the market and probably enough paperwork to wallpaper Ankh-Morpork.

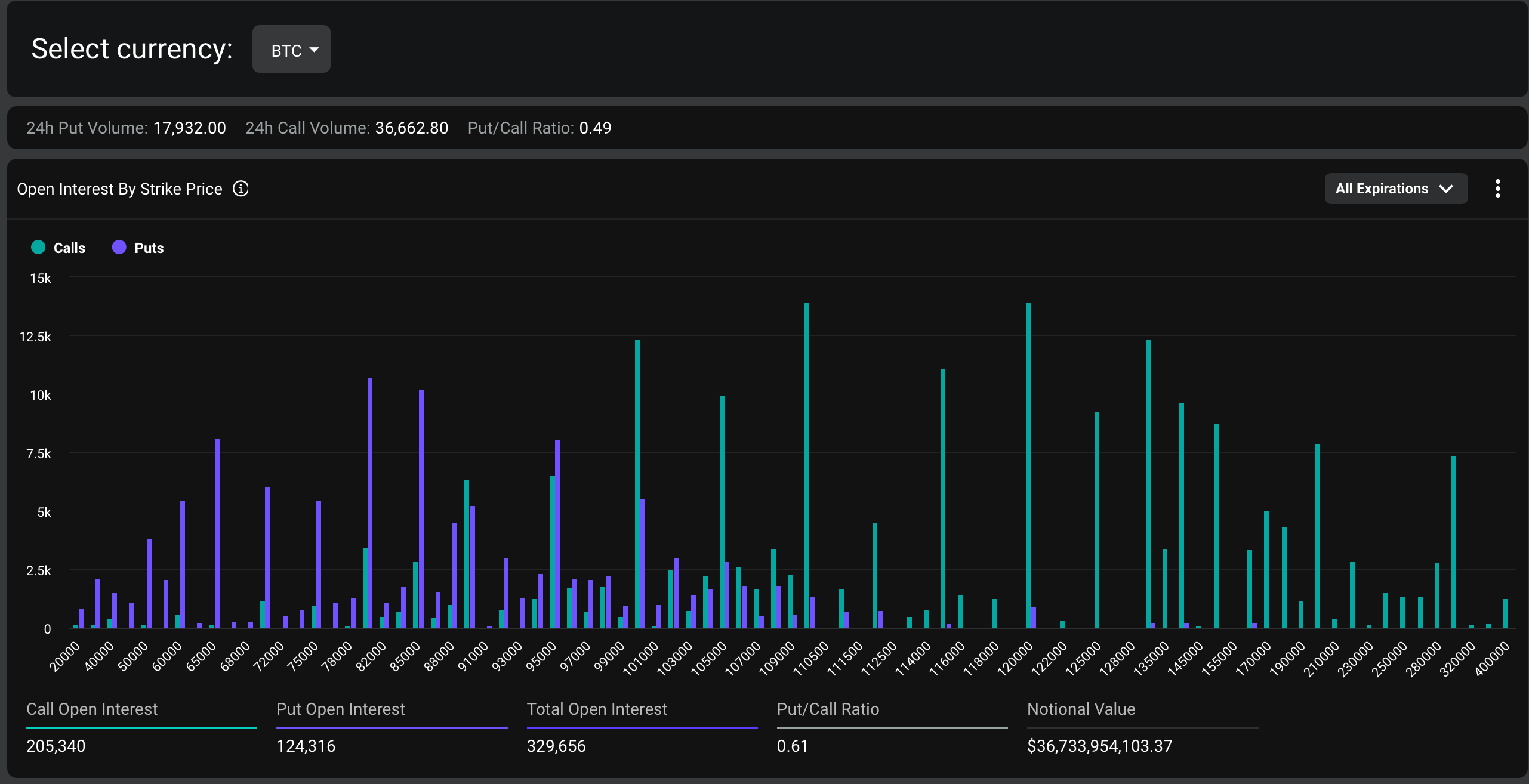

Retail exchanges like Binance and Bitget have also seen double-digit growth, proving that optimism is contagious and possibly airborne. Meanwhile, bitcoin options—those magical contracts that let you buy or sell at a set price by a certain date—have hit $42.5 billion in notional open interest on Deribit. The put/call ratio is 0.61, which in plain language means everyone’s betting on up, up, and away (and only a few are packing parachutes).

The hottest bets are clustered between $100,000 and $120,000 for June and July—because if you’re going to dream, dream big and do it before summer holidays. The real showstoppers are the $300,000 call options: rare, wild, and about as likely as finding a troll in a tutu. These “out-of-the-money” calls are cheap, risky, and beloved by those who think lightning can strike twice (preferably in their wallet).

Why the frenzy? Some traders are clearly betting on wild macroeconomic magic or regulatory plot twists. CME’s open interest jumped 2.8% in just 24 hours—perhaps after someone sneezed on Wall Street. Retail platforms like Binance and Whitebit saw even sharper gains, up 5.19% and 7.63%, respectively, which is either a sign of confidence or mass hysteria (the difference is mostly in the hats).

Of course, when everyone’s leveraged to the hilt, volatility isn’t just likely—it’s practically mandatory. June 2025 options dominate, with over 65,000 contracts open and traders lining up for long-dated calls like it’s Hogswatch Eve at the toy shop. The $300,000 strikes may be moonshots, but their very existence proves that hope springs eternal—and sometimes wears a wizard’s robe.

Bitcoin’s derivatives boom mirrors its spot price comeback, with both markets humming with optimism and just a hint of impending chaos. But beware: when the music stops and everyone rushes for the exit, things could get messy. For now, though, it’s all fireworks and confetti—at least until the next plot twist.

Would you like me to explain or break down any part of this code?

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-05-22 21:11