Jamie Coutts, the guy over at Real Vision who thinks about crypto a little too much, has an eye-popping prediction that could make your wallet cry with joy. He believes there’s one little thing that could send Bitcoin (BTC) to nearly twice its current price—oh, in just a few months. How cute, right?

According to our pal Jamie, global liquidity has reached a new, sparkly all-time high. It’s now sitting at just under $140 trillion after decades of being all tight and stingy. Like the old man who never spends a dime until he dies and leaves it all to his cats.

Now, here’s the kicker: Liquidity, according to Jamie, is the magic dust that has “historically fueled explosive asset price rallies.” So, you know, there’s a chance that your crypto dreams could come true. Or they could turn into a flaming dumpster fire. Time will tell.

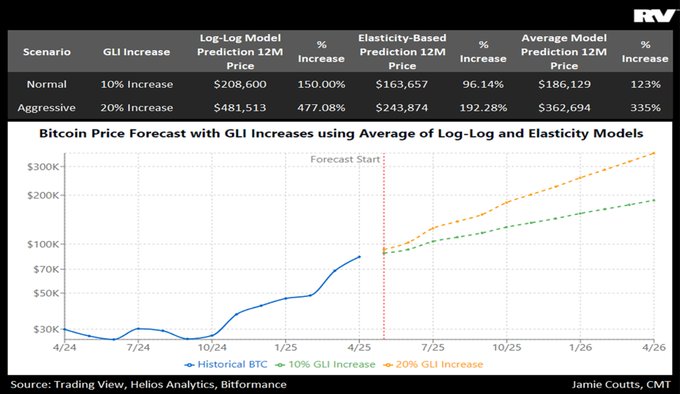

Our friend Jamie isn’t stopping there. Oh no. He’s convinced that global liquidity is going to keep climbing, and that’s going to send Bitcoin’s price soaring by a cool 98%. Yup, you heard that right. Almost a 100% increase. It’s like your grandma’s vintage collection of Beanie Babies suddenly becoming priceless.

“With central banks so far behind the curve, we’re looking at a $13 trillion increase in liquidity over the next year. That could translate to a $186,000 BTC using a nice, shiny regression model,” says Jamie. Oh, and by the way, those of you who held on through all the market madness? Well, Jamie thinks you’ll be laughing all the way to the bank (if Bitcoin’s value doesn’t implode first).

At the time of this mind-blowing update, Bitcoin is sitting at a chill $93,772. But hey, we all know how quickly things can change in this wild world of crypto.

But wait—there’s more! Our crypto guru Jamie thinks Bitcoin’s volatility is doing a little jig opposite the traditional markets. While Bitcoin is mellowing out (in that weird, rebellious way), traditional assets are acting like they drank a six-pack of espresso shots.

“Since 2022, it’s been glaringly obvious that while Bitcoin’s volatility is dropping, traditional assets are losing their minds. But volatility is fine, as long as you’re getting those sweet, sweet returns.” And you know what? Jamie’s got a point. Volatility isn’t the boogeyman as long as you’re making bank.

Jamie’s charts show that Bitcoin has been cruising with a volatility-normalized return of -7.12. To put that in perspective, the S&P 500 is sitting there, all sad and lonely, with a -45.08. Bitcoin’s doing better, and it’s not even trying that hard. So, if you’re into numbers and things that make your head hurt, that’s a fun comparison.

And get this—since 2022, Bitcoin’s volatility-normalized return is a jaw-dropping 131.89, while the S&P 500 is doing its best imitation of a sinking ship at -37.37. Oh, the drama!

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Every House Available In Tainted Grail: The Fall Of Avalon

- Tainted Grail The Fall of Avalon: See No Evil Quest Guide

2025-04-24 12:26