As a seasoned researcher with over a decade of experience in the cryptocurrency market, I’ve seen more than a few bull runs and corrections. The current Bitcoin rally is nothing short of exhilarating, with the $100K milestone just within reach. However, as the saying goes, “What goes up must come down,” and the technical and on-chain analysis suggest that a correction might be imminent.

Bitcoin’s price came just a small step away from reaching the $100K milestone.

In simpler terms, after the U.S. election, the market has surged powerfully, with investing in Bitcoin proving particularly lucrative – a successful strategy often associated with President Trump. Yet, Bitcoin’s value has since fallen back, moving even farther away from its goal of reaching numbers with six digits.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the past few weeks, Bitcoin’s price has been skyrocketing at an almost vertical angle, starting from early November. It appears we might soon reach 100,000 BTC. Just looking at the price movement doesn’t reveal much, but the Relative Strength Index (RSI) has been signaling a significant overbought condition for some time now.

It’s possible that Bitcoin may reach $100K soon, but it’s equally plausible that a decrease or stabilization might follow afterwards.

The 4-Hour Chart

Examining the four-hour timeframe, it appears there could be a potential for a price adjustment, given the persistent upward trend within an ascending channel that has developed over the last fortnight. Moreover, a noticeable bearish divergence displayed by the Relative Strength Index (RSI) suggests such a correction may indeed occur.

Yet, any potential pullback will likely occur after the market has broken through the $100K level.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Exchange Reserve

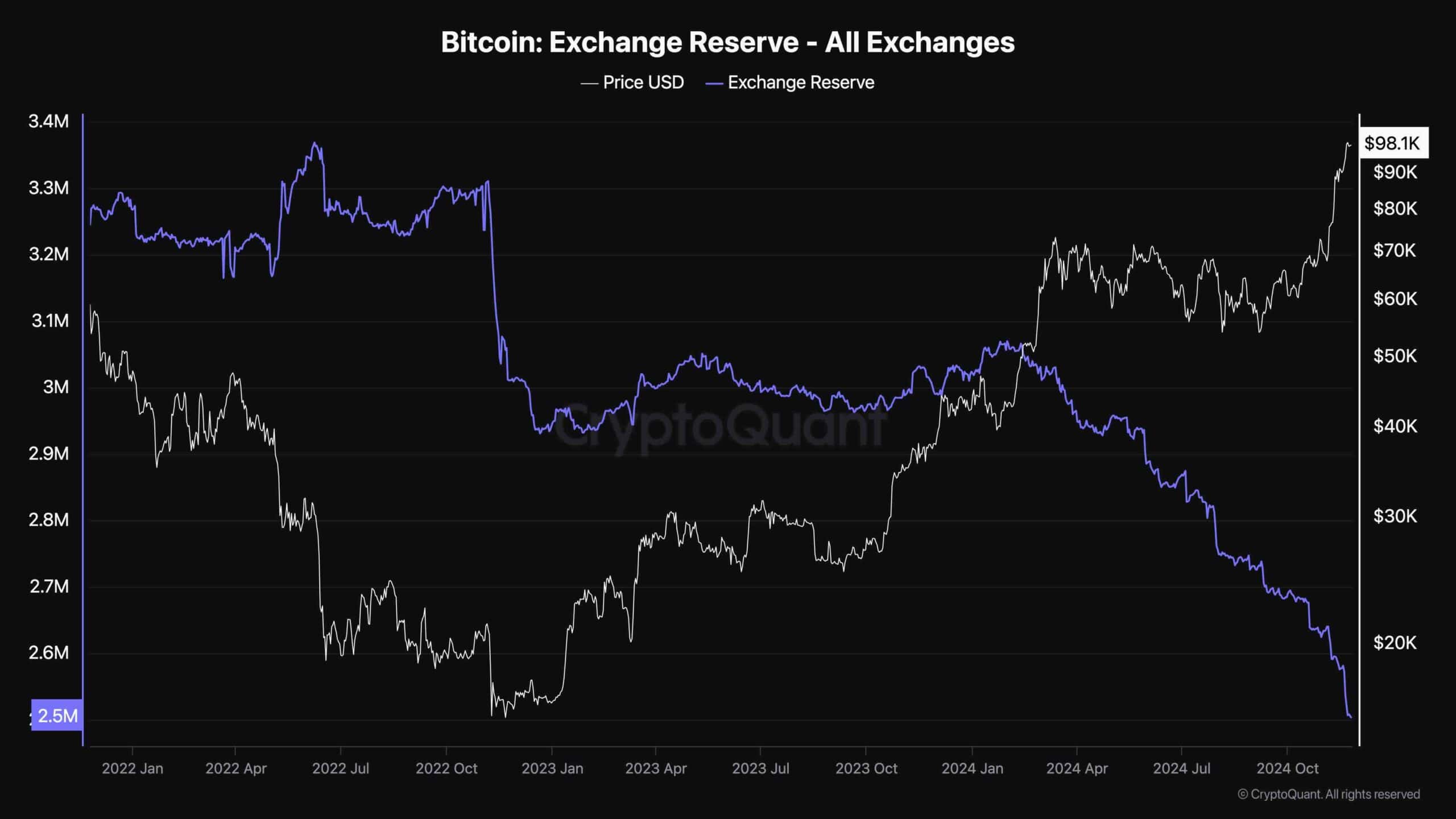

As Bitcoin’s value steadily increases, there’s a strong sense of optimism among traders that the cryptocurrency will surpass the $100K milestone for the first time. This bullish sentiment is evident in the exchange reserve graph.

The Bitcoin exchange reserve metric measures the amount of BTC held in wallets associated with trading platforms. These BTC are generally a proxy for supply, as they can be sold at any instant.

As the chart suggests, the exchange reserve metric has been taking a nose dive as investors are withdrawing their Bitcoin from exchanges. This clearly indicates that market sentiment is bullish, and the statement is backed up by a significant supply shock, which could push the price much higher in the coming weeks.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-11-25 18:51