As a seasoned researcher with over a decade of experience navigating the volatile world of cryptocurrencies, I have learned to appreciate the resilience and unpredictability of Bitcoin. The recent dip, while disheartening for many investors, is not uncommon in this market. However, my technical analysis suggests that we might be on the cusp of a short-term bullish rebound.

Bitcoin is currently experiencing a period of consolidation that’s moving upward, hovering close to the significant $108K barrier it encountered a sudden drop from.

However, strong support zones suggest a potential for a short-term bullish rebound.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin has been gathering strength in a rising trend around the $108K barrier, but it’s now experiencing heightened selling activity and accumulation by significant market players.

This surge in sales resulted in a substantial 15% drop, causing the price to stabilize near approximately $90,000 and at the midpoint of a lengthy, bullish price range. These points serve as vital barriers preventing any potential additional falls.

If the price bounces back from this current support, it could pave the way for another effort to reach the $108,000 mark again. On the other hand, if the support is not maintained, it might trigger a more significant correction, with the lower boundary around $75,000 being the next important level of support to watch out for.

The 4-Hour Chart

As an analyst, I’ve noticed that Bitcoin has been consistently climbing within a prolonged bullish trend on the 4-hour chart. A recent reversal at approximately $108K caused a significant drop, bringing the price down to the midpoint of this channel around $95K – a critical dynamic support level worth keeping an eye on.

In simpler terms, we expect a brief dip in this area, which should help the price settle down and possibly continue rising again. But there’s worry about a strict monetary policy coming up in 2025, which could increase the urge to sell, making it more likely that we’ll see a downtrend instead.

If the current situation continues, there’s a possibility that Bitcoin may experience more drops. The immediate potential bottom might be around $90,000, while $75,000 could serve as a longer-term support level.

On-chain Analysis

By Shayan

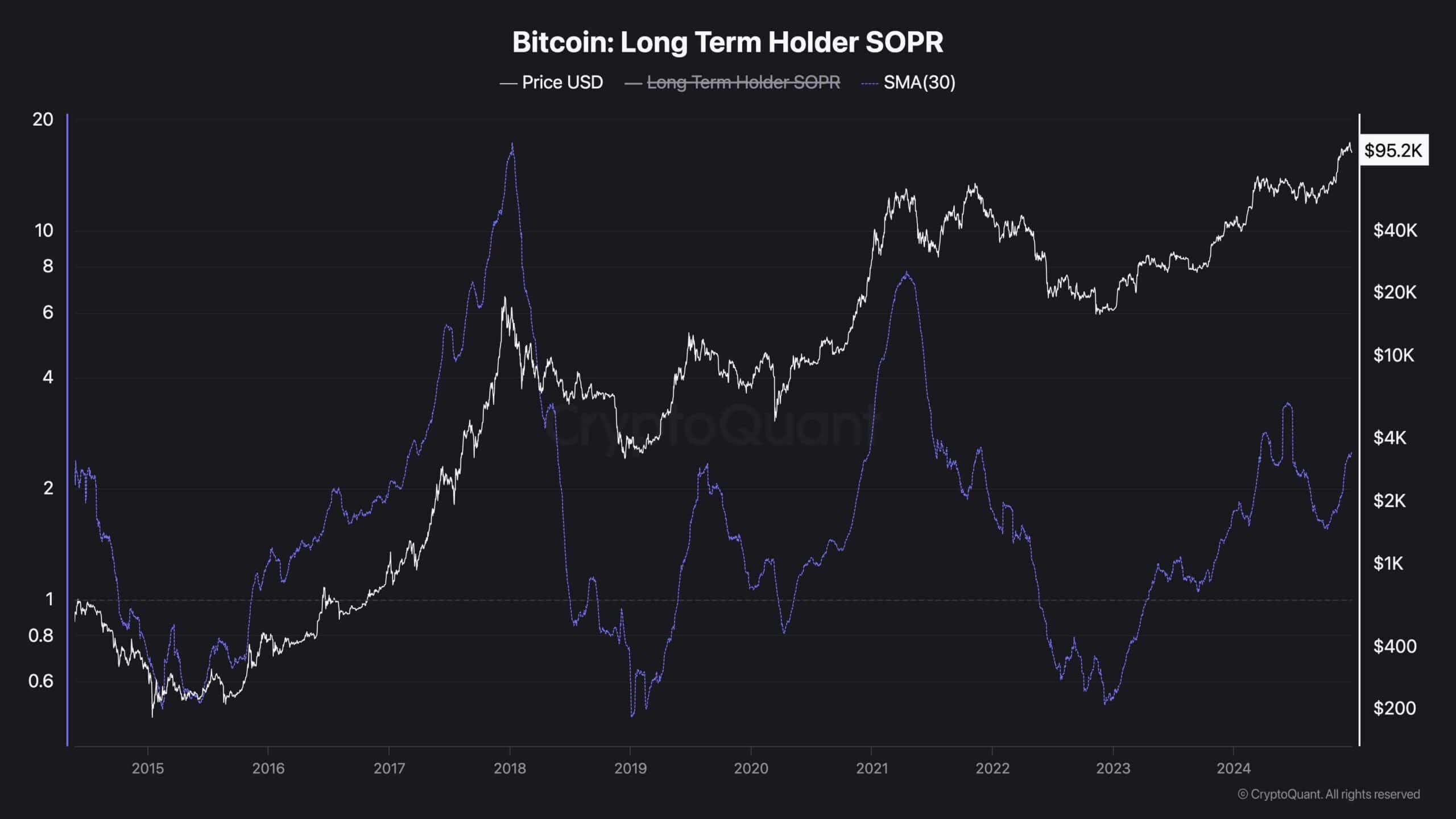

The Bitcoin Long-Term Holder Sentiment and Behavior Observation (SOPR) metric offers significant insights into market trends and investor attitudes. Over the span of 2022 to mid-2023, this SOPR stayed below 1 for a long time, suggesting that long-term Bitcoin holders were offloading their coins at a price lower than they originally paid during a widespread selling phase.

By the midpoint of 2023, the Spent Output Profit Ratio (SOPR) started moving towards or surpassing 1, indicating the initiation of recovery. This change coincided with a wider market upswing, as Bitcoin prices ascended, showcasing restored trust among investors. The increasing SOPR pattern implied that long-term holders were no longer offloading their coins at a loss, which is an essential indicator of enhanced optimism.

In early 2024, as the market progressed, the price of Bitcoin steadily increased, while the Spent Output Profit Ratio (SOPR) persistently exceeded 1. This situation indicated that long-term investors were making profits, yet the level of selling pressure remained manageable.

The stability of the SOPR above 1 highlights sustained confidence among investors, reinforcing that market conditions support continued growth, with a potential for further market expansion.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Why Sona is the Most Misunderstood Champion in League of Legends

- House Of The Dead 2: Remake Gets Gruesome Trailer And Release Window

- Skull and Bones: Players Demand Nerf for the Overpowered Garuda Ship

- Last Epoch Spellblade Survival Guide: How to Avoid the One-Shot Blues

- The Great ‘Honkai: Star Rail’ Companion Sound Debate: Mute or Not to Mute?

- US Blacklists Tencent Over Alleged Ties With Chinese Military

- Destiny 2: Is Slayer’s Fang Just Another Exotic to Collect Dust?

- Square Enix Boss Would “Love” A Final Fantasy 7 Movie, But Don’t Get Your Hopes Up Just Yet

- Gaming News: Rocksteady Faces Layoffs After Suicide Squad Game Backlash

2024-12-23 14:39