What to know:

- Bitcoin climbed to near $102,000 on Monday, reclaiming its six-digit price for the first time since December 19 and starting 2025 strong following the holiday lull.

- 10x Research noted that the crypto bounce will likely extend into Trump’s inauguration, but momentum may falter towards month-end as the hawkish Federal Reserve remains a key risk.

The value of Bitcoin (BTC) has once again reached numbers with six digits, as it continued to build momentum from its early 2021 surge on Monday.

During the trading session earlier today, Bitcoin moved closer to $100,000 and then surged beyond this mark significantly, increasing by approximately 2.5% within an hour as the U.S. stock markets started operating. At the moment, it is being traded around $102,000, which represents its highest point since late December and a rise of 4.3% in the last 24 hours.

During the specified timeframe, the CoinDesk 20, a measure of the broader cryptocurrency market, increased by 3.5%. Each of the twenty major cryptocurrencies experienced growth. Ethereum‘s ether (ETH) rose by 2.8% to reach $3,700, while Solana’s SOL soared by 4.5%, surpassing the $220 mark.

As a crypto investor looking back at the end of 2024, I can’t help but reflect on the correction that Bitcoin and the broader market experienced. After an impressive rally since Donald Trump’s election victory, some of the gains were trimmed as investors decided to cash out their profits. The prices and trading volumes dipped during the holiday season, adding to the downward trend, especially with the outflows from Bitcoin and Ethereum exchange-traded funds.

By December 30, Bitcoin had hit a local bottom around $91,000 – a nearly 15% pullback from its all-time highs. It’s always an interesting time to learn from market fluctuations and prepare for the future.

Demand returns as leverage remains muted

As the first full week of business in the new year got underway and traders resumed their work following the holiday break, news about companies buying Bitcoin persisted. On Monday, MicroStrategy disclosed another purchase of 1,020 Bitcoins, while KULR Technology Group, a Texas-based energy management firm, increased its Bitcoin holdings by $21 million, effectively doubling its supply.

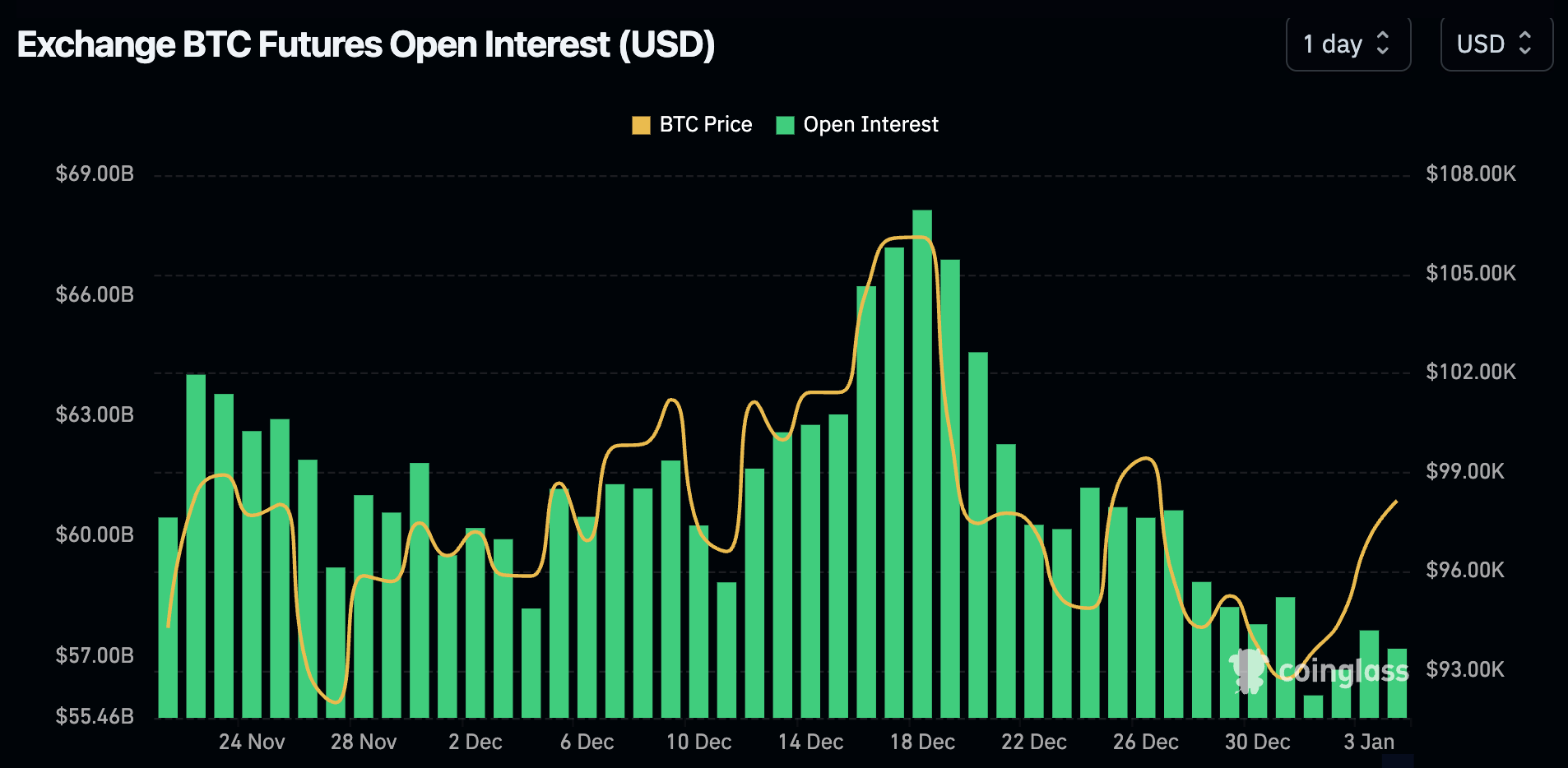

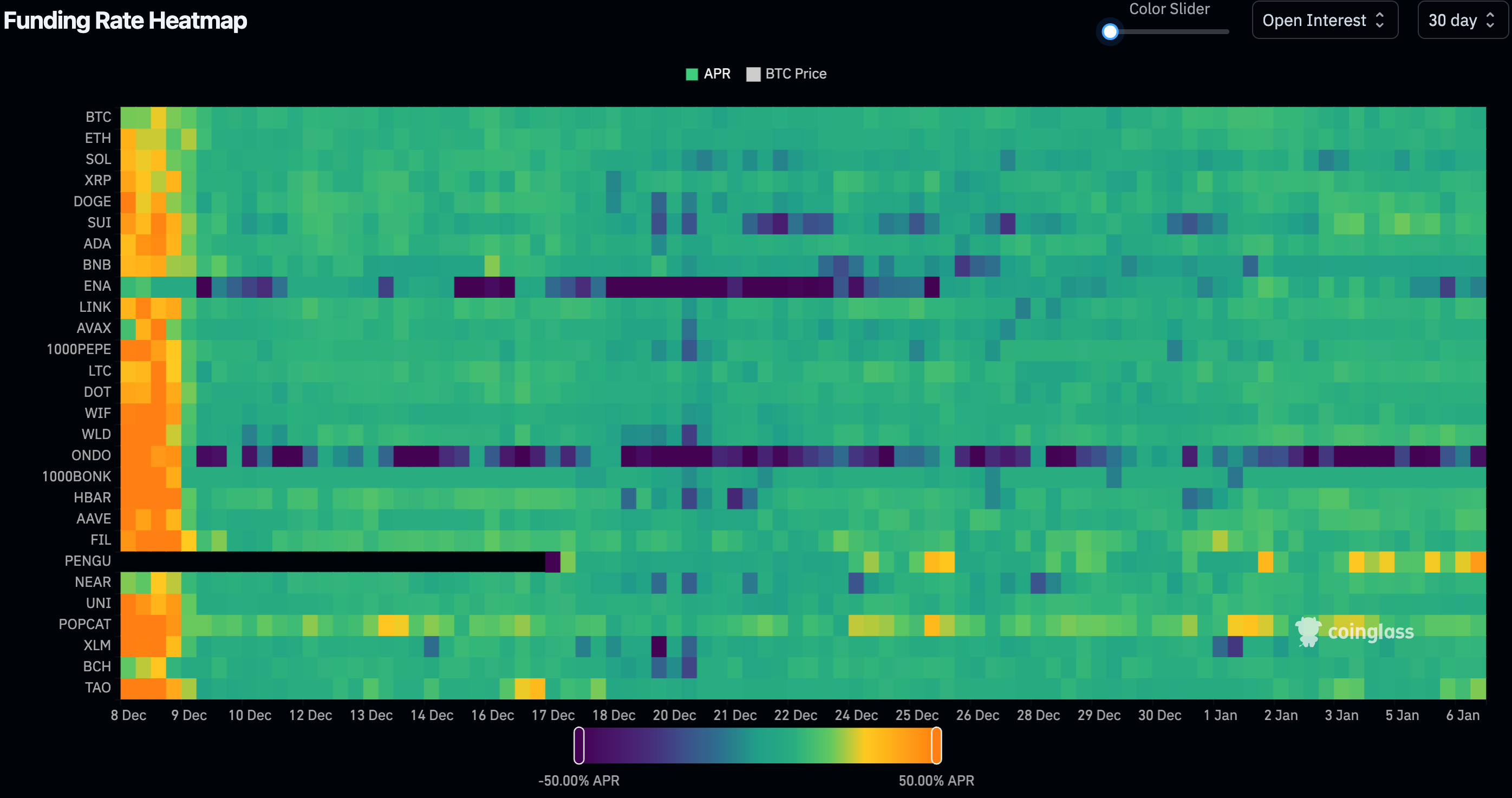

On Friday, there was an influx of $908 million into Bitcoin ETFs, suggesting that demand is resurfacing. At the same time, the number of open contracts on Bitcoin futures is markedly lower compared to mid-December on platforms like CME and overall, implying that the recent price increase was largely due to direct purchases rather than borrowing or leverage. According to James Van Straten, senior analyst at CoinDesk, this trend was observed. Additionally, funding rates remained balanced across all exchanges, as per data from CoinGlass, indicating a lack of excessive excitement during the upward movement in prices.

Fed risk

Similar to how institutions have been cautiously managing their risky assets on their balance sheets as the end of the year approaches and holidays near, it’s likely we will witness market fluctuations and demand recovery, particularly as we move into what is anticipated to be a prosperous year for this asset class and with the upcoming U.S. administration. Paul Howard, senior director at crypto trading firm Wincent, shared this perspective in a message to CoinDesk on Telegram.

In simpler terms, Howard stated that he doesn’t believe we should place too much significance on Bitcoin prices exceeding $100,000 because the market is likely to become more volatile over the next two weeks.

10x Research, a company specializing in cryptocurrency analysis, predicted a rise in digital currency prices around the start of January, leading up to President-elect Trump’s inauguration, as stated in their report on Monday. However, they cautioned about a potential sell-off towards the end of the month, prior to the Federal Reserve’s meeting in January.

At the December gathering, Federal Reserve Chairman Jerome Powell made hawkish remarks that triggered a retreat in risky investments. According to 10x Research, the Fed might need some time to alter its approach, even if inflation moderates significantly in the upcoming months.

The main danger still lies in the way the Federal Reserve communicates, particularly if fresh worries about inflation surface, according to Markus Thielen, founder of 10x Research. We expect a decrease in inflation this year, but it might take a while for the Federal Reserve to acknowledge and officially react to this change.

Although a certain amount of optimism is natural at the beginning of the year, it’s important to avoid the same degree of excessive enthusiasm that we saw from late January to March 2024 and again from late September to mid-December.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- What was the biggest anime of 2024? The popularity of some titles and lack of interest in others may surprise you

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- Deep Rock Galactic: The Synergy of Drillers and Scouts – Can They Cover Each Other’s Backs?

- Sonic 3 Just Did An Extremely Rare Thing At The Box Office

- Final Fantasy 1: The MP Mystery Unraveled – Spell Slots Explained

- Influencer dies from cardiac arrest while getting tattoo on hospital operating table

- Smite’s New Gods: Balancing Act or Just a Rush Job?

- Twitch CEO explains why they sometimes get bans wrong

2025-01-06 20:39