As a seasoned researcher with over two decades of market analysis under my belt, I find myself intrigued by the current state of Bitcoin’s price action. With its recent surge and consolidation around all-time highs, it feels like we’re witnessing history being made yet again in the world of cryptocurrencies.

In recent times, Bitcoin‘s value has stabilized close to its record peak after experiencing a significant increase of approximately 30% in the preceding period.

As things currently stand, the bull run is seemingly not over yet.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the past day-to-day graph, the value has been surging forcefully ever since it exceeded the $74K barrier. Right now, the market is finding it challenging to surpass the $92K milestone, as the RSI indicates a condition of being overbought.

Given the current market setup, it’s quite likely that Bitcoin will eventually surpass $100,000, a price point that many investors have viewed as a long-term goal in recent years.

The 4-Hour Chart

On the 4-hour scale, it’s evident that the market is exhibiting a consolidation trend, with a symmetrical triangle taking shape near the $90K level, offering a clear visual representation of recent price movements.

These patterns can be continuation or reversal patterns, depending on the direction of the breakout. Yet, even if the asset breaks the pattern to the downside, it would likely be a short-term correction, as the overall trend remains bullish as long as the $80K support level is intact.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

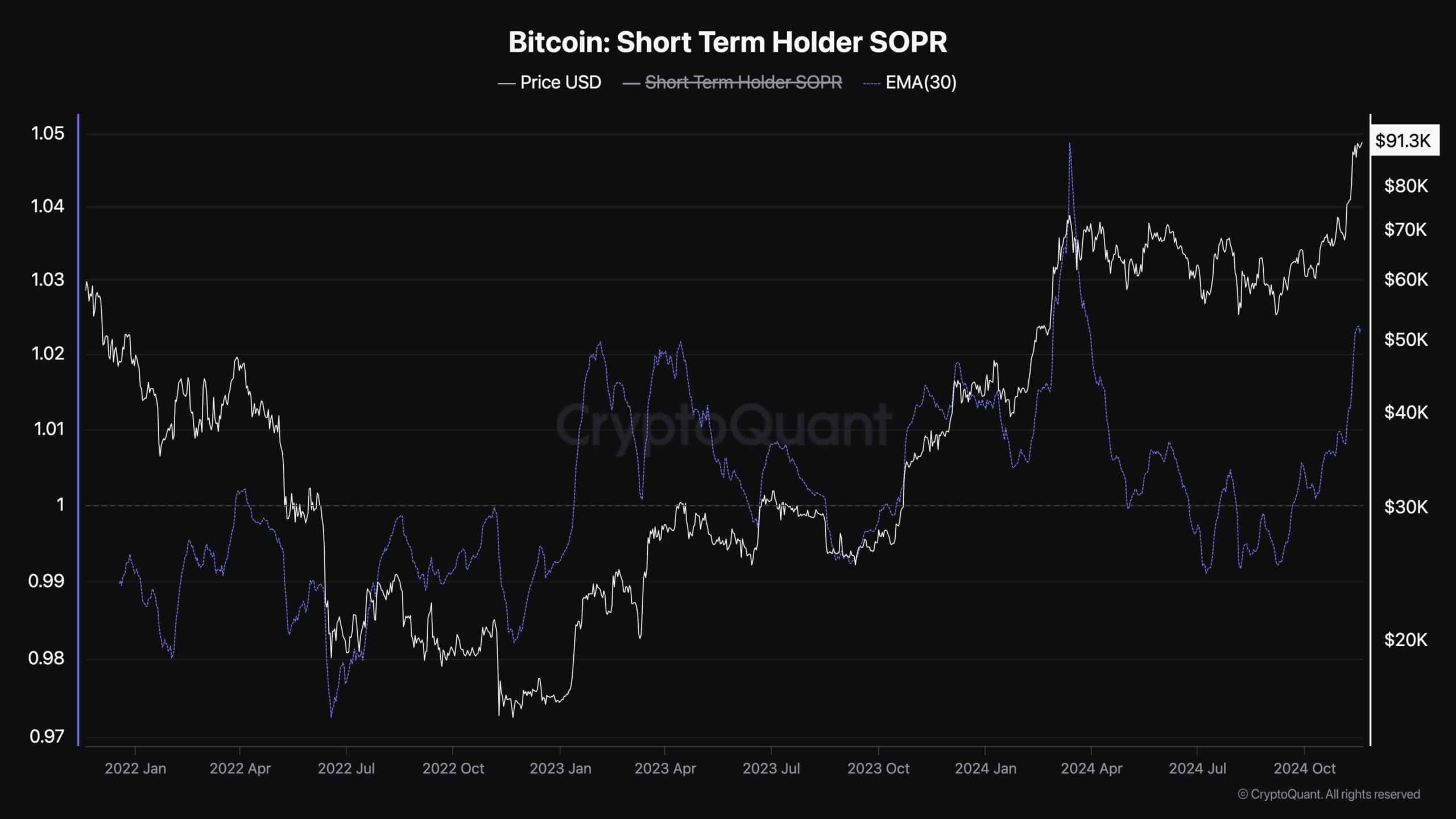

Short-Term Holder SOPR (EMA 30)

Often, just analyzing technical aspects may not fully uncover the nuances of Bitcoin’s market movements. To gain more insight into investor tendencies, it can be useful to leverage the openness of the Bitcoin blockchain for a clearer view of investment patterns.

This chart presents the Bitcoin Short-Term Holder SOPR, which measures the ratio of profits realized by holders who have bought their BTC in the last 155 days.

According to the graph, the 30-day exponentially weighted moving average for the STH-SOPR is on an upward trend once more; however, it hasn’t climbed as high as the levels recorded when Bitcoin was trading at approximately $70,000 earlier in 2021.

This could indicate that short-term market participants are realizing their profits less aggressively. As a result of this decrease in selling pressure compared to before, Bitcoin is likely to rally much higher in the near term.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-11-19 17:29