The cost of Bitcoin has surpassed the $100,000 mark once more, leaving investors questioning if it will sustain this level, given its rebound from a dip below $90,000 just a few days ago.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

For several weeks, the asset has found it difficult to surpass the $100,000 threshold on its daily chart. Recently, though, the market is attempting to maintain itself above the six-digit mark and push forward towards a fresh record high.

If the cryptocurrency finishes trading at this point, it’s quite probable that it will increase significantly over the next few months and may even touch the $120K milestone.

The 4-Hour Chart

Examining the 4-hour graph, the market has been confined within a large falling wedge formation, repeatedly testing both the upper and lower limits. However, the asset has recently breached the upward trendline, indicating a potential increase in value. According to traditional price action analysis, the cryptocurrency could be headed towards its previous all-time high of $108K.

Meanwhile, it should also be noted that the RSI is entering an overbought region, which could result in a short-term pullback before further continuation.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Bitcoin Exchange Reserve

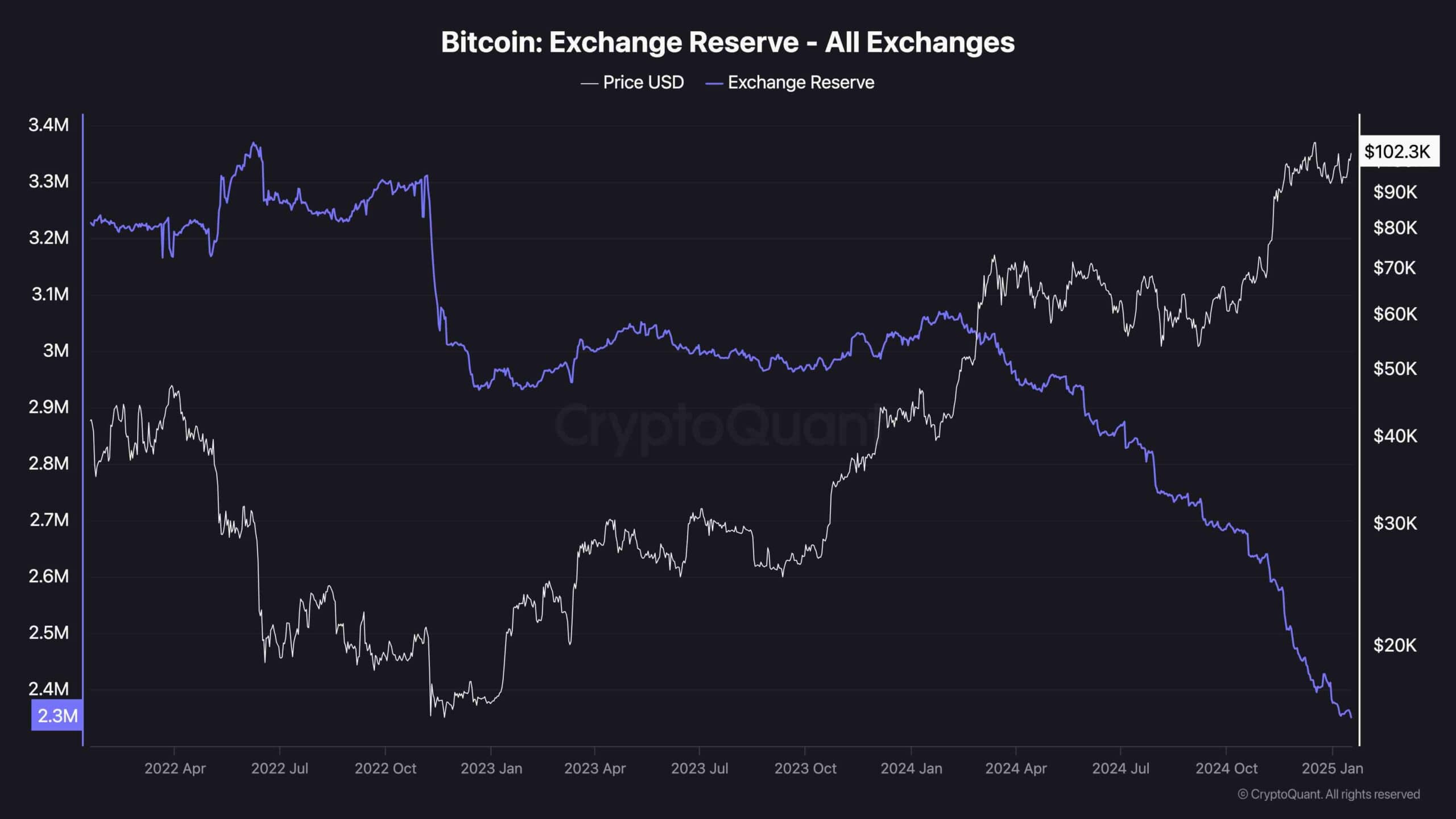

As Bitcoin’s value surges past the $100K mark yet again, delving into the intricacies of its supply and demand patterns might prove insightful. The following graph illustrates the BTC trading reserves, a metric that represents the quantity of Bitcoin stored within exchange accounts.

As the chart demonstrates, the BTC exchange reserve metric has been dropping aggressively. As this vital metric is a proxy for supply, this decrease in selling pressure can lead to even higher prices in the coming weeks.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-17 16:52