Over the last few days, Bitcoin‘s value has been steadily dropping and then stabilized around $94,000, which is a significant support level. However, there’s a possibility that this level might break down, leading to further price decreases.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Currently, the asset briefly surpassed the $100K mark on its daily chart, but it couldn’t sustain that momentum and dropped instead. However, the $92K threshold has managed to keep the cryptocurrency from experiencing a more significant drop.

Given that the level has been tested repeatedly, there’s a strong possibility it could give way on further testing, leading to a potential price drop. Conversely, if the level maintains its strength, the market might attempt to surpass the $100K mark again, potentially reaching a new record high.

The 4-Hour Chart

Examining the four-hour timeframe, the latest price movements become easier to understand. A recent unsuccessful attempt at surpassing $100K resulted in a swift drop, but the market has now found support at around $92K and halted its descent.

Yet, the momentum is still bearish, as the market is not showing any significant willingness to rise back toward the $100K area. Therefore, if things remain the same, a breakdown of the $92K level and a drop toward the $85K mark will be probable.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

Exchange Reserve

Over the last few months, Bitcoin’s value has held steady just under the $100K mark, causing some uncertainty among investors regarding its future trajectory. This apprehension can be observed by examining trends in the futures market.

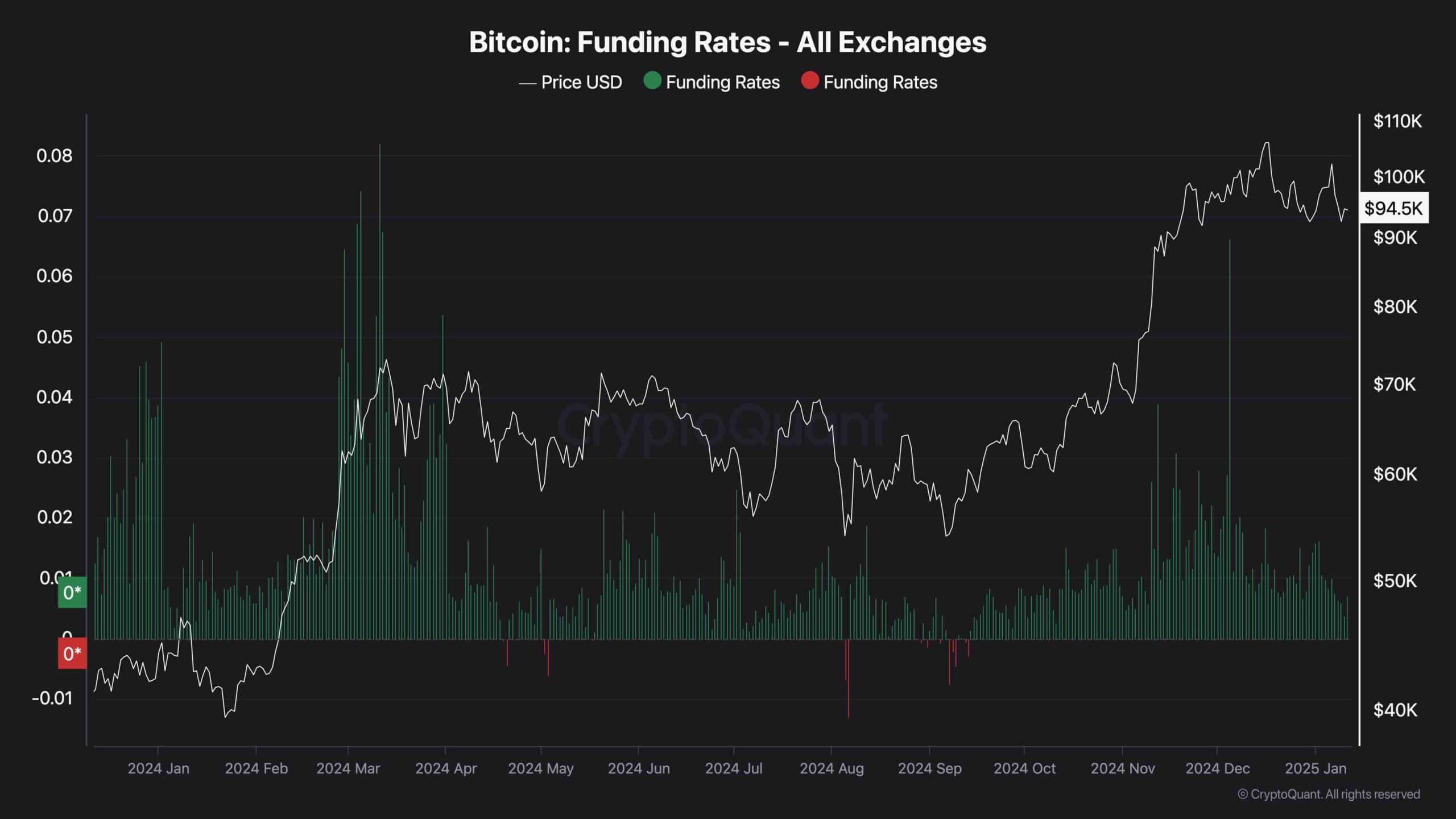

This graph illustrates the Funding Rates indicator, which is an effective tool for assessing investor sentiment in the futures market. A positive value suggests a bullish outlook, while negative values point towards a bearish attitude.

As the chart suggests, while the funding rates remain positive, they have significantly declined compared to December and even March last year when the market first touched the $70K mark. While this shows uncertainty by market participants, it also indicates that the futures market is not overheated, and sufficient spot market demand can push the price higher and initiate a sustainable rally.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-12 10:11