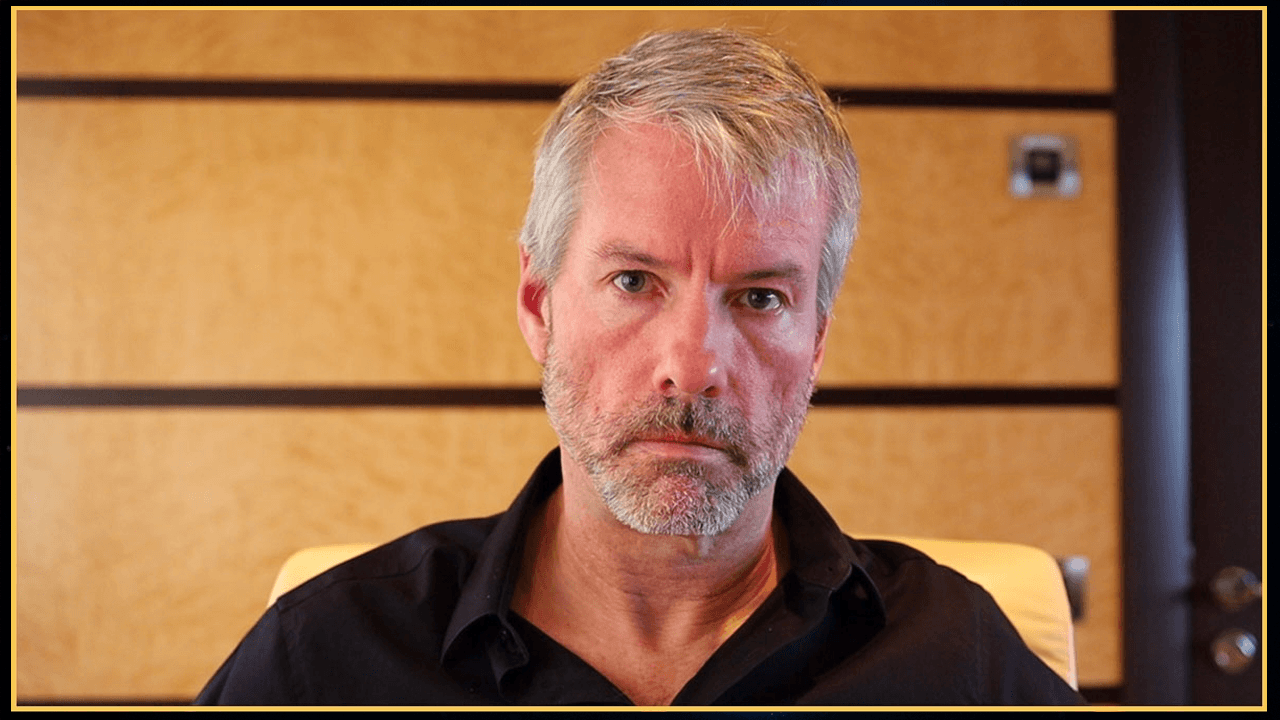

Strategy Chairman Michael Saylor, who sparked a wave of corporate Bitcoin buyers, has become the unlikely hero for this new breed of treasure hunters. But now, Standard Chartered is waving a big, red warning flag.

The Shocking Reality Behind Bitcoin Corporate Treasuries

So, what could possibly go wrong when over a hundred companies decide to play the world’s riskiest game of “let’s stockpile Bitcoin” in hopes of spiking their stock price? According to Standard Chartered Bank’s digital assets research team, plenty. Their latest report, published just this Tuesday, has investors squirming.

Not too long ago, Michael Saylor and his team at Microstrategy (now just “Strategy” for the cool kids) were sitting on a heap of cash—$500 million to be exact—right when the world was in the grip of a pandemic-induced financial crisis. Central banks were slashing interest rates like they were going out of style, and Saylor, with all the flair of a high-stakes gambler, had an idea:

“We thought about buying gold, but nah, that’s too safe. We decided to roll the dice on Bitcoin. It’s like gold, but… better and with tech vibes,” he said in an interview. So, in the blink of an eye, Saylor and his crew dumped $250 million into Bitcoin and threw another $250 million into a Dutch auction to give shareholders a chance to bail if they hated the plan. Bold move, right?

Fast forward five years, and Microstrategy’s stock has skyrocketed by almost 2,900%—turns out, betting on Bitcoin was a winning lottery ticket. No one even came close—except for Nvidia, but let’s face it, they were just a tiny blip at 1,400%. Everyone was on board the Bitcoin train, right?

But hold on—Standard Chartered isn’t so sure this party’s going to last. They’re ringing the alarm on what’s essentially a corporate Bitcoin gold rush, with companies stockpiling BTC at record highs. The bank warns that if Bitcoin takes even a tiny dive, say, 22% from the average purchase price or falls below $90,000, half of these so-called “Bitcoin treasury” companies will find themselves “underwater”—their shares worth less than the Bitcoin they’re holding. Ouch.

“If Bitcoin dips below $90,000, prepare for panic,” the report warns. “Just like Core Scientific in 2022, when Bitcoin prices crashed, these companies could face a similar fate and be forced to sell at a loss.”

Core Scientific: A Glorious (and Painful) Cautionary Tale

Ah, Core Scientific—an absolute textbook example of what can go wrong when you bet it all on Bitcoin. The company, once a mining giant, jumped on the Bitcoin treasury bandwagon in 2021, but with a twist—they didn’t buy the crypto, they simply held onto what they mined and used debt to cover daily expenses. Classic overconfidence.

For a while, it worked. The company made some decent profits, riding the Bitcoin wave like a champ. But when Bitcoin took a nosedive in June 2022, Core Scientific was caught with its pants down. They were forced to sell 7,202 Bitcoins at a loss, dumping them at $23,000 each—while their mining cost was over $29,000 per coin. The result? Bankruptcy in December 2022. Talk about bad timing.

“Core Scientific’s mistake wasn’t just bad luck—it was a failure to account for Bitcoin’s volatility. When prices fall 22% below the average purchase price, these companies might be forced to bail out, just like Core did,” the report concludes. So, if you’re thinking of following the Bitcoin treasury trend, maybe put on your crash helmet first.

Let’s just hope these companies can handle the heat. After all, when it comes to Bitcoin, the rise might be meteoric—but the crash? Well, it’s nothing short of a disaster movie.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- KPop Demon Hunters: Real Ages Revealed?!

2025-06-06 04:59