Will BTC Crash or Boom to $92K?

Oh, the drama! The agony! The ecstasy! Bitcoin’s price has been careening about like a debutante at a ball, unable to decide whether to swoon or swoop. And yet, amidst all this chaos, some signs of recovery are peeking out like a bashful debutante’s smile.

Technical Analysis: A Study in Contrasts

By Edris Derakhshi, the oracle of all things crypto (or so he claims)

The Daily Chart: A Tale of Two Peaks

On the daily chart, Bitcoin has found solace in the $80,000 zone, where it’s been nestled like a bird in a gilded cage. After a precipitous drop from its lofty $100,000+ perch, the price action is currently trading near $85,000 – a far cry from its former glory, but still a decent spot for a picnic.

However, the resistance around $92,000 is as stubborn as a mule, refusing to budge. The RSI, that great arbiter of sentiment, is climbing back towards neutral territory, but hasn’t yet entered the realm of overbought – a sign, dear friends, that there’s still room for further upside if the bulls can maintain their grip on the reins.

The 4-Hour Chart: A Rising Wedge of Woe

The 4-hour chart reveals a classic rising wedge pattern, which BTC has been ensnared in like a fly in a spider’s web. With the rejection from the $87,000 region, a bearish reversal setup is forming, which often signals a pullback after a strong rally. Ah, the cruel whims of the market!

Immediate support sits near $82,000 – $80,000, a comforting thought for those who fear the worst. Moreover, the RSI on the 4H is decreasing rapidly, indicating a weakening bullish push. Unless the wedge is broken to the upside with all due haste, there’s potential for a deeper retracement towards the blue support zone around $80,000 in the short term.

On-Chain Analysis: A Dismal Picture

By Edris Derakhshi, the bringer of bad tidings

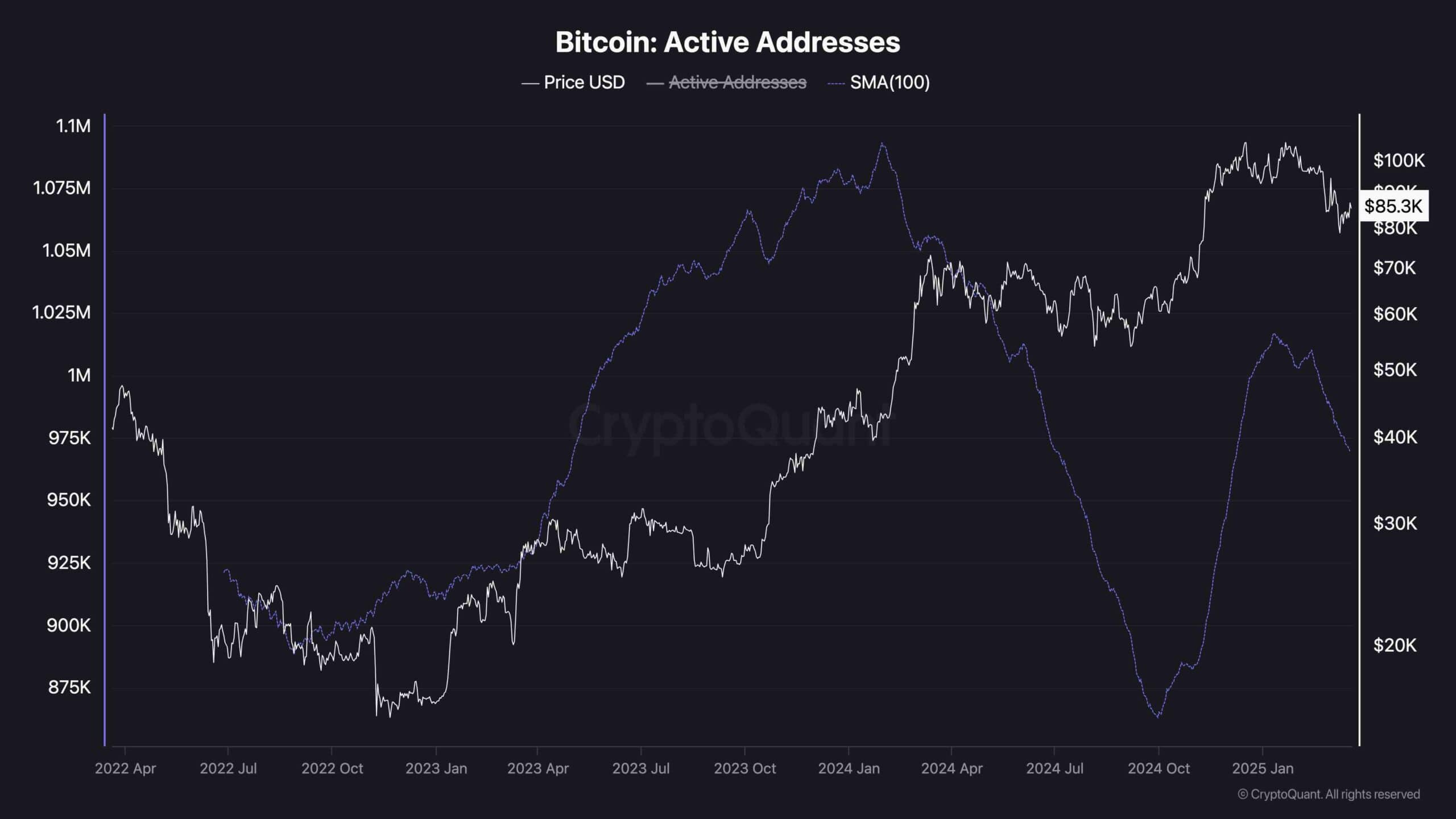

Bitcoin Active Addresses: A Decline of Epic Proportions

The recent downtrend in Bitcoin’s active addresses paints a picture of despair. After peaking in February 2024, the number of active addresses has been consistently declining, even as BTC’s price reached new highs. This divergence signals weakening network participation and user engagement – a recipe for disaster, if you will.

The sharp drop in active addresses over the past months suggests that fewer unique participants are transacting on-chain, which often reflects reduced organic demand and market interest. If this downtrend continues, it could aggravate bearish sentiment, as lower network activity typically precedes or confirms price corrections.

In the current context, the declining active addresses metric may act as a warning sign that the recent bullish bounce lacks fundamental on-chain support, potentially increasing the risk of a deeper crash. Ah, the perils of speculation!

And so, dear friends, we await the outcome with bated breath. Will BTC crash or boom to $92K? Only time will tell, but one thing is certain: the drama will continue, and we’ll be here, laughing and crying, until the very end.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- Gaming’s Hilarious Roast of “Fake News” and Propaganda

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-03-20 17:36