What to know:

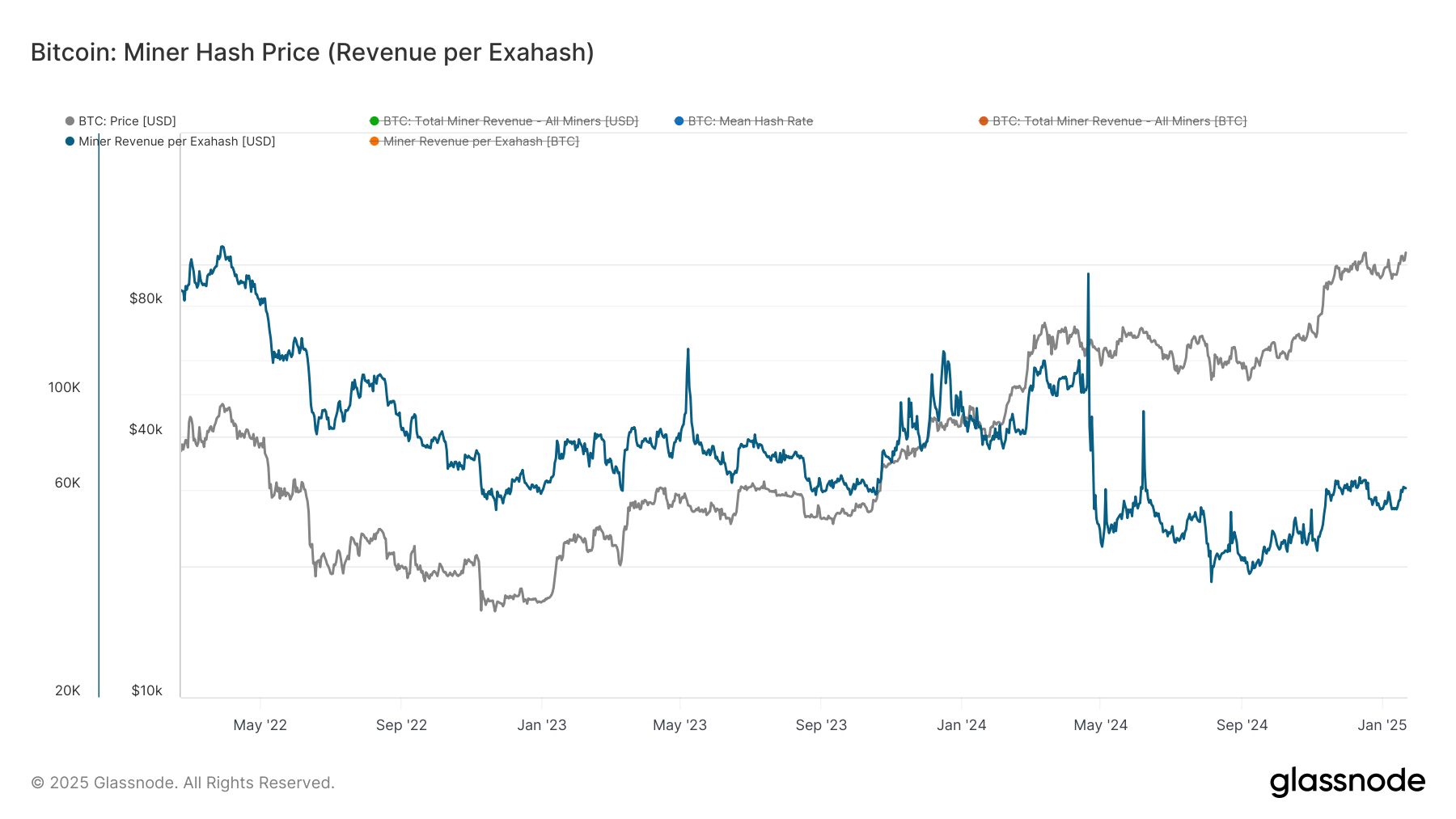

- Miner hashprice has hit a staggering $62 PH/s, the highest it’s been in a month. 🎉

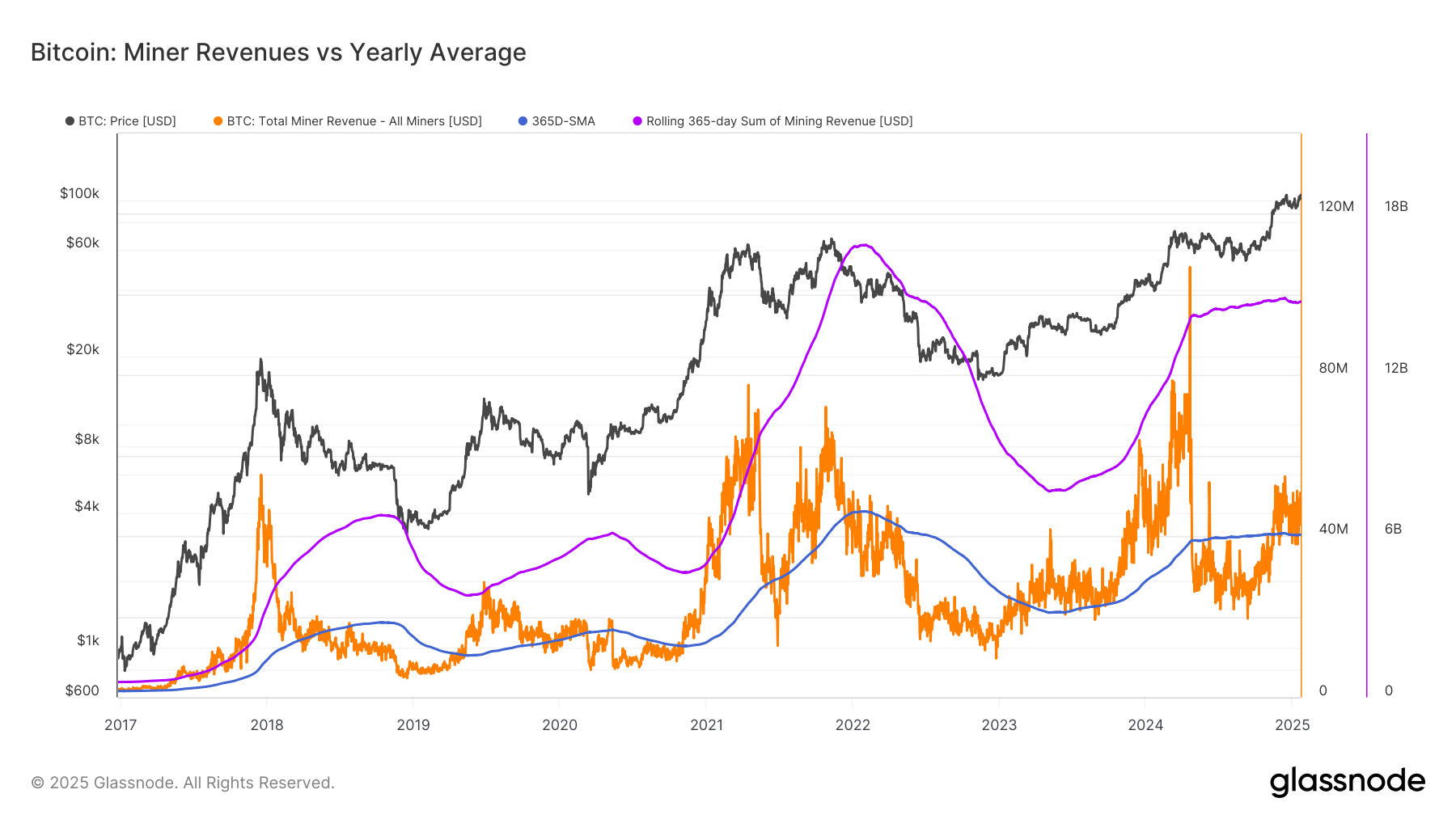

- Since November, mining revenue has been above the 365-simple moving average, historically a bullish signal. (Or as bullish as a cow in a field of daisies.) 🐄🌼

Hashprice, a delightful little metric invented by Luxor, measures the profitability of mining. It estimates how much daily income miners can expect relative to their esteemed contribution to the Bitcoin network’s hash power. In layman’s terms, it’s the expected value miners can expect from 1 TH/s of hashing power per day. And yes, that’s a mouthful. 🍽️

According to Glassnode, our dear hashprice is hovering above $62 PH/s, which is about as high as it’s been since mid-December. One can only imagine the miners popping champagne corks in celebration! 🍾

So, what’s fueling this surge in hashprice? Well, Bitcoin (BTC) has decided to strut its stuff, soaring to well over $100,000—a dazzling 56% increase in three months. Miners are feeling a bit of relief, like finding a forgotten $20 bill in an old coat pocket. 💸 The network has also seen a slight uptick in miner fees, roughly 12 BTC per day, which is the highest amount for over a month, thanks to some lively inscription activity on the network.

However, due to the impending halving in April 2024—where mining rewards will be cut in half faster than a bad haircut—the hashprice had dropped from around $115 PH/s. It’s a bit like being told your favorite dessert is now twice as small. 🍰

As a result of this halving, miners have struggled with share price appreciation last year; while mining revenue for much of 2024 was below the rolling 365-simple moving average (SMA). But, fear not! Since November, it has reclaimed this moving average, which is historically a bullish signal. Or at least, it’s a signal that doesn’t require a crystal ball to interpret. 🔮

While the hash rate—the computational power required to mine on a proof-of-work blockchain—recently hit all-time highs, it has sent the network difficulty soaring to all-time highs as well. This is akin to running a marathon and suddenly realizing you’re in a triathlon. 🏃♂️🏊♀️🚴♂️

Andre Dragosch, the European head of research at Bitwise, shared some exclusive insights with CoinDesk about miners being in a healthier position than last year. “We have recently seen a decline in network hash rate since the all-time highs in early January. Meanwhile, the price of Bitcoin has increased, and the overall transaction count has picked up again. This has led to a recovery in hash price, which should technically incentivize miners to continue ramping up their hash rate.” It’s a bit like a motivational speech, but for miners. 📈

Dragosch continues, “Overall, Bitcoin miners appear to be well capitalized judging by the continued increase in Bitcoin miner holdings since the beginning of the year, which implies that miners are selling less than they are mining on a daily basis.” In other words, they’re hoarding Bitcoin like it’s the last slice of pizza at a party. 🍕

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Skull and Bones: Players Demand Nerf for the Overpowered Garuda Ship

- Gaming News: Rocksteady Faces Layoffs After Suicide Squad Game Backlash

- Mastering the Tram Station: Your Guide to Making Foolproof Jumps in Abiotic Factor

- League of Legends: The Mythmaker Jhin Skin – A Good Start or a Disappointing Trend?

- SUI PREDICTION. SUI cryptocurrency

- The Hilarious Realities of Sim Racing: A Cautionary Tale

- ‘The Batman 2’ Delayed to 2027, Alejandro G. Iñarritu’s Tom Cruise Movie Gets 2026 Date

- Destiny 2: The Surprising Stats Behind Slayer’s Fang – A Shotgun Worth Discussing

- Honkai: Star Rail Matchmaking Shenanigans and Epic Hand-Holding Moments!

2025-01-22 15:42