As an analyst with over two decades of trading experience under my belt and having closely watched Bitcoin‘s meteoric rise since its inception, I find myself optimistic about the current market structure. While Bitcoin’s struggle to maintain above the $100K mark is indeed a test of patience for many, the daily and 4-hour chart patterns suggest that it could only be a matter of time before we see higher prices.

The value of Bitcoin has been finding it tough to sustain above $100,000 following a brief surge past that mark last week.

Yet, the market structure indicates that it could only be a matter of time.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the past several weeks, the price trend on a daily basis has been steadily ascending due to the market’s deceleration post-breach above the $90K mark.

Despite a brief surge over $100K last week, Bitcoin has struggled to maintain its momentum above this price point. However, with a robust bullish market structure and a clear indication of bullish momentum from the RSI, there’s a strong possibility that Bitcoin could break through to even higher prices in the near future.

The 4-Hour Chart

Examining the 4-hour timeframe, the asset has been creating progressively higher peaks and troughs for the last few weeks, shaping an ascending channel that’s relatively narrow. At present, the market is finding support along the lower edge of this channel, which could potentially trigger a surge towards the upper trendline and values exceeding $100K within the next couple of weeks.

On the other hand, if the lower boundary of the pattern is broken, a drop toward the $90K support zone could be expected. Yet, looking at how things stand right now, the bearish scenario is less likely.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Funding Rates

As Bitcoin’s price continues its steady climb towards the $100K mark and potentially beyond, futures traders are likely bursting with optimism. Yet, a sudden spike above $100K last week followed by a sharp drop has noticeably dampened the enthusiasm in the futures market.

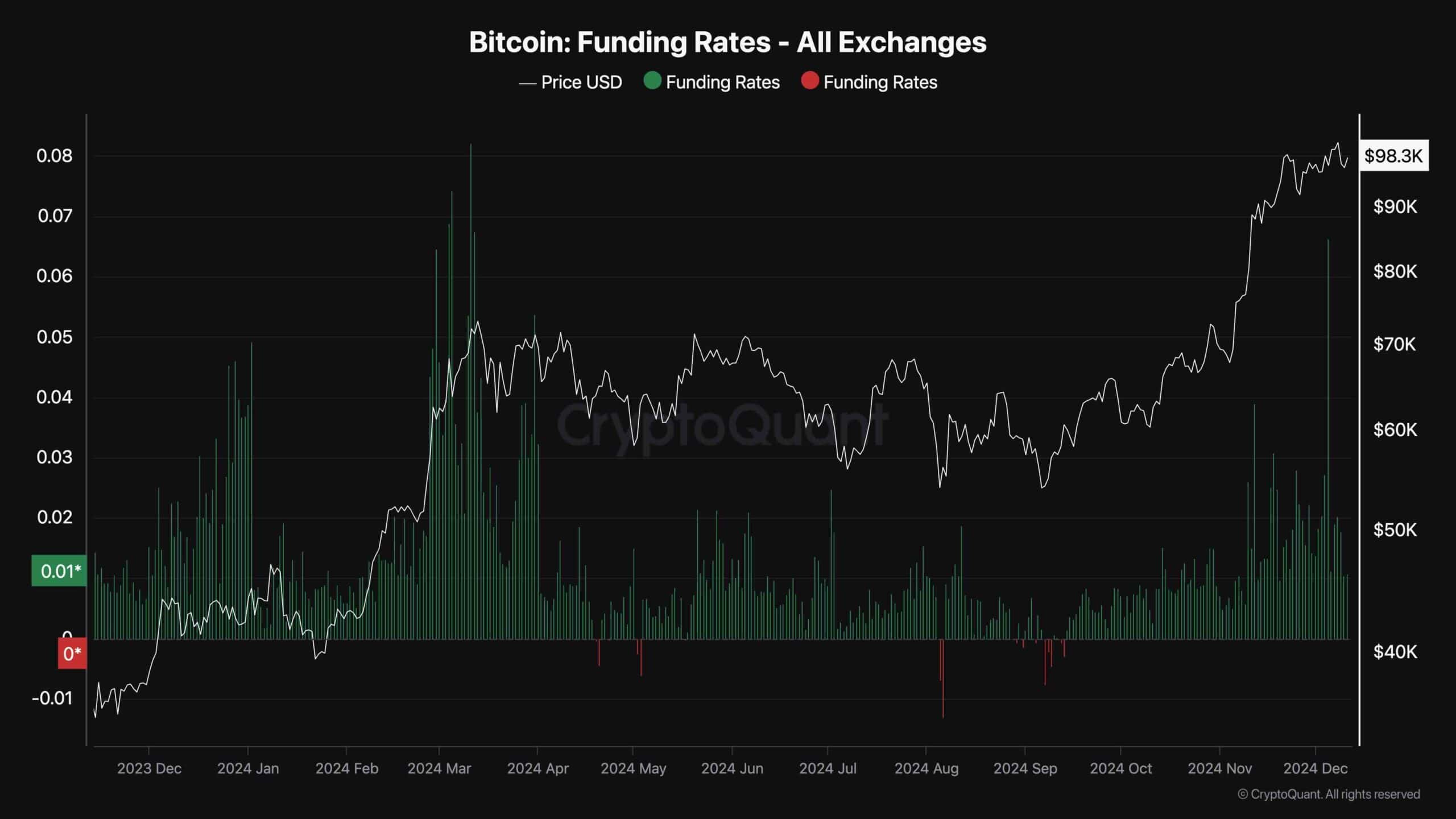

This graph illustrates the funding rates indicator, a useful stand-in for the feelings within the futures market. It demonstrates which party, buyers or sellers, is more active and assertive in placing their orders. Generally, higher values imply optimistic sentiments among traders, while lower ones indicate pessimism.

While Bitcoin’s aggregate funding rates massively spiked last week, the huge volatility on the day BTC finally reached $100K led to significant liquidations. As a result, funding rates have returned back to normal values for a bull run, which could lead to a more sustainable rally in the upcoming weeks.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-11 17:44