What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin’s structure, which is both censorship-resistant and decentralized, offers individuals the ability to engage in direct, peer-to-peer financial transactions that are free from intervention or management by governments or corporations.

You’ve probably heard that from a Bitcoin maxi many times.

Today, the concept holds even greater weight given recent speculations about President Donald Trump considering measures to replace Jerome Powell, current chairman of the Federal Reserve – widely recognized as the globe’s most influential central bank.

On Friday, National Economic Council Director Kevin Hassett discussed President Trump’s plans, which prompted markets to react early Monday by reducing the value of the dollar and U.S. stock futures. The Dollar Index, a measure that follows the currency’s exchange rate against significant currencies, reached a three-year low of 98.00, while gold prices surged past $3,400 per ounce, establishing new highs.

Bitcoin surpassed $87,000, signaling a strong upward trend after its brief period of horizontal movement between $83,000 and $86,000, implying further growth is likely. In the crypto market, sectors involving gaming, AI, and memecoins outperformed others during this upswing. Notable smaller tokens such as ENJ and MAGIC recorded gains of over 50% within a day. However, MANTRA experienced a 15% drop.

Matrixport, a company offering crypto financial services, stated that a weak U.S. dollar might rekindle interest among American investors, underscoring bitcoin’s possible role as a safeguard against the depreciation of the dollar.

The analysis from IntoTheBlock suggests that, with fewer sellers likely to emerge under the $90,000 price point, there may be a rapid market surge before a significant number of investors reach their break-even point and decide to cash out. This warning indicates increased volatility could be on the horizon.

Meanwhile, in recent updates, the Chief Executive Officer of Charles Schwab, Rick Wurster, expressed optimism and a strong possibility that their financial services company could facilitate direct cryptocurrency trading within the upcoming twelve months. Wurster noted an increasing interest among clients regarding cryptocurrencies.

In simpler terms, the Slovenian government is suggesting a 25% tax on the profit made when people sell cryptocurrencies for traditional currencies (fiat) or use them to buy products and services. This tax is planned to start in 2026.

Vitalik Buterin, co-founder of Ethereum blockchain, suggested swapping the Ethereum Virtual Machine (EVM) with RISC-V – an open-source processor design that can be customized for multiple purposes. Buterin believes this change would tackle one of Ethereum’s major scaling issues by significantly enhancing the effectiveness and simplicity in executing smart contracts, thus improving their efficiency.

Regarding Ethereum, it momentarily dropped below its main competitor, the Solana network, when considering the total value locked in their respective native tokens (ETH and SOL). The creator of Uniswap, Hayden Adams, cautioned that Ethereum could lose ground to Solana if it reverts back to depending on its layer 1 blockchain instead of utilizing layer-2 scaling solutions.

In summary, China has announced that they will respond reciprocally towards nations collaborating with the U.S., as part of the trade conflict initiated by Trump’s administration. Keep a close eye on developments!

Token Talk

By Shaurya Malwa

- Bitget, a centralized crypto exchange, will reverse trades and compensate users due to “abnormal trading” in its perpetual futures market for VOXEL, a token linked to the Polygon-based RPG game Voxie Tactics.

- Early Sunday, VOXEL’s trading volume surged past bitcoin’s 24-hour volume — with the token’s value surging over 300% in a week — despite being only the 723rd-largest cryptocurrency by market cap.

- An X user claimed six-figure profits from a sub-$100 investment, attributing the surge to a potential bug in Bitget’s market-making robot,. The trade rollback will likely erase these gains.

As an analyst, I believe there might have been a bug in Bitget’s market-making robot, causing the Voxel/USDT contract to automatically execute trades within the range of 0.125-0.138. Interestingly, someone discovered they could short sell tens of thousands of units using just 100u…

Moments ago, USDT temporarily halted withdrawals, but it has since resumed. However, some related accounts seem to be on hold due to risk management measures. It feels a bit like an ATM spitting out bills wildly, quite amusing! 😂

— 迪伦Dylan🎒 (@0xDy_eth) April 20, 2025

- Bitget’s investigation revealed possible market manipulation by certain accounts, prompting the exchange to activate its risk-control system and plan a trade rollback within 24 hours.

- Affected users who incurred losses will receive compensation, and Bitget is continuing its investigation.

Derivatives Positioning

- The market-wide futures open interest has climbed to $37.22 billion, the highest since March 24, according to Velo Data. The figure represents open interest in all coins listed on Binance, Bybit, OKX, Deribit and Hyperliquid.

- ETH is the best performing major token in terms of futures open interest growth, followed by BTC and LINK.

- Speaking of OI-adjusted cumulative volume delta, ETH also leads the pack with the highest positive reading, implying an influx of buying pressure in the market.

- On Deribit, BTC and ETH risk reversals for short- and near-dated expiries have flattened out, recovering from the recent persistent negative prints that represented bias for protective put options.

Market Movements:

- BTC is up 3.19% from 4 p.m. ET Sunday at $87,270.44 (24hrs: +3.63%)

- ETH is up 2.54% at $1,631.90 (24hrs: +3.17%)

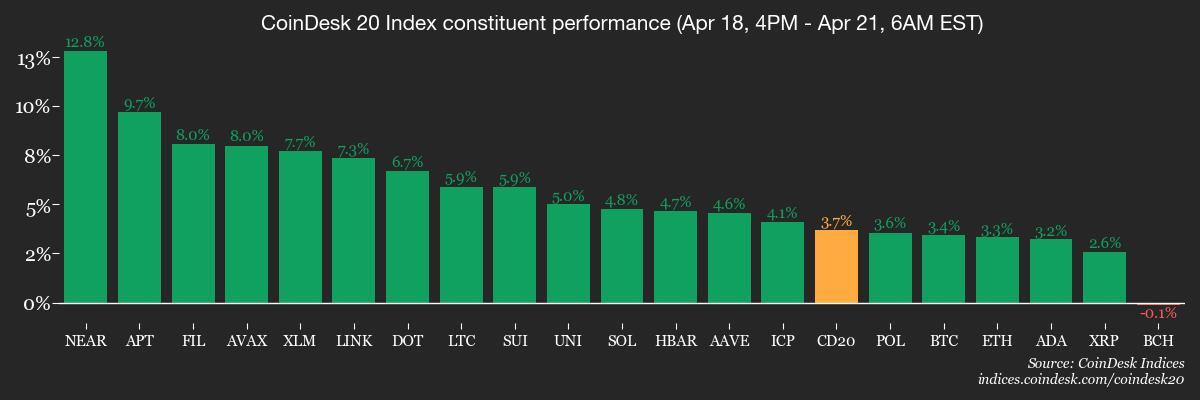

- CoinDesk 20 is up 0.8% at 2,268.01 (24hrs: +3.77%)

- Ether CESR Composite Staking Rate is up 47 bps at 2.47%

- BTC funding rate is at 0.0044% (4.776% annualized) on Binance

- DXY is down 1.11% at 98.26

- Gold is up 2.04% at $3,395.65/oz

- Silver is up 1.12% at $32.89/oz

- Nikkei 225 closed -1.3% at 34,279.92

- Hang Seng closed +1.61% at 21,395.14

- FTSE is closed at 8,275.66

- Euro Stoxx 50 is closed at 4,935.34

- DJIA closed on Thursday -1.33% at 39,142.23

- S&P 500 closed +0.13% at 5,282.70

- Nasdaq closed -0.13% at 16,286.45

- S&P/TSX Composite Index closed +0.36% at 24,192.81

- S&P 40 Latin America closed +1.64% at 2,383.75

- U.S. 10-year Treasury rate is unchanged at 4.33%

- E-mini S&P 500 futures are down 1.04% at 5,275.00

- E-mini Nasdaq-100 futures are down 1.16% at 18,168.25

- E-mini Dow Jones Industrial Average Index futures are down 0.92% at 38,969

Bitcoin Stats:

- BTC Dominance: 64% (0.23%)

- Ethereum to bitcoin ratio: 0.1873 (0.54%)

- Hashrate (seven-day moving average): 858 EH/s

- Hashprice (spot): $45.22

- Total Fees: 5.48 BTC / $479,045

- CME Futures Open Interest: 141,280 BTC

- BTC priced in gold: 25.7 oz

- BTC vs gold market cap: 7.2%

Technical Analysis

- Bitcoin’s breakout has set the stage for a continued move higher to $90,000.

- However, trading volume has dipped, suggesting low participation in the price recovery.

- A low-volume rally often ends up being short-lived.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $317.20 (1.78%), up 3.13% at $327.12 in pre-market

- Coinbase Global (COIN): closed at $175.03 (1.64%) up 1.4% at $177.49

- Galaxy Digital Holdings (GLXY): closed at C$15.36 (-1.41%)

- MARA Holdings (MARA): closed at $12.66 (2.76%), up 2.69% at $13.00

- Riot Platforms (RIOT): closed at $6.46 (1.57%), up 2.63% at $6.63

- Core Scientific (CORZ): closed at $6.63 (0.61%), down 0.45% at $6.60

- CleanSpark (CLSK): closed at $7.51 (3.16%), up 1.86% at $7.65

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.04 (1.09%), up 2.41% at $12.33

- Semler Scientific (SMLR): closed at $32.49 (4.79%)

- Exodus Movement (EXOD): closed at $36.58 (-1.64%), up 2.1% at $37.35

ETF Flows

U.S. equity markets were closed on Friday.

Overnight Flows

Chart of the Day

- XRP‘s short- and near-dated risk reversals continue to be priced negative, a sign of persistent demand for put options, which offer downside protection.

In the Ether

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Lottery apologizes after thousands mistakenly told they won millions

- Mirren Star Legends Tier List [Global Release] (May 2025)

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-04-21 15:01