As a seasoned crypto investor with over a decade of experience, I’ve witnessed the highs and lows of the Bitcoin market, from its humble beginnings to its meteoric rise and occasional corrections. While I remain cautiously optimistic about Bitcoin’s future prospects, I have learned to approach every market analysis with a critical eye and a healthy dose of skepticism.

In this case, the technical and on-chain analysis provided by Edris Derakhshi (TradingRage) presents an interesting perspective that warrants further examination. The daily chart suggests that Bitcoin may be forming a bottom to rally toward new highs above the $100K resistance level, with the $110K mark as the next potential target. However, the 4-hour chart indicates that the market has broken an ascending channel to the downside and is currently retesting its lower boundary, which could potentially lead to a deeper correction before any significant upswing.

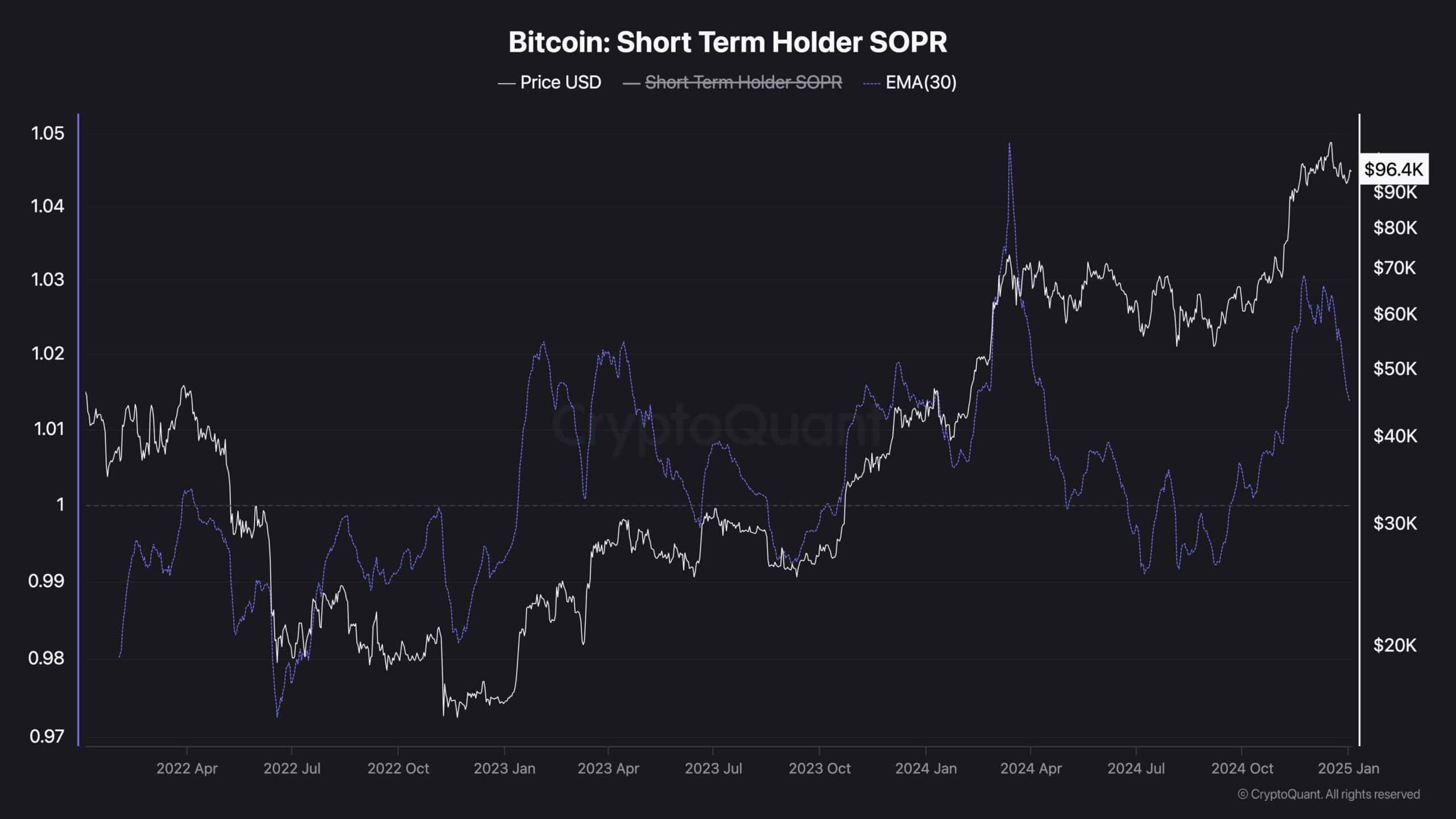

The on-chain analysis supports this notion by highlighting the decline in short-term holder SOPR, indicating that a wave of profit realization has occurred recently as Bitcoin hit the key $100K level. This selling pressure could indeed have contributed to the market’s failure to continue its rally higher. Nevertheless, the fact that the price is still holding above the $90K mark suggests that there is still sufficient demand to support the market and potentially push it higher in the coming weeks.

Given my past experiences in this market, I wouldn’t be surprised if Bitcoin experiences a deeper correction before embarking on its next bull run. But as the saying goes: “Buy the rumor, sell the news.” If the market does indeed break the $100K resistance level to the upside and begins a new rally higher, it could very well be an excellent opportunity for those who are patient and disciplined enough to weather the storm.

And to lighten the mood, let me add a bit of humor: “Investing in crypto is like waiting for a bus – you wait for hours, and then three come at once!” So buckle up, fellow investors, and get ready for the rollercoaster ride that is the Bitcoin market!

Based on my personal experience as a long-time investor in the cryptocurrency market, I have seen Bitcoin’s incredible potential for growth and its ability to shatter expectations. Despite the fact that it has yet to breach the $100K level, I remain optimistic about its future performance due to recent price action. As someone who has witnessed Bitcoin’s historic runs in the past, I understand that it can be a volatile market, but I believe that its long-term potential is strong and I am hopeful that we will see it surpass the $100K mark eventually.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

As a crypto investor, I’ve noticed on the daily chart that my asset has been battling to break through the $100K ceiling after dipping below it in December. However, it’s encouraging to see that the price has repeatedly found support at around $92K, suggesting we might be hitting a bottom and gearing up for another bull run towards new highs above the $100K barrier. If this is the case, I’m keeping my eyes on the $110K milestone as the next potential peak for Bitcoin.

The 4-Hour Chart

Over the last several weeks, the Bitcoin price movements are evident on the 4-hour chart. The market, after breaching an uptrend channel, has dipped below. It’s tested the lower boundary of this trend pattern more than once, but the $92K support level has successfully kept prices from falling further.

With the RSi also rising above the 50% threshold again, market momentum can be considered bullish, and the price could soon break the $100K resistance level to the upside and begin a new rally higher.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Short-Term Holder SOPR

As Bitcoin’s value hovers near $100K, investors are engaged in ongoing discussions about whether the bull market has reached its end. The uncertainty surrounding this question can be seen by examining the actions of those who own Bitcoin during the last week.

As someone who has been following and investing in cryptocurrencies for several years now, I have found that charts and metrics can provide valuable insights into market trends. One such metric is the Short-Term Holder SOPR (Spent Output Profit Ratio), which measures the ratio of profits realized by short-term holders. Recently, I’ve noticed that this metric has been on a steady decline after a sharp increase during the latest bull run. This suggests to me that a significant wave of profit taking has taken place recently, as Bitcoin surpassed the $100K mark. It’s an interesting development to observe, and one that underscores the importance of staying informed about market trends and keeping a close eye on relevant metrics when making investment decisions.

The resulting selling pressure by short-term holders has probably been one of the primary reasons Bitcoin failed to continue its rally higher. Yet, as the price is still holding above the $90K mark, it is evident that there is still sufficient demand to hold the market and even push it higher in the coming weeks.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- DAG PREDICTION. DAG cryptocurrency

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-03 16:53