What to know:

- Bitcoin‘s difficulty hits a new high of 114.7 T, rising 5.6%.

- Hash Ribbon metric signals miner capitulation, which tends to mark local bottoms in price.

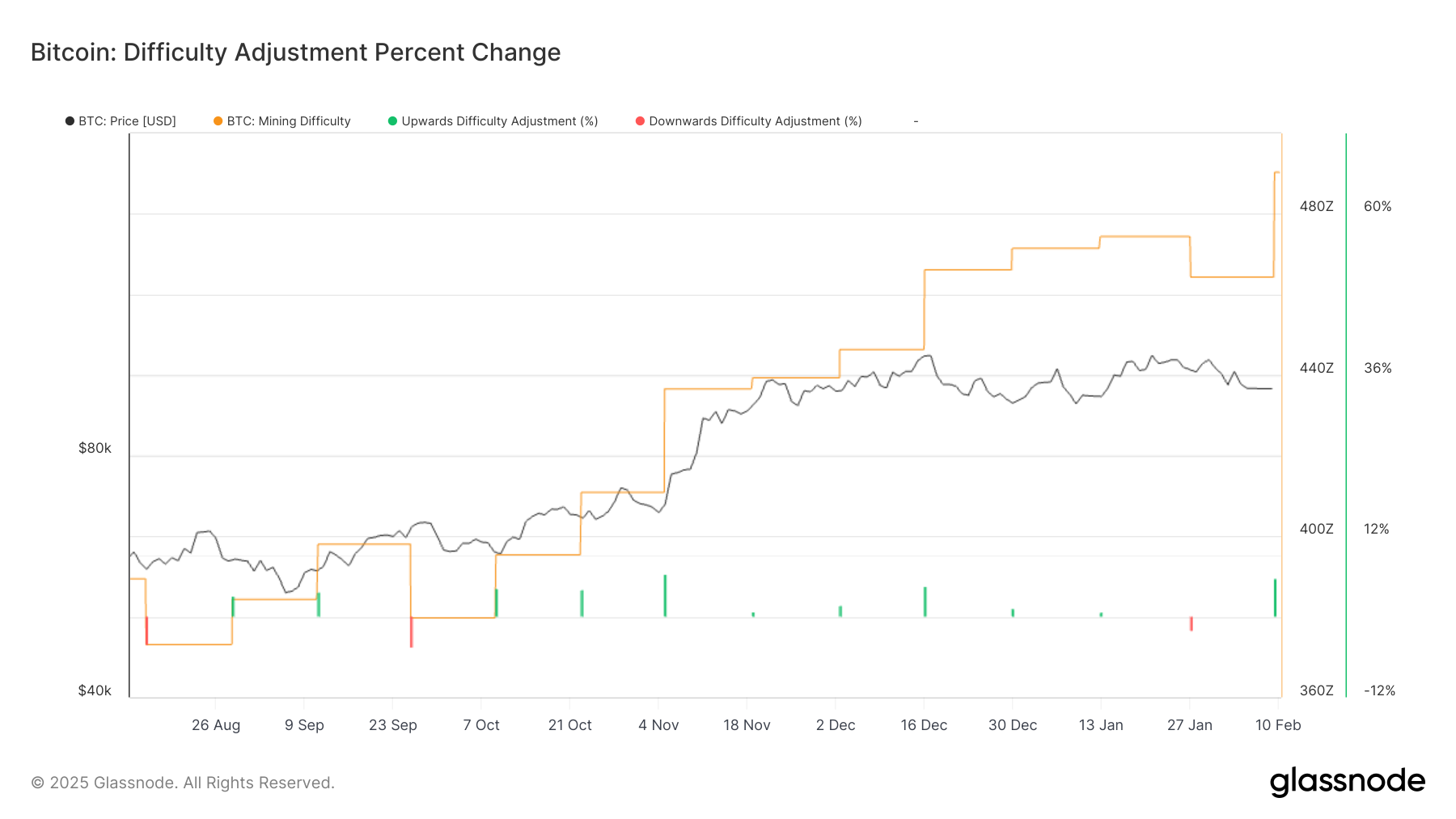

Bitcoin’s difficulty has reached an all-time high of 114.7 trillion (T) following a 5.6% upward adjustment over the weekend, according to CoinWarz. 😱

This coincides with the Hash Ribbon metric signaling a miner capitulation. Hash Ribbon, a market indicator, hints at a local bottom for bitcoin (BTC) and often forms when miners capitulate — when mining costs exceed profitability. 💸

According to Glassnode data, miner capitulation began in early February. Bitcoin is down over 4% month-to-date. Historically, when this metric signals capitulation, it has marked local price bottoms. 📉

If this pattern holds, bitcoin’s bottom could be around $91,000. The last capitulation signal occurred in October 2024, just before BTC surged 50%. 🚀

This rise in difficulty is due to bitcoin’s rising hash rate, which hit an all-time high on Feb. 4. Mining difficulty adjusts every 2,016 blocks, targeting an average block time of 10 minutes. 🕰️

As difficulty increases, mining becomes more competitive, placing additional pressure on miners. January’s production data reflects this, with Riot Platforms (RIOT) being the only major public miner to report a month-over-month production increase. 📈

Read More

- Best Crosshair Codes for Fragpunk

- How to Get Seal of Pilgrim in AI Limit

- Wuthering Waves: How to Unlock the Reyes Ruins

- Enigma Of Sepia Tier List & Reroll Guide

- Are We Actually Witnessing a Crunch Time for ADA? 😲📈

- Final Fantasy Pixel Remaster: The Trials of Resurrection and Sleeping Bags

- Lost Records Bloom & Rage Walkthrough – All Dialogue Options & Puzzle Solutions

- Shocking NFT Sales Surge! But Where Did Everyone Go? 🤔💸

- Katherine Heigl Says ‘Grey’s Anatomy’ Ghost Sex Was ‘Confusing,’ Reunites With Jeffrey Dean Morgan to Discuss ‘Awkward’ Storyline: ‘She’s F—ing a Dead Guy?’

- Honkai: Star Rail Fans Applaud Epic Firefly/SAM Cosplay – 8 Months of Creativity on Full Display!

2025-02-10 15:23