As a seasoned researcher with over two decades of experience in the financial markets under my belt, I have seen trends come and go, but none quite like the meteoric rise of Bitcoin. Having closely followed its trajectory since its inception, I must admit, I find myself both captivated and cautiously optimistic about this asset’s potential to reach new heights.

The cost of Bitcoin is nearly poised to surge past the $100K barrier, a significant resistance point, as investors gear up for a possible upward trend.

Is a new all-time high on the horizon?

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Over the past days, this asset has persistently been reaching new highs and lows that are higher than previous ones, ever since it recovered from the $52K support point. Furthermore, it has breached multiple resistance levels, currently standing significantly above the $100,000 barrier which was previously a resistance level.

Currently, the Relative Strength Index (RSI) indicates a strong upward trend, suggesting that the market could soon break through the $100K barrier and continue climbing towards the $120K psychological resistance level.

The 4-Hour Chart

On a 4-hour scale, the chart offers a clearer depiction of the current market trend, with prices steadily rising within an expansive uptrending channel.

Yet, with the lower boundary of the pattern remaining intact, the market is now paving its way toward the higher trendline and potentially the $105K level in the short term. A breakout above the ascending channel is likely to lead to an aggressive rally higher.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

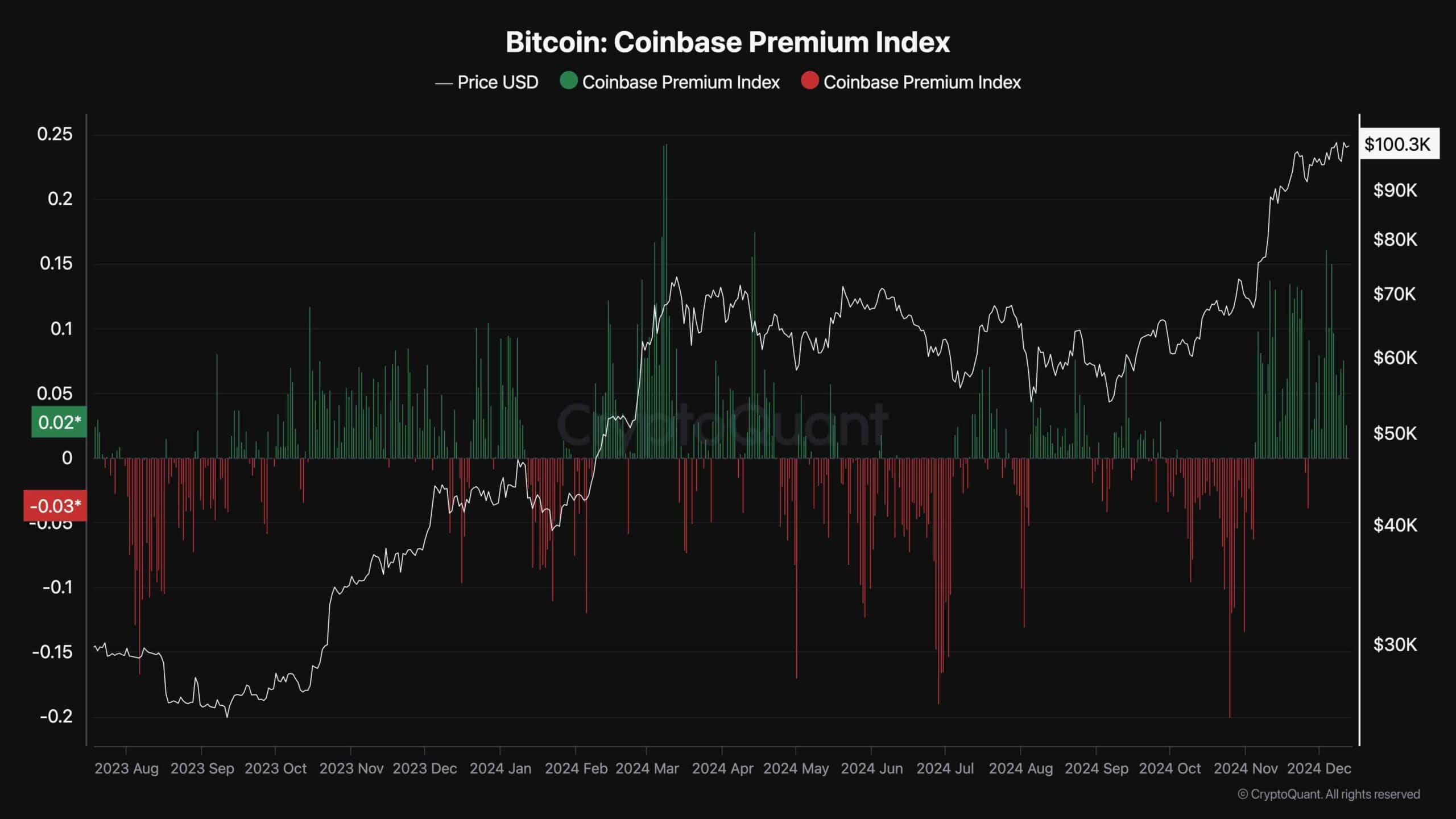

Coinbase Premium Index

U.S. investors, encompassing both individual and institutional investors from America, largely dictate market trends. Consequently, understanding their actions could prove advantageous when trying to forecast short-term market fluctuations.

This graph showcases the Bitcoin Coinbase Premium Index, a tool that quantifies the difference in Bitcoin buying and selling activity between Coinbase and Binance. Primarily favored by American traders, Coinbase stands out from Binance, which is globally used. Consequently, this index helps determine whether U.S. investors are more actively buying or selling compared to other regions.

As the chart demonstrates, the Coinbase Premium Index has demonstrated highly positive values over the last couple of months, indicating the buying pressure from the US post-election, which is likely responsible for the market’s recent rally. As long as this metric shows positive readings, BTC could expect more upside.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-14 10:50