So, you know how everyone’s always talking about the importance of “following your passion”? Yeah, well, it turns out that if your passion is bitcoin mining, you’re probably doing okay for yourself. Like, more than okay. Like, “I-can-afford-avocado-toast-and-a-vacation-home” okay.

JPMorgan just raised its price targets for a bunch of bitcoin mining companies, including CleanSpark, Riot Platforms, and MARA Holdings. Because, you know, bitcoin prices are up and mining profitability is improving. It’s like the whole industry is one big, happy (and slightly-nerdy) family.

- CleanSpark’s price target got bumped up to $14 from $12. Not bad, CleanSpark. Not bad at all.

- Riot Platforms is now looking at a price target of $14, up from $13. I mean, who doesn’t love a good riot?

- MARA Holdings got a nice little boost to $19 from $18. I’m not really sure what MARA Holdings does, but I’m pretty sure they’re doing it well.

According to JPMorgan’s analysts, Reginald Smith and Charles Pearce (who sound like they could be characters in a Dickens novel), the price targets went up because of “higher bitcoin prices and improving mining profitability.” Yeah, no kidding.

Oh, and JPMorgan also tweaked its spot bitcoin assumption by 24% and its network hashrate estimate by 9%. Because, you know, math.

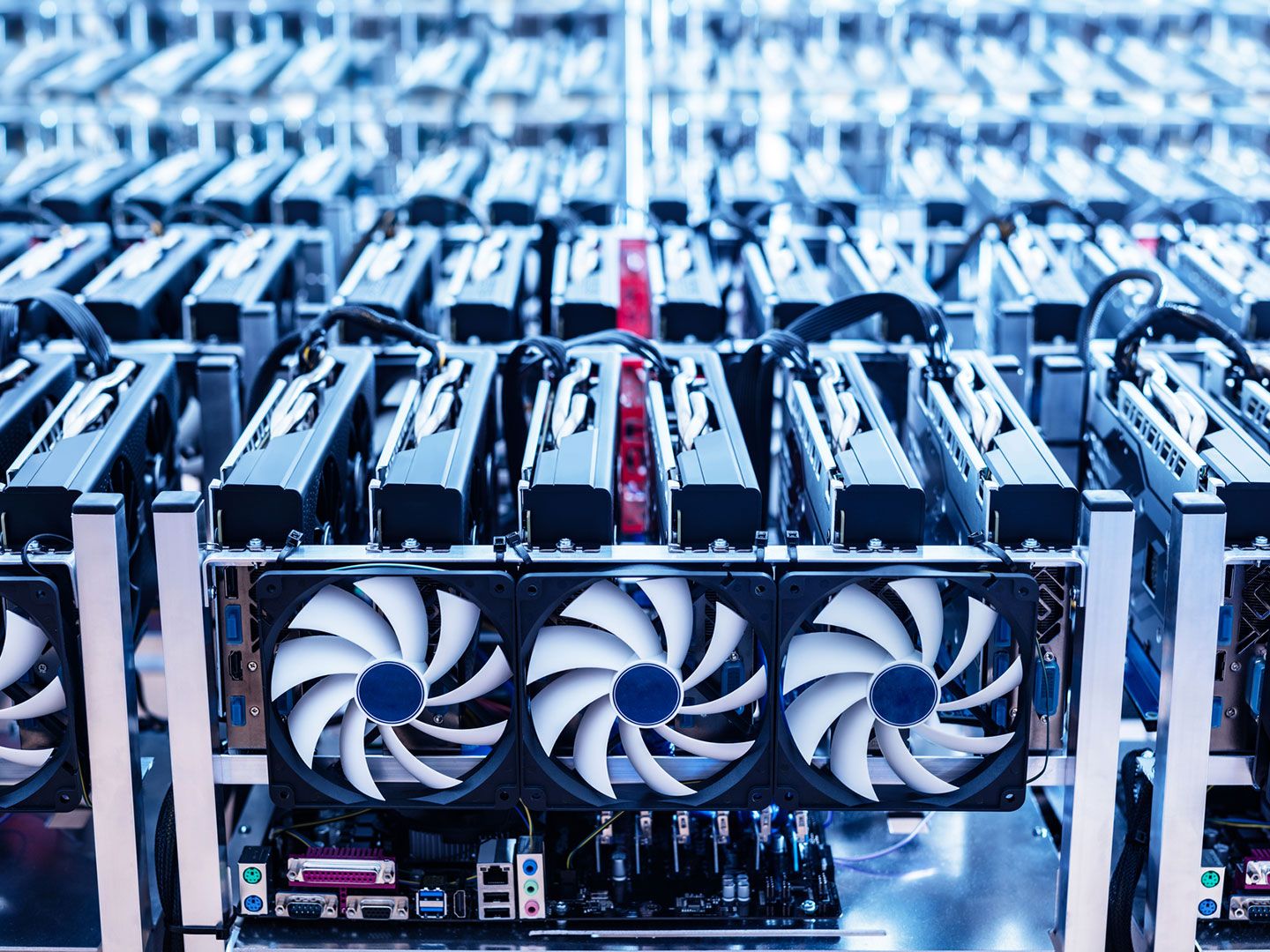

The hashrate, for those who don’t know (and I didn’t, until I looked it up), is like a big measure of how hard it is to mine bitcoin. It’s like a big, digital game of “keep up with the Joneses,” but with more computers and fewer Joneses.

Anyway, JPMorgan is still all about CleanSpark, IREN, and Riot, and is meh about Cipher Mining and MARA. But hey, being meh is still better than being, like, totally down on something, right? 🤷

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- Gaming’s Hilarious Roast of “Fake News” and Propaganda

2025-06-13 17:17