Well, it seems that over a third of Bitcoin’s circulating supply has decided to take a permanent vacation in the plush vaults of centralized treasuries. Yes, you heard it right! These include the usual suspects: centralized exchanges, exchange-traded funds, and, of course, governments—because who doesn’t want a slice of the digital pie? 🥧

According to the latest gossip from the esteemed Gemini and Glassnode’s Report, a staggering 30% of Bitcoin (BTC) is now snugly tucked away in the hands of just 216 centralized entities. That’s right, folks! These entities are divided into six categories: centralized exchanges, ETFs and funds, public companies, private companies, DeFi protocols, and governments. It’s like a game of Monopoly, but with more zeros and less chance of landing on Boardwalk. 🏦

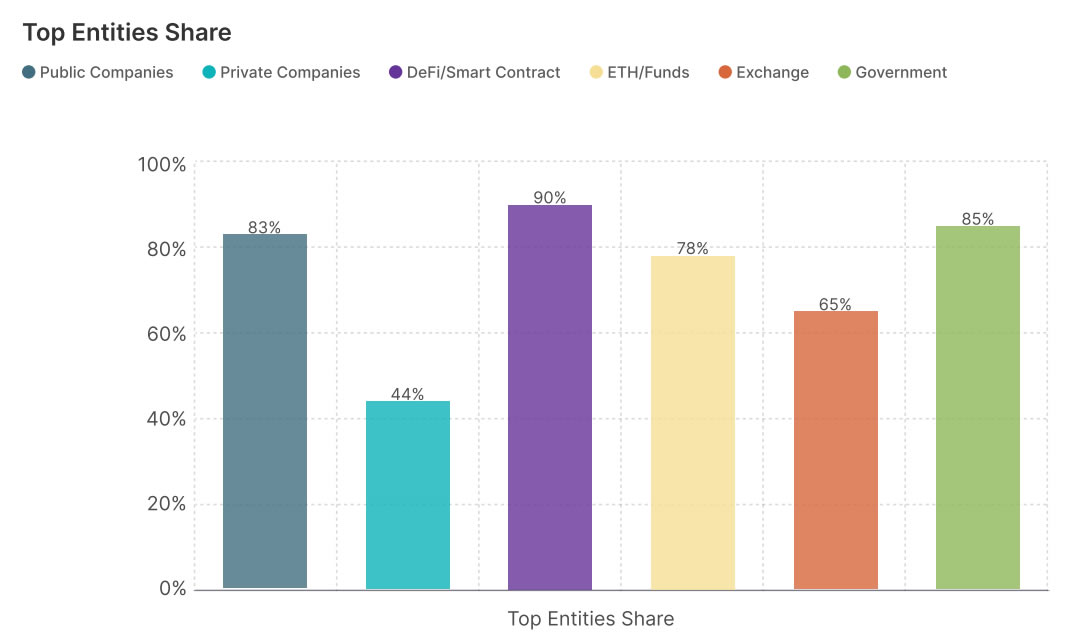

Now, if you look closely (and squint a bit), you’ll notice that the top three entities across nearly all categories are hoarding between 65% to 90% of the total assets. It’s a bit like a three-headed dragon, each head gobbling up more than its fair share, especially in the DeFi, public company, and ETF realms. Talk about early movers shaping the Bitcoin landscape! 🚀

But wait! There’s more! The report also mentions that over the past two years, Bitcoin balances on centralized exchanges (CEXs) have been on a diet, leading many to believe that a supply shortage is just around the corner. Spoiler alert: it’s not! Most of that BTC has simply decided to party over at ETFs and funds, particularly the U.S. spot ETFs. 🎉

Since June 2021, the total BTC held by this spot trading sector has been as stable as a cat on a hot tin roof, fluctuating between 3.9 million and 4.2 million BTC. This stability suggests that the decrease in exchange balances is more about a game of musical chairs than an actual reduction in supply. The ETFs are getting cozy, but the liquidity for spot buyers remains as consistent as a well-timed punchline. 😂

And let’s not forget the shiny new toy: the U.S. Strategic Bitcoin Reserve! This creation has given institutional confidence a hefty boost, making Bitcoin look like a sovereign-grade asset. Following the SBR announcement, public and private companies have been on a Bitcoin shopping spree, as if it were Black Friday every day! 🛒

In conclusion, with over 30% of Bitcoin’s circulating supply now in the clutches of centralized entities, the market has undergone a structural shift, driven by long-term investments and strategic custody. While the early adopters still hold the keys to the kingdom, Bitcoin’s newfound status as a sovereign-grade asset—thanks to the SBR—has made it the belle of the ball. Even as custody shifts from exchanges to ETFs and other custodians, the overall supply available for spot trading remains as stable as a well-placed bet at the races. 🏇

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- 50 Goal Sound ID Codes for Blue Lock Rivals

2025-06-12 13:20