Ah, the illustrious research by Standard Chartered Bank reveals that a veritable cornucopia of institutions are now indulging in the delightful pastime of acquiring bitcoin proxies for their investment portfolios. How quaint! 💸

Bitcoin Sets Its Sights on the $106K Support Level as the Aristocrats of Finance Flock In

In a most riveting revelation, the London-based Standard Chartered Bank has unveiled, on this fine Tuesday, that bitcoin (BTC) has captured the fancy of an ever-expanding array of institutions, as evidenced by the recently filed 13-F documents. One must wonder, is it the allure of wealth or merely a passing fancy? 🤔

The U.S. Securities and Exchange Commission (SEC), in its infinite wisdom, mandates that institutional investment firms managing a princely sum of $100 million or more must disclose their holdings quarterly via the illustrious 13-F form. These documents, available for public perusal, offer a tantalizing glimpse into the assets that the grand institutions, such as public pension funds, are so keenly investing in.

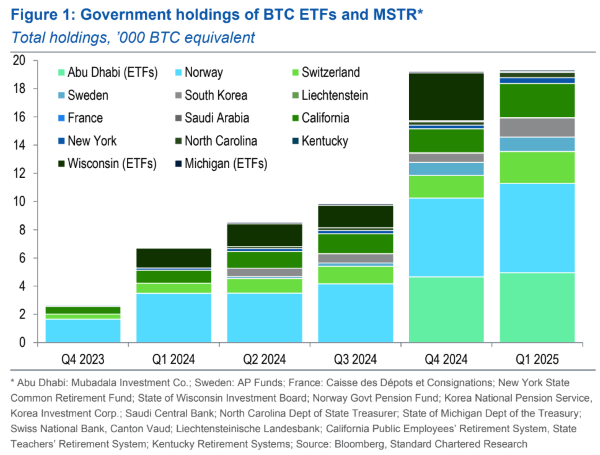

Upon reviewing the 13-F data for the first quarter of 2025, Standard Chartered noted a delightful uptick in the number of companies seeking bitcoin exposure through the ever-so-chic Strategy (Nasdaq: MSTR) stock. Previous data indicated that Blackrock’s spot bitcoin exchange-traded fund (ETF) or Ishares Bitcoin Trust (IBIT) was the belle of the ball. However, as the interest in bitcoin ETFs waned in Q1, MSTR, that perennial bitcoin proxy, experienced a surge in popularity, prompting Standard Chartered to predict a staggering $500,000 BTC price by January 2029. How delightfully optimistic! 🎩

“The latest 13F data from the SEC supports our core thesis that bitcoin (BTC) shall ascend to the USD 500,000 level before Trump bids adieu to the White House, as it attracts a veritable menagerie of institutional buyers,” the firm elucidated in its research paper. “As more investors gain access to this asset and as volatility diminishes, we believe portfolios shall migrate towards their optimal level from an underweight starting position in BTC.” How very profound! 📈

Overview of Market Metrics

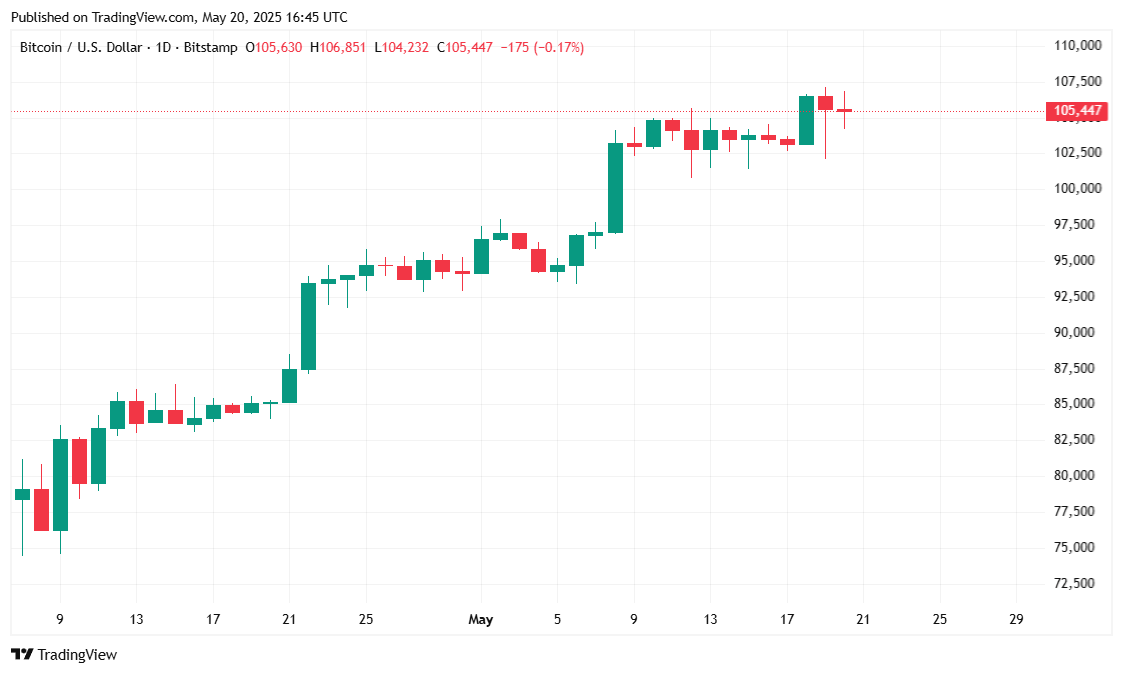

Bitcoin has been engaging in a rather lackadaisical trading pattern, currently priced at $106,070.90, reflecting a modest 0.95% gain over the past 24 hours and a 2.15% increase since last week, according to the ever-reliable data from Coinmarketcap. The cryptocurrency has danced within a 24-hour range of $104,206.52 to $106,814.18, suggesting a rather stable price action. Market capitalization has also seen a slight uptick of 0.26%, bringing BTC’s total valuation to a staggering $2.09 trillion. How positively extravagant! 💰

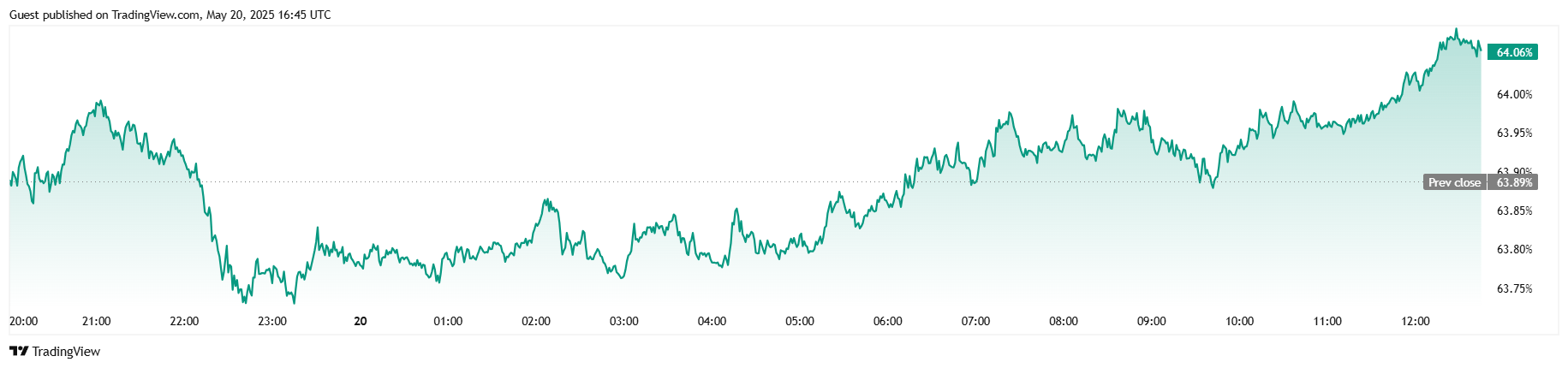

Despite this stability, trading volume has cooled considerably, plummeting 23.14% to $51.32 billion in the past 24 hours. However, BTC’s dominance in the crypto market has risen slightly to 64.05%, up by 0.26 percentage points, indicating a mild shift of capital back into the cryptocurrency despite the somewhat subdued market activity. Futures open interest remained nearly flat, with a minor increase of 0.05% to $71.20 billion, suggesting that traders are still cautiously engaged. How thrilling! 🎉

Data from Coinglass reveals that today, much like yesterday, the bears have bet the wrong way. Of the $1.53 million in total liquidations over the past 24 hours, a staggering $1.52 million, nearly all liquidations, came from short positions, compared to a mere $10,040 in long liquidations. Oh, the irony! 🐻

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- Mirren Star Legends Tier List [Global Release] (May 2025)

- KPop Demon Hunters: Real Ages Revealed?!

2025-05-20 21:09