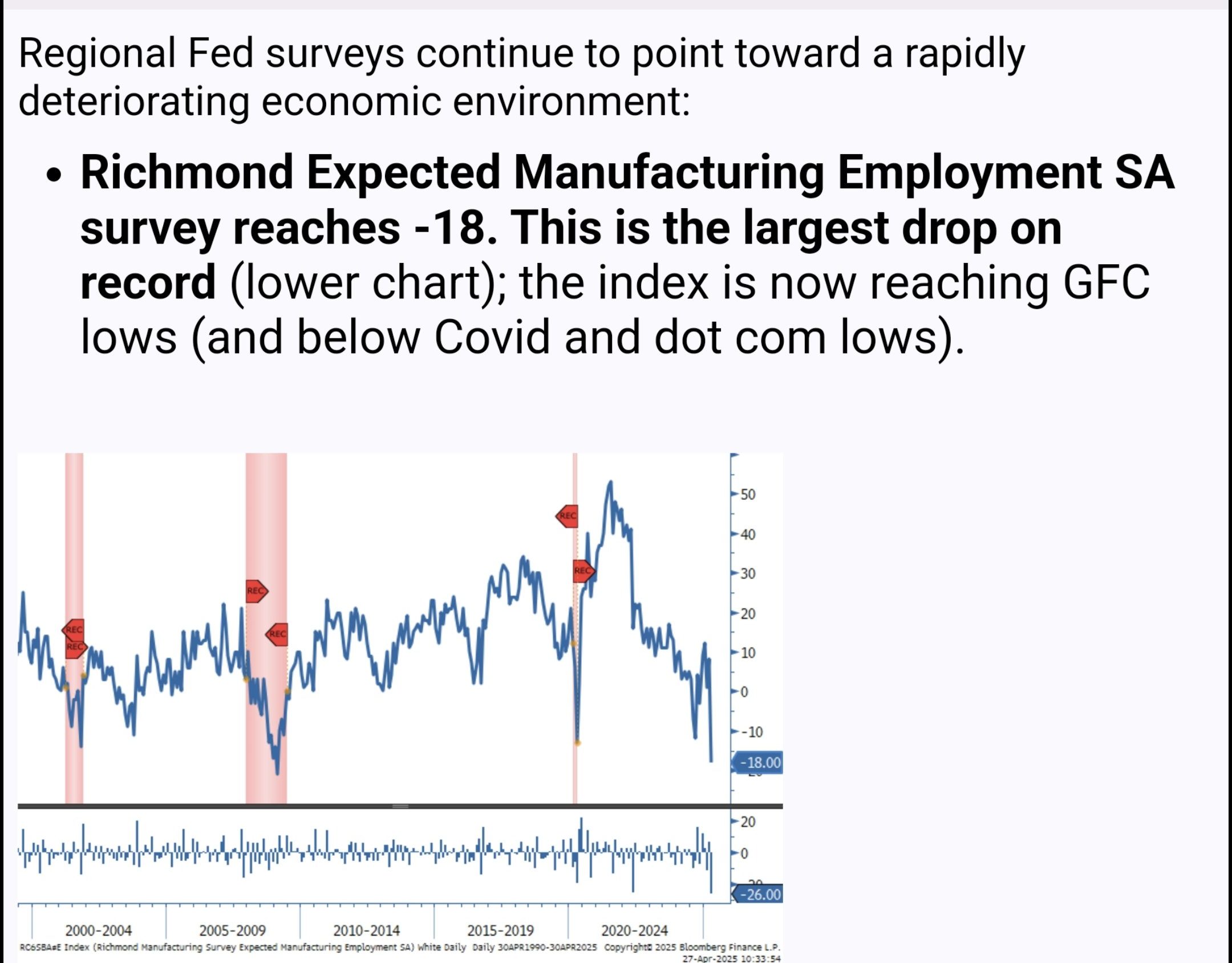

So, here’s the scoop straight from Tapiero — not some random barista with an opinion, but a guy who watches macro indicators like hawks eye their next snack. These second-tier economic signals, which usually rattle the nerves before the big disaster, are diving faster than my enthusiasm for morning meetings. We’re talking about a drop that hasn’t been seen since that awkward, sweat-inducing 2008 financial meltdown. It’s the “largest drop ever,” because apparently, financial crises are going for the world record these days.

The plot thickens because these worrying signs aren’t whispers from some shady hedge fund—nope, they come right from the Federal Reserve’s own survey. That means when the bigwigs gather, they can’t just shrug and say, “Meh, who cares?” It’s hard to ignore the data when it’s practically waving a red flag and shouting “Hey, pay attention!”

Brace Yourself: A Liquidity Tsunami May Be Surfing Your Way

Tapiero points out that short-term interest rates are chilling around 4%, which is about as cozy as a cactus hug for an economy gasping for air. Monetary conditions are still straitjacket-tight, even though everything screams for some loosenin’ up.

Given the Fed’s love for history lessons that involve pumping buckets of cash into the system, the stage is set for a liquidity wave to crash in—probably sooner than your morning coffee kicks in. When central bankers get this nervous, they tend to loosen the purse strings, flooding the market with dollars like it’s Black Friday on Wall Street.

And who’s ready to catch that wave? Hard assets, with Bitcoin (BTC) front and center, probably dusting off its surfboard.

Bitcoin’s Ambitious Goal: $180,000 in Two Years—Because Why Not?

Tapiero isn’t shy about his optimism. He’s been waving the Bitcoin flag for a while now, and the forecast remains bullish: BTC might zoom to $180,000 by summer 2026. The fuel? A cocktail of monetary easing, capital doing the cha-cha into scarce assets, and investors finally getting excited about something other than avocado toast.

According to the macroeconomic crystal ball, the conditions couldn’t be better for Bitcoin to strut its stuff in a liquidity-soaked world. (Or should we say, “liquidity-flooded” — no floaties necessary.)

What Now?

If Tapiero’s predictions hold water, the coming months might kick off a game-changing dance between markets and monetary policies—with Bitcoin stealing the spotlight like the snarky lead in a financial soap opera.

In short: the economy is wheezing, the money fountain is about to gush, and Bitcoin’s march to a mind-boggling $180K might just be unstoppable. Fasten your seatbelts and maybe keep some popcorn handy. 🍿🚀

Read More

2025-04-28 15:47