What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

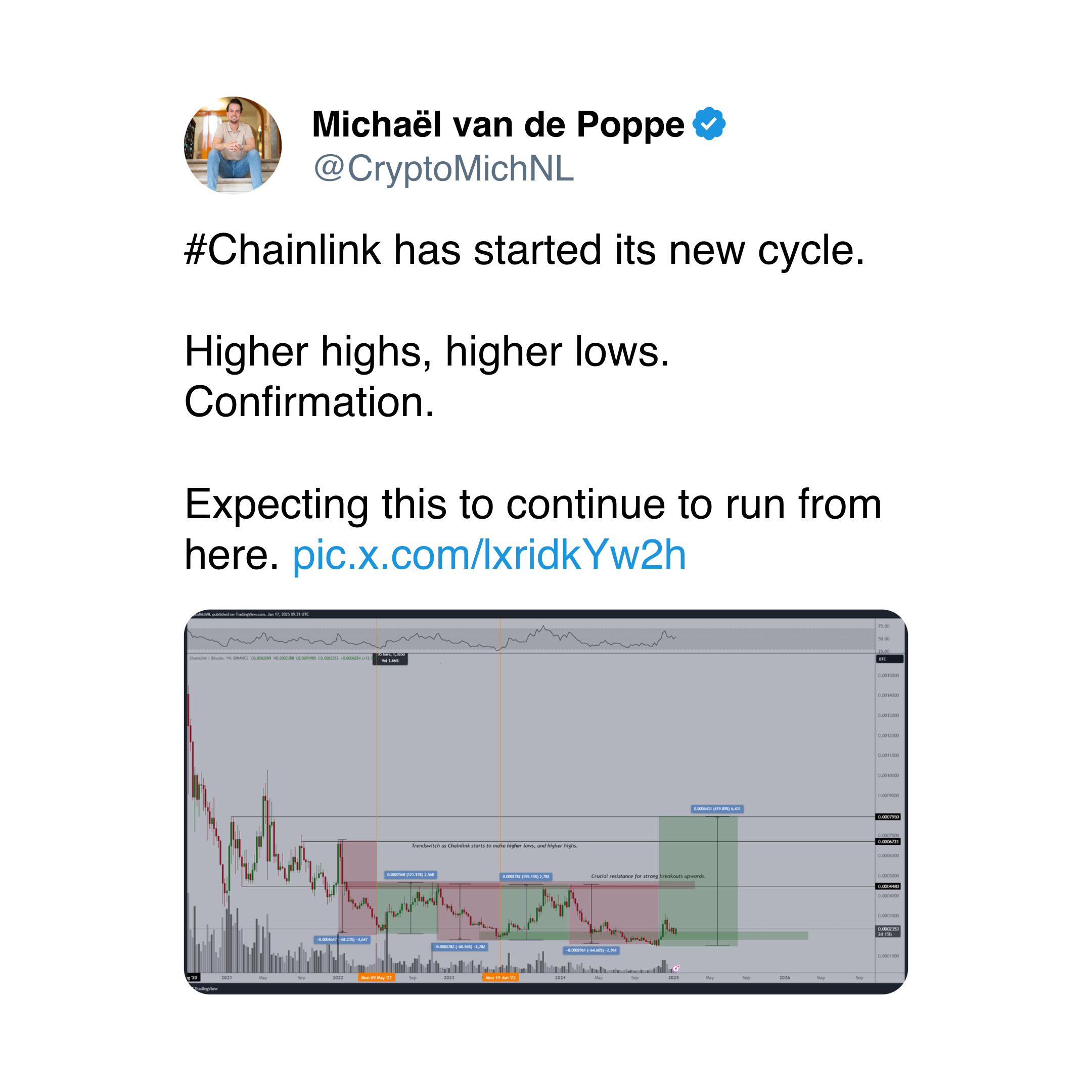

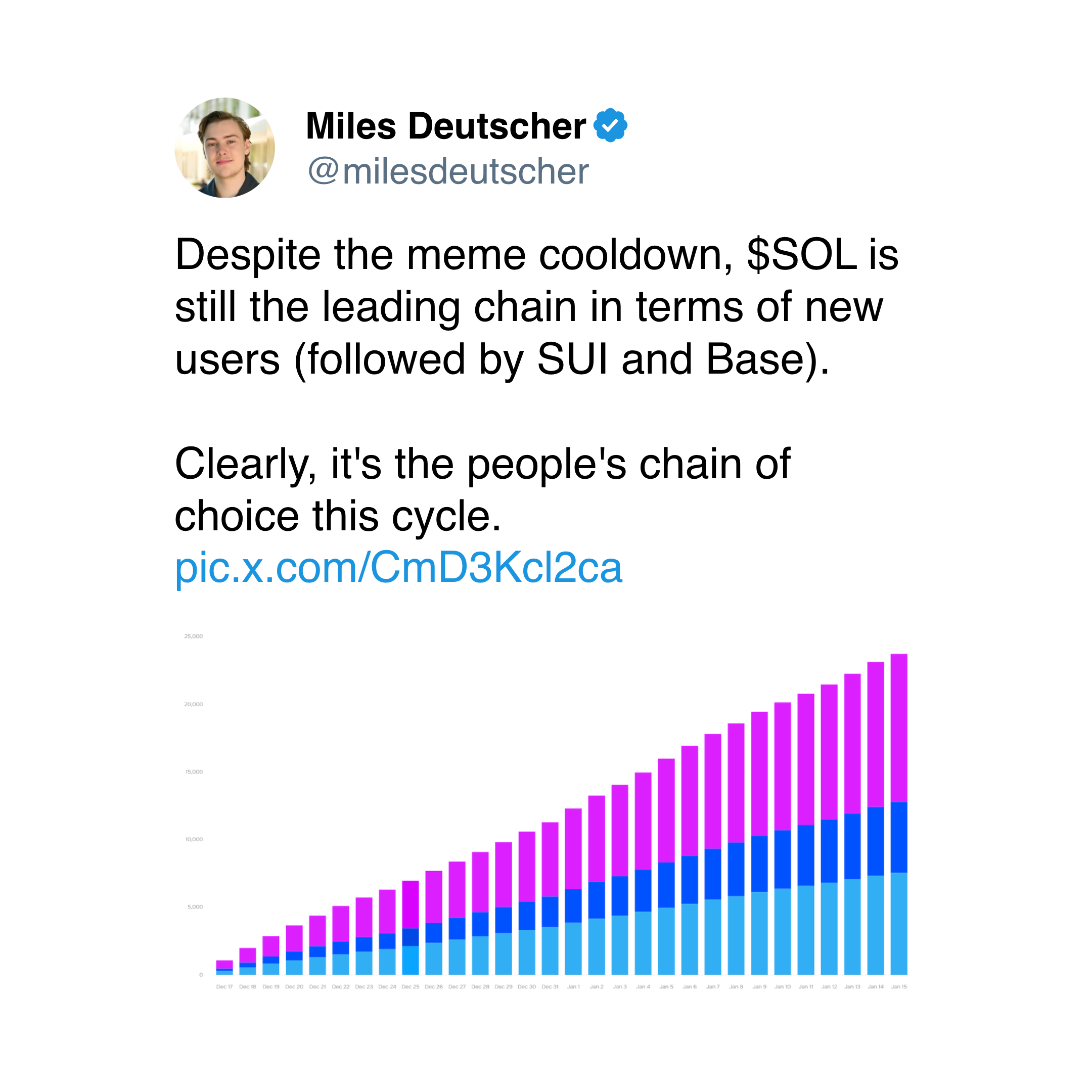

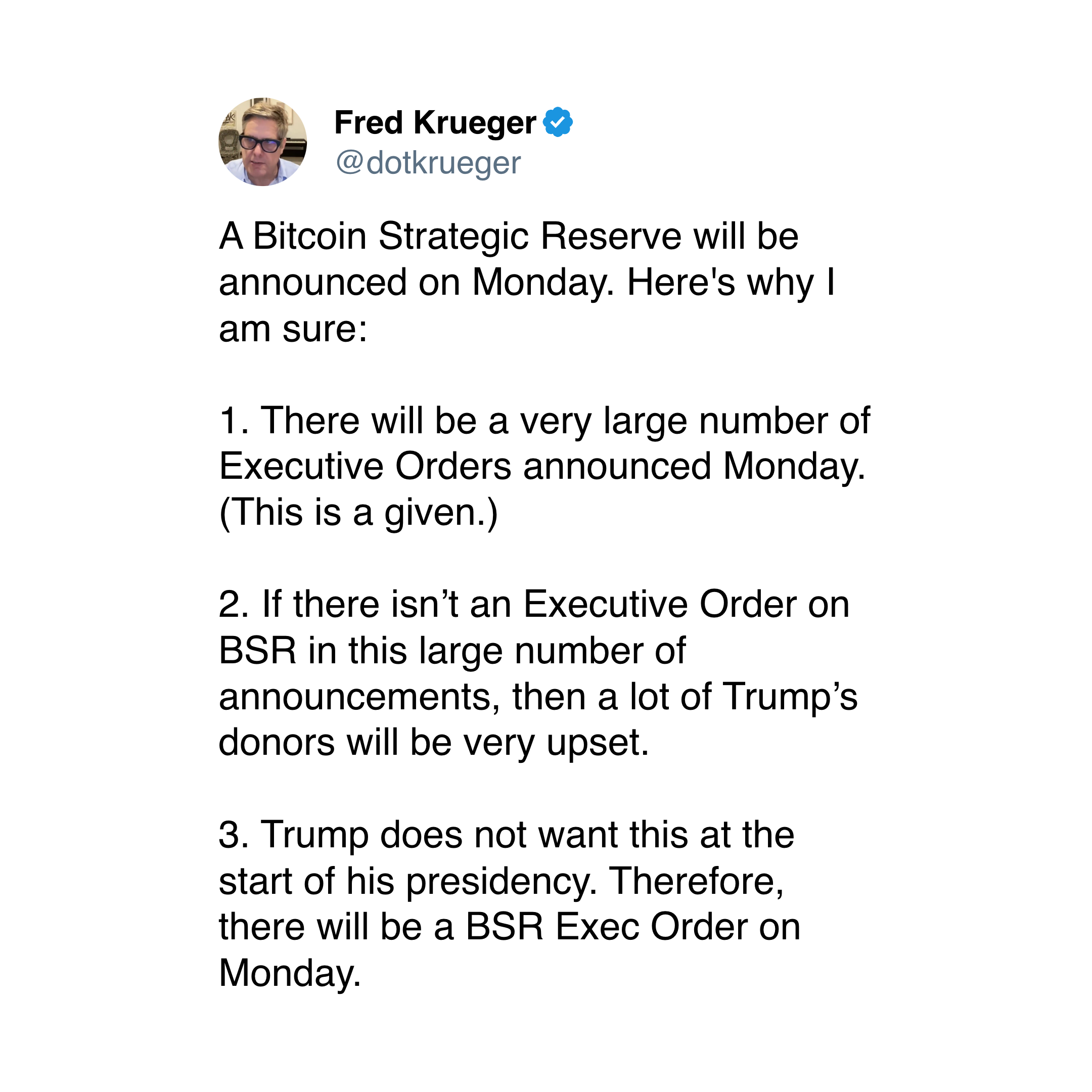

As Donald Trump’s inauguration approaches, there’s a lot of excitement in the world of cryptocurrency. Bitcoin is maintaining its position above $100,000, and coins like Solana (SOL), Cardano (ADA), Chainlink (LINK), Ripple (XRP) and Litecoin (LTC) are also gaining attention. It’s not just about a potential strategic bitcoin reserve anymore; reports hint that Trump could make cryptocurrency a key policy focus.

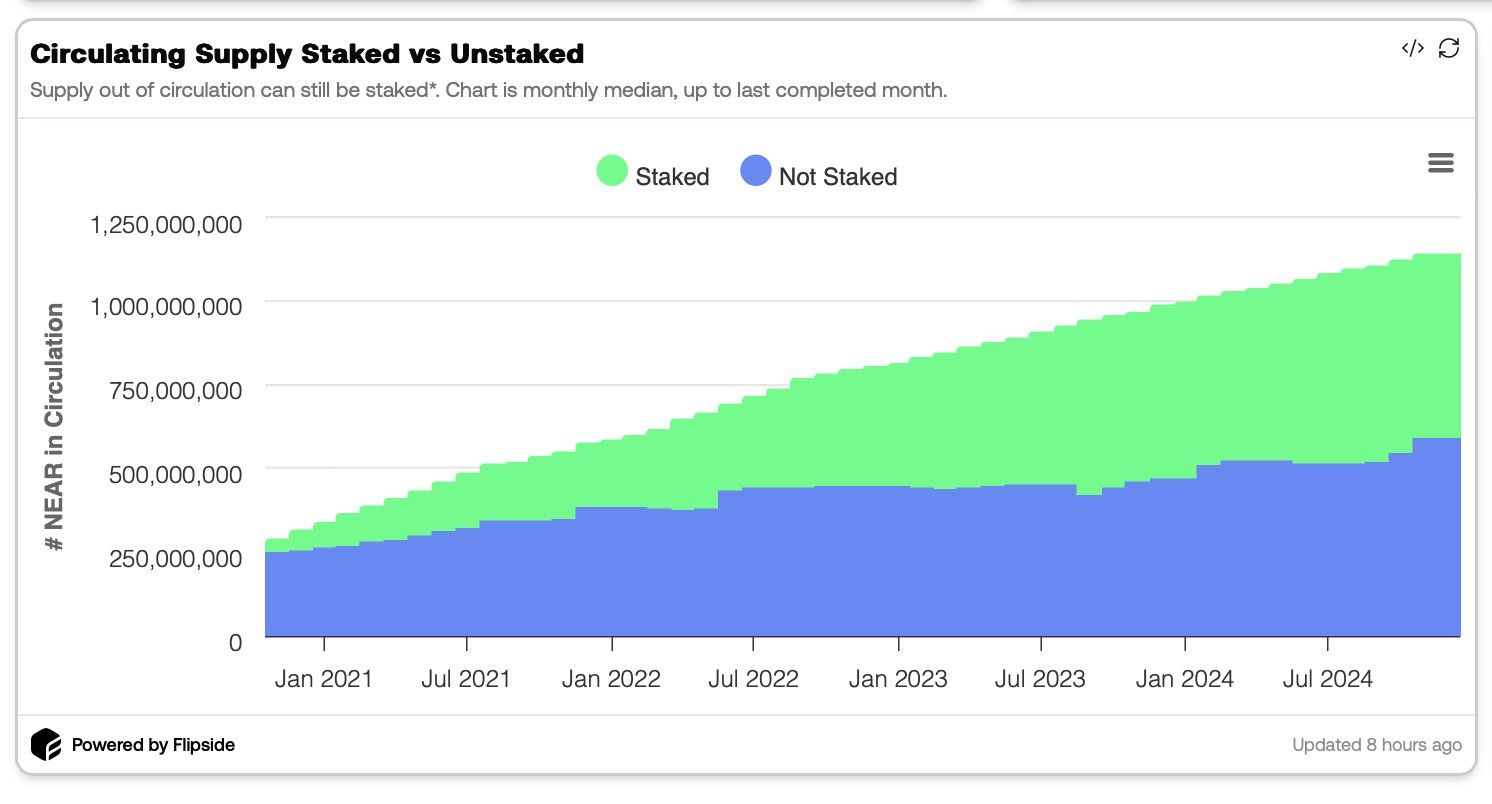

The situation is becoming more intense for ether as well. An Ethereum address linked to Donald Trump’s World Liberty Finance (WLF) project has purchased close to $10 million worth of ETH this week, as reported by Arkham Intelligence. Additionally, pay attention to the Near Protocol’s NEAR token. The supply dynamics appear promising, with the ratio of staked to unstaked NEAR tokens increasing, according to data from Flipside.

In summary, the crypto market appears optimistic due to a decrease in inflation worries following the U.S. CPI report, which has shifted focus towards Trump’s inauguration. According to data from 21Shares, there is still potential for Bitcoin to rise further.

Keep in mind, there could be a potential decrease in price should a significant announcement fail to occur on Donald Trump’s inaugural day.

According to analyst Valentin Fournier from BRN, the overall economic environment continues to be favorable as unemployment decreases, inflation indicators soften, and the market is buoyed by optimism surrounding President Trump’s inauguration. He remains optimistic for Q1, but warns that a potential correction may occur this week if the new administration fails to present a clear action plan.

It’s worth noting that Bitcoin is currently being sold at a lower price on Coinbase compared to Binance, suggesting a lack of interest from U.S. investors. Additionally, Arkham Intelligence data reveals a significant whale transferred over $1 billion in Bitcoin to Coinbase on Thursday, which is often an indication that the investor intends to offload their holdings.

Be mindful of inflation concerns resurfacing, as the Producer Price Index (PPI) in the U.S., indicating growing pressure on prices within the supply chain, surpassed the Consumer Price Index (CPI) in December for the first time since 2022. Keep a keen eye!

Token Events

- Governance votes & calls

- ApeChain is voting on a revamped governance process for 75% of the on-chain treasury to be directed to DAO treasury contract and the remaining 25% to the Ape Foundation for administrative and support purposes. Voting began Jan. 17 and will last for 13 days.

- The Aave DAO is discussing a joint incentive program with Polygon that would require $3 million to enhance liquidity and adoption of Aave on the Polygon blockchain.

- Unlocks

- Jan. 17: ApeCoin (APE) to unlock 2.16% of its circulating supply, worth $18.1 million

- Jan. 17: QuantixAI (QAI) to unlock 4.79% of its circulating supply, worth $21.28 million

- Jan. 18: Ondo (ONDO) to unlock 134% of its circulating supply, worth $2.19 billion.

- Jan. 21: Fasttoken (FTN) to unlock 4.6% of circulating supply worth $76 million.

- Token Launches

- Jan. 17: Solv Protocol (SOLV) to be listed on Binance.

Token Talk

By Oliver Knight

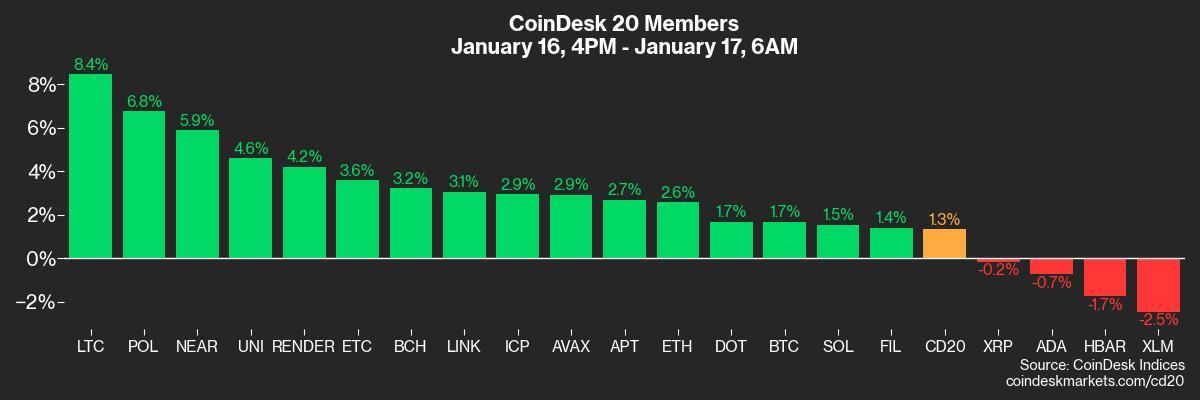

- Litecoin (LTC) led the pack over the past 24 hours after a Nasdaq 19B-4 filing paved the way to roll out an LTC exchange traded-fund (ETF). The token rose 17% to overtake bitcoin cash (BCH) in terms of market cap.

- Ethereum developers confirmed that the mainnet Pectra upgrade will take place in March, with a series of hard forks planned on Ethereum testnets in February. The upgrade will improve wallet functionality and increase the native staking limit to 2,048 ETH from 32 ETH. This increase means larger stakers like Coinbase and restaking protocols will be able to control fewer validators, reducing complexity. Coinbase currently has tens of thousands of validators.

- Altcoin whales are aggressively buying solana (SOL) in the lead-up to Donald Trump’s inauguration. One particular wallet, reported by Lookonchain, bought $2.49 million worth of SOL and withdrew an additional $3.94 million worth out of Binance. It then deposited a total of 144,817 SOL ($30.4 million) into lending platform Kamino before borrowing $20 million of stablecoins. This is effectively taking a long position on SOL as when the value of the underlying asset rises, the user will have to pay less stablecoin.

Derivatives Positioning

- Litecoin is the best-performing coin in terms of futures open interest growth and positive CVD readings that imply net buying pressure.

- HYPE stands out as overheated, with annualized funding rates in excess of 100%, according to Velo Data. The elevated funding rate indicates overcrowding in bullish bets.

- BTC‘s annualized one-month futures basis on the CME has climbed above 12%, surpassing ETH’s 11%. BTC, ETH CME futures open interest, however, remains little changed and well below December highs.

- BTC, ETH options on Deribit show bias for calls.

Market Movements:

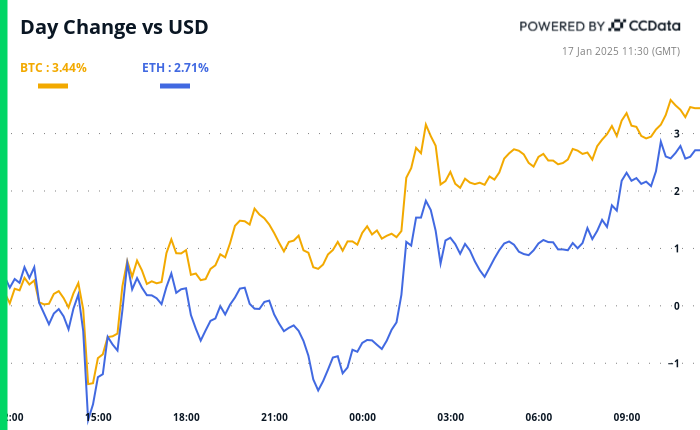

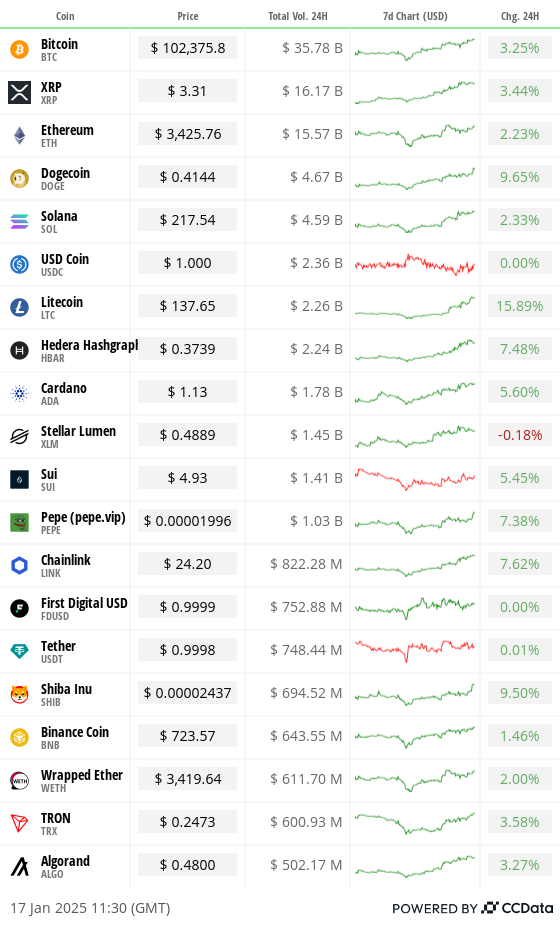

- BTC is down 2.17% from 4 p.m. ET Thursday at $102,319.71 (24hrs: +3.15%)

- ETH is up 3.13% at $3,424.04 (24hrs: +3.22%)

- CoinDesk 20 is up 1.36% at 3,960.57 (24hrs: +4.36%)

- Ether staking yield is unchanged at 3.1%

- BTC funding rate is at 0.0092% (10.12% annualized) on Binance

- DXY is unchanged at 109.02

- Gold is up 0.67% at $2,730.60/oz

- Silver is down 1.3% at $31.28/oz

- Nikkei 225 closed -0.31% to 38,451.46

- Hang Seng closed +0.31% to 19584.06,

- FTSE is up 1.06% at 8,481.19

- Euro Stoxx 50 is up 0.66% at 5,140.87

- DJIA closed on Thursday -0.16% to 43,153.13

- S&P 500 closed -0.21% to 5,937.34

- Nasdaq closed -0.89% to 19,338.29

- S&P/TSX Composite Index closed +0.23% to 24846.2

- S&P 40 Latin America closed -1.41% to 2,230.95

- U.S. 10-year Treasury is down 2 bp at 4.6%

- E-mini S&P 500 futures are unchanged at 5,993.50

- E-mini Nasdaq-100 futures are down 0.32% at 21,332.25

- E-mini Dow Jones Industrial Average Index futures are unchanged at 43,496.00

Bitcoin Stats:

- BTC Dominance: 57.49

- Ethereum to bitcoin ratio: 0.0334

- Hashrate (seven-day moving average): 784 EH/s

- Hashprice (spot): $57.0

- Total Fees: 7.34 BTC/ $731,223

- CME Futures Open Interest: 178,755 BTC

- BTC priced in gold: 37.8 oz

- BTC vs gold market cap: 10.75%

Technical Analysis

- The dollar index’s (DXY) rally has stalled, but the bullish trendline characterizing the uptrend from 100 is still intact.

- A renewed bounce from the trendline support could create a headwind to risk assets.

Crypto Equities

- MicroStrategy (MSTR): closed on Thursday at $367 (+1.77%), up 3.26% at $378.98 in pre-market.

- Coinbase Global (COIN): closed at $281.63 (+2.44%), up 2.68% at $289.28 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$28.77(+3.01%).

- MARA Holdings (MARA): closed at $18.3 (+0.83%), up 3.17% at $18.88 in pre-market.

- Riot Platforms (RIOT): closed at $13.29 (-1.29%), up 3.24% at $13.72 in pre-market.

- Core Scientific (CORZ): closed at $14.63 (+0.69%), up 1.71% at $14.88 in pre-market.

- CleanSpark (CLSK): closed at $11.18 (-0.18%), up 3.58% at $11.58 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.60 (+0.12%), up 2.93% at $25.32 in pre-market.

- Semler Scientific (SMLR): closed at $58.24 (+3.8%), up 2.76% at $59.85 in pre-market.

- Exodus Movement (EXOD): closed at $37.87 (+7.1%), up 5.62% at $40 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: $527.9 million

- Cumulative net flows: $38.04 billion

- Total BTC holdings ~ 1.14 million.

Spot ETH ETFs

- Daily net flow: $166.59 million

- Cumulative net flows: $2.64 billion

- Total ETH holdings ~ 3.57 million.

Overnight Flows

Chart of the Day

- The chart shows trends in NEAR’s circulating supply staked or locked in the blockchain in return for rewards, versus supply unstaked.

- The rate at which NEAR holders are staking their coins is increasing, creating a bullish demand-supply dynamic for the token.

In the Ether

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-17 15:03