Ah, Bitcoin! That enigmatic digital creature, which, after scaling the dizzying heights of a new all-time high in January, has since been floundering like a fish out of water. For two long months, it has been trapped in a downtrend, much like a man who has lost his way in a dense forest. But fear not, dear reader, for Egrag Crypto, a market analyst of some repute, has peered into the murky depths of the crypto abyss and declared that Bitcoin may yet rise again—though not before enduring a few more months of correction. 🧐

The 231-Day Cycle: A Path to $175,000 or Just Another Wild Goose Chase?

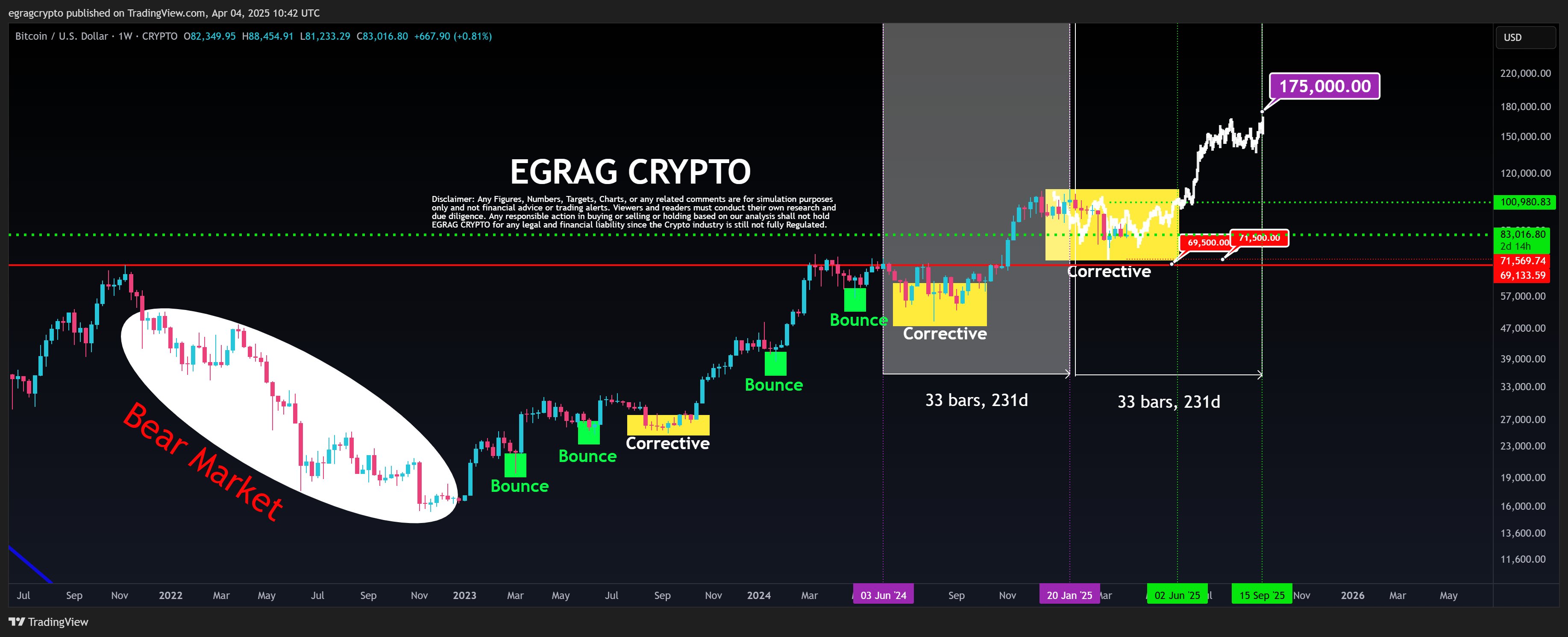

Egrag Crypto, ever the optimist, had initially suggested that Bitcoin’s February price decline was merely a hiccup—a CME gap correction before the inevitable bounce. But alas, the weeks have dragged on, and the bullish conviction has been as elusive as a cat in a dog park. Now, Egrag posits that Bitcoin is stuck in a corrective phase, a fractal pattern that repeats like a broken record across multiple timeframes. This pattern, based on a 33-bar (231-day) cycle, supposedly transitions Bitcoin from correction to explosive rally. 🚀

Comparing past cycles to the present, Egrag predicts that Bitcoin could break free from its shackles by June, soaring to a market top of $175,000 by September. That’s a 107.83% gain, for those keeping score at home. But before you mortgage your house to buy Bitcoin, remember: the bulls must first conquer the $100,000 barrier. And if Bitcoin falls below the $69,500-$71,500 support level? Well, let’s just say the bull run might be as dead as a dodo. 🦤

Exchange Activity Slows: Are Investors Napping or Just Playing Hard to Get?

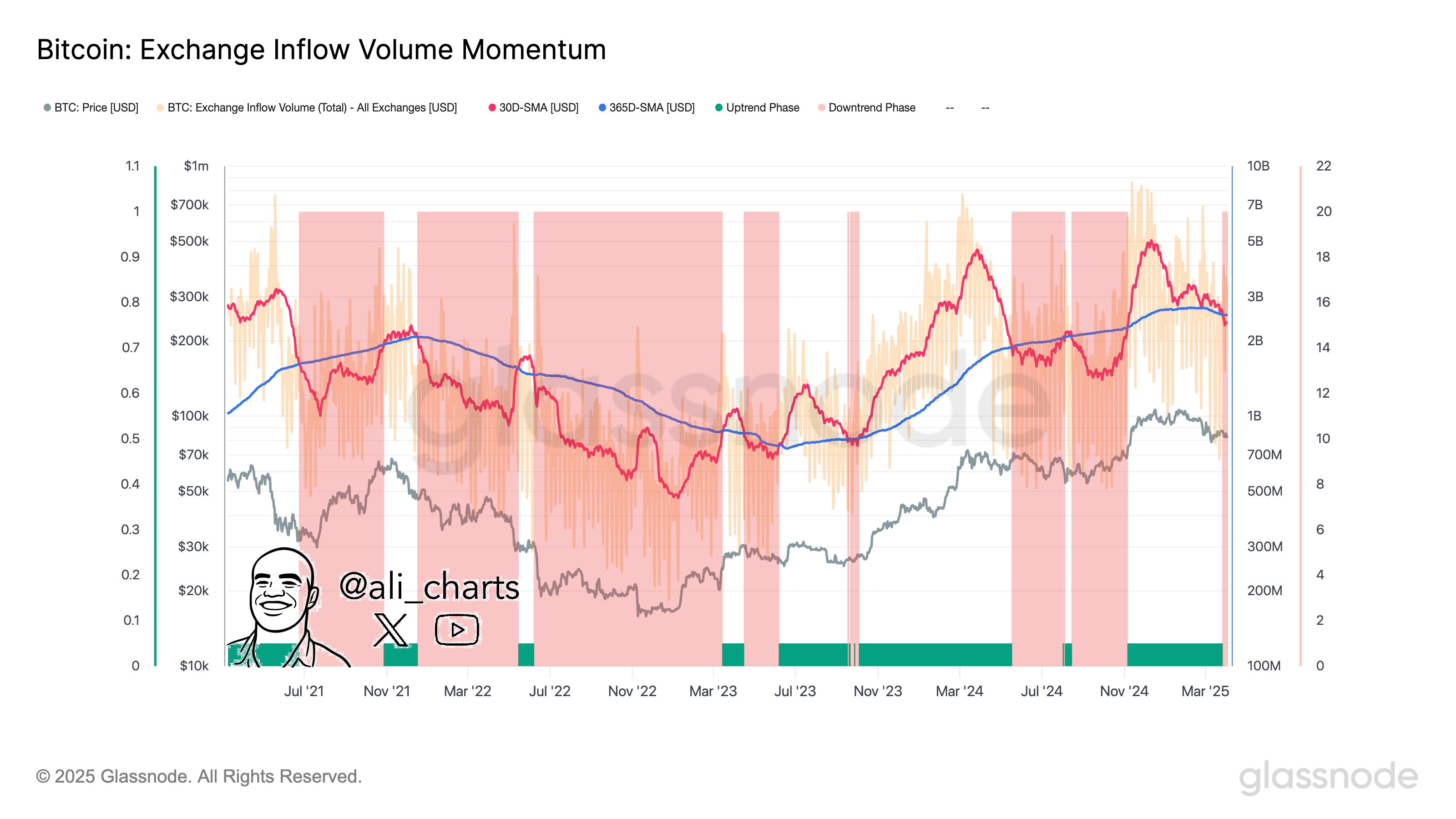

Meanwhile, in the land of crypto exchanges, activity has slowed to a crawl. Ali Martinez, another self-proclaimed expert, reports that investors are hesitating to deposit or withdraw Bitcoin, perhaps because they’re too busy binge-watching cat videos. This decline in exchange activity suggests a trend shift is on the horizon, as investors wait for the next big market catalyst. 🐱

Despite the US government’s new tariffs on April 2, Bitcoin has shown the resilience of a cockroach in a nuclear apocalypse. Its price dipped a mere 4% post-announcement, a far cry from previous tariff-related market tantrums. Since then, Bitcoin has clawed its way back, currently trading at $83,805. The crypto market has seen a $5.16 billion inflow in the past day, and BTC’s trading volume is up by 26.52%, now valued at $43.48 billion. Not bad for a digital asset that’s supposedly “just a fad.” 💅

Read More

- How to use a Modifier in Wuthering Waves

- Mistfall Hunter Class Tier List

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- WIF PREDICTION. WIF cryptocurrency

- Basketball Zero Boombox & Music ID Codes – Roblox

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- Ultimate Half Sword Beginners Guide

2025-04-06 04:12