Bitcoin‘s $90,000 support level has proven robust, leading to a significant upward trend. Currently, the price is approaching its record high of $108,000. If it breaks through this barrier, it might trigger a rapid series of short position closures, possibly propelling the cryptocurrency into unexplored regions.

Technical Analysis

By Shayan

The Daily Chart

The price of Bitcoin has consistently stayed around $90,000 for several months now, which suggests a strong level of support and high buyer confidence. This renewed interest in buying has pushed the price of Bitcoin above its middle trendline, bringing it very close to its all-time high of $108,000.

At that high point, there’s a significant zone of resistance where the supply is densely packed and there’s increased selling activity. As Bitcoin gets closer to this crucial barrier, it’s likely we’ll see some short-term price fluctuations because of the ongoing struggle between those wanting to buy and those wanting to sell.

Should bullish energy persist, regaining the all-time high of $108K might set off a chain reaction of short position closures, potentially sparking yet another price increase as investors scramble to protect their positions.

The 4-Hour Chart

On a shorter timescale, it’s clear that the $90K level has been crucial in stemming Bitcoin’s recent price declines, leading to a strong push upward and approaching the resistance at $108K.

In this area, we not only find Bitcoin reaching its all-time high, but also sitting right on the midline of an ascending channel. This suggests that it’s a crucial crossroads. If Bitcoin manages to break through and stabilize above this point, it could lead to a prolonged surge towards even higher peaks.

In the near future, whether Bitcoin breaks or holds above the $108K barrier significantly impacts its future direction. There might be increased price fluctuations in the coming days.

On-chain Analysis

By Shayan

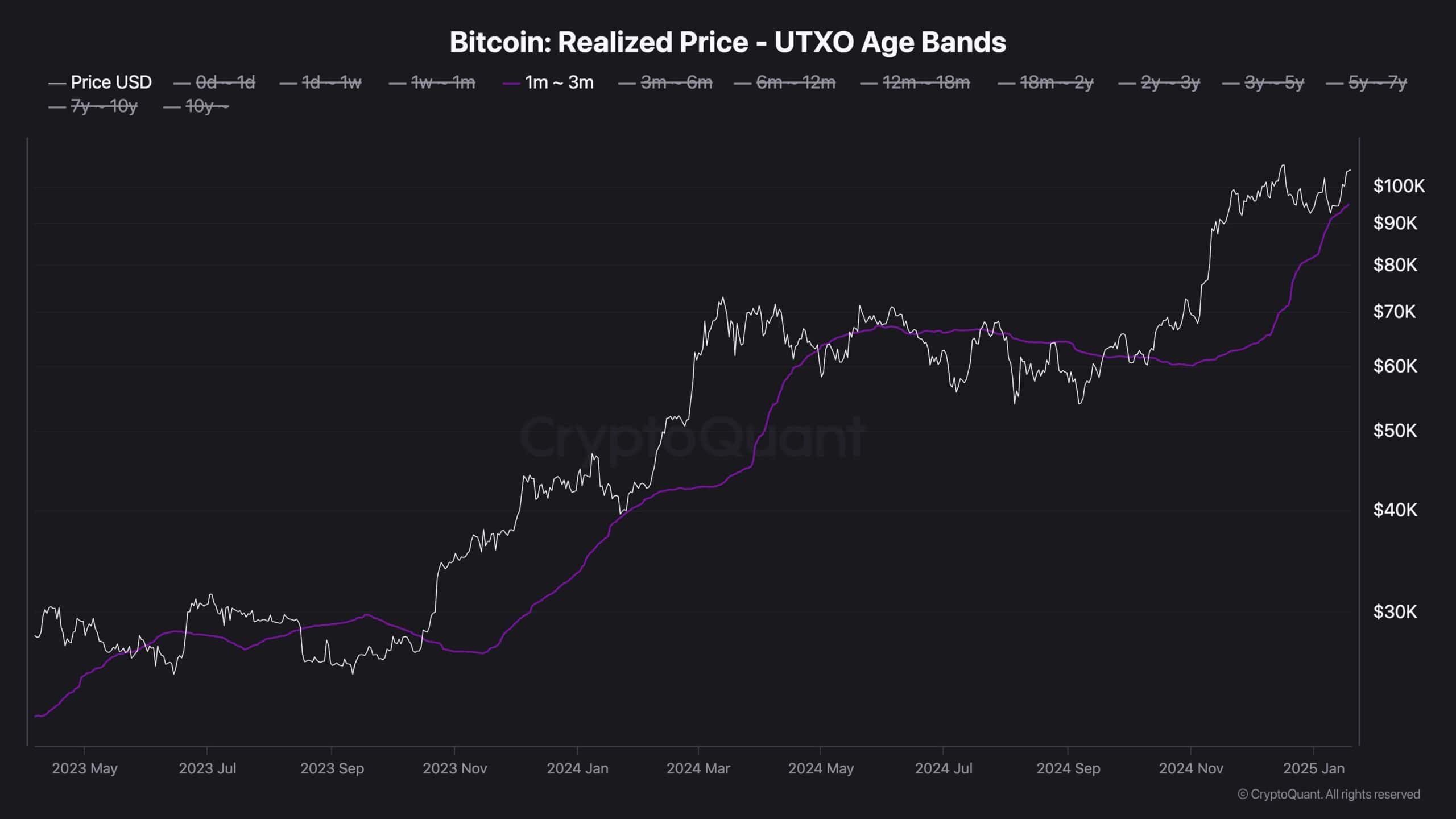

The average price at which UTXOs (Unspent Transaction Outputs) in different age groups are cashed out, particularly those between 1-3 months old, provides essential insights into short-term holding patterns and overall market attitudes. This measurement signifies the typical purchase price for recent investors, functioning as a flexible line of support or resistance that mirrors market confidence levels.

As an analyst, I observe that when the current market price of Bitcoin surpasses the short-term average price at which coins were last realized (or bought), it’s a sign of strengthening bullish sentiment. This suggests that new investors are optimistic about maintaining their positions, even at higher price points. Contrarily, a dip below this benchmark may signal an increased possibility of sell-offs, as these investors might be grappling with potential losses yet to be realized.

Lately, the $90K price range has proven to be a significant support point for the UTXO group that holds bitcoin for 1-3 months. This support has helped propel the asset closer to its All-Time High (ATH). Bitcoin maintaining above this level suggests optimism in the market, implying that the price could potentially keep rising.

However, if the cryptocurrency breaks below this dynamic support line, market sentiment could shift to a fearful state, increasing the likelihood of a distribution phase.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-19 19:58