The Middle East, restless as a dog scratching fleas, rattled the crypto corral this Friday. Everywhere you looked, men with iron stomachs watched as their dreams—Bitcoin especially—bounced like a tin pail down a dusty road. BTC, which had swaggered around North America just yesterday, found itself wallowing at $105k—down 3 percent in 24 hours—like a rancher’s kid with a black eye and a good story.

Altcoins, those scrappy sidekicks, followed Bitcoin’s lead into the muddy ditch. The leveraged traders, always certain they’re smarter than the next guy, lost $1.1 billion in the carnage. Some optimists whistled in the graveyard, claiming this was but a blip. Others squinted at the horizon, waiting for a “clear signal”—ignoring the fact that clear signals in crypto are about as common as rain in the Mojave.

Bitwise’s Matt Hougan Tosses His Cowboy Hat in the Ring 🤠

Regulators had been playing nice lately, and the stablecoins strutted their stuff under the hot sun, all plump and sassy with new money. The institutions showed up, lured by tales of liquidity, like cattlemen drawn to a river after too many dry seasons.

In the aftermath of the drop, Matt Hougan (the big thinker at Bitwise, who likely keeps his optimism in a jar beside the coffee) said now is the time for “accumulation.” The faithful should pile in, shovels and all, before a wild rally comes stampeding into town by year’s end.

“I think this is the ‘Summer of Accumulation’, a moment for long-term investors to build positions ahead of an epic EOY run,” Hougan noted, sounding as excited as a chicken in a grain store.

The Spellbound Chart: Or, Reading Chicken Bones by Lamplight 🐓📉

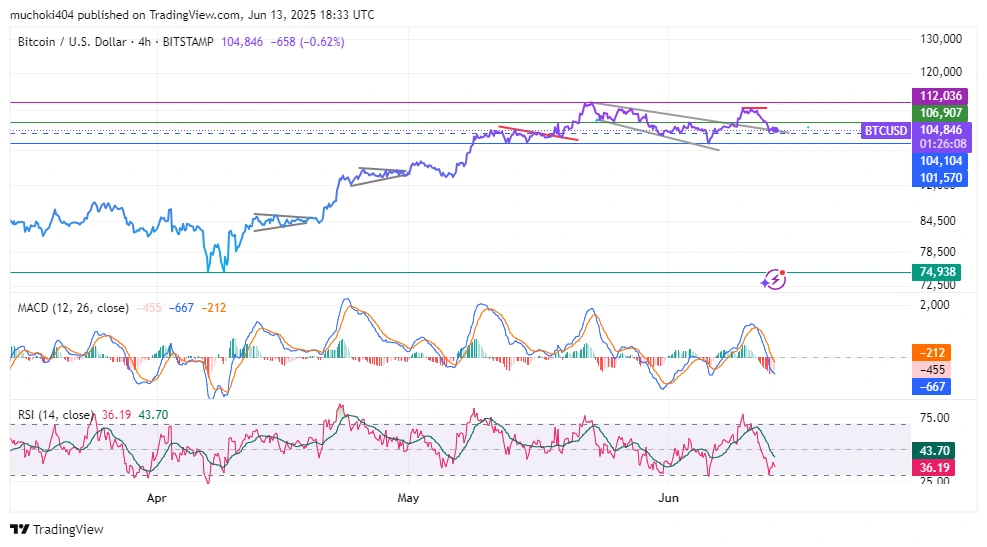

Bitcoin had been riding high ever since the last trade war turned into dust and memory. $112k became the mighty wall, the kind that repels dreamers and fools alike. BTC smacked into that wall and tumbled, landing on its back at the $105k “buy zone”—which is analyst-speak for “maybe you won’t lose your shirt here.”

The chart-watchers, those mystics still employed, peered at four-hour candles and hollered, “Reversal ahead!” Like a miner’s canary, the Relative Strength Index (RSI) nestled among the oversold. The MACD, as inscrutable as a silent sheriff, ticked lower. Maybe the selling’s slowing, maybe not. The only certain thing: the story isn’t over, and the next chapter will probably come with more drama, a few laughs, and maybe—just maybe—a happy ending for the stubborn dreamers hanging on.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lottery apologizes after thousands mistakenly told they won millions

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

2025-06-13 22:07