What to know:

- Wintermute’s 2025 predictions: China, UAE, and Europe may follow the U.S. in creating a BTC strategic reserve.

- Wintermute saw OTC trading volumes grow by 313%.

- Institutions continue to search for more sophisticated yield and risk management instruments.

It’s predicted that this year will see increased integration of cryptocurrencies with conventional financial systems (TradFi), primarily via exchange-traded funds (ETFs) and company holdings, as suggested by the crypto trading company, Wintermute.

Furthermore, significant corporate events like acquisitions or mergers may be resolved using stablecoins, according to the market maker and liquidity provider’s annual report and forecast.

Among its other forecasts:

- The U.S. will begin consultations to create a strategic bitcoin reserve, with China, the UAE and Europe following suit.

- A publicly listed company will sell debt or shares to buy ether (ETH), mimicking MicroStrategy’s (MSTR) bitcoin acquisition policy.

- A systemically important bank will offer spot cryptocurrency trading to clients.

The forecasts are based on a significant surge in demand experienced last year, which led to a considerable increase in over-the-counter (OTC) trading volumes among institutional traders. This rise followed the approval of Bitcoin (BTC) ETFs in January and later introduction of Ether (ETH) ETFs. The report suggests that this increased interest is due to clearer regulatory guidelines and the desire for efficient capital trading. The size of an average OTC trade grew by 17%, while the total volume experienced a 313% increase, according to the report.

The increase in derivative volumes exceeded 300% due to institutions seeking advanced yield and risk control tools. In the spot market, Wintermute recorded an unprecedented single-day OTC volume of $2.24 billion, outperforming the weekly record of $2 billion from 2023.

Shift in Asset Preferences

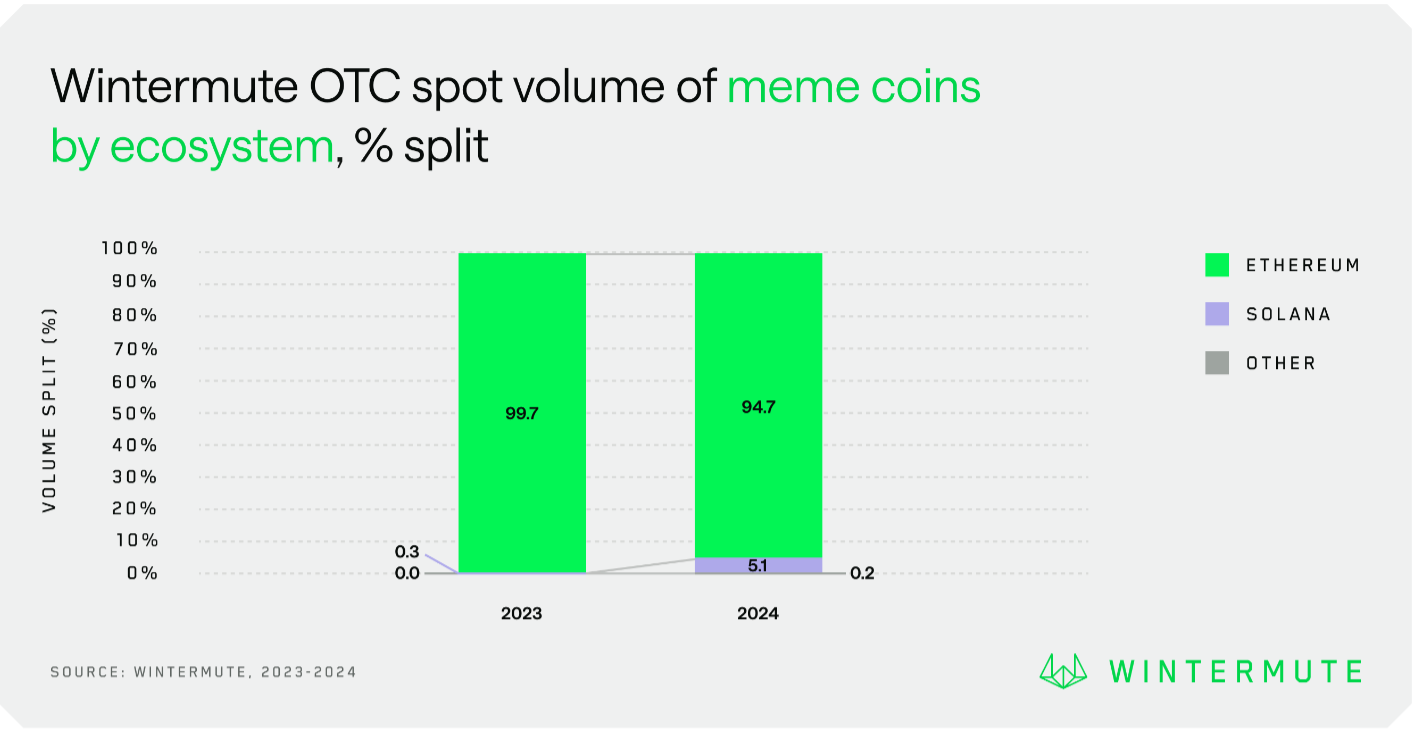

2024 witnessed a significant triumph for memecoins, as their market share surged over 100% to reach approximately 16%. This growth was largely spurred within the Solana network, with coins like dogwifhat (WIF), bonk (BONK) and ponke (PONKE) playing prominent roles. However, ether still holds a dominant position in the market.

In the report, CEO Evgeny Gaevoy stated that our company experienced exceptional growth, primarily fueled by the high demand for advanced financial instruments such as CFDs and options. This suggests a maturing market that is starting to resemble traditional finance more closely. We expect this trend to continue, with even more momentum, as cryptocurrencies become more integrated into global financial systems through ETFs, corporate holdings, tokenization, and the development of structured products.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-17 16:57