What to know:

- Public companies buying bitcoin has been one of the big themes of 2024 and asset management companies are taking notes.

- Bitwise filed Thursday for an ETF that includes only corporations with at least 1,000 BTC in its treasury.

- Strive Asset Management filed for the Bitcoin Bond ETF, which seeks exposure to MicroStrategy’s convertible securities.

As a seasoned researcher with over two decades of experience in the financial markets, I find myself increasingly intrigued by the recent surge of institutional interest in Bitcoin and other cryptocurrencies. Having witnessed the evolution of the dot-com bubble, the 2008 financial crisis, and the subsequent rise of blockchain technology, I can confidently say that we are standing on the precipice of a new era in digital finance.

2024’s prevailing storyline in the world of cryptocurrencies has centered around institutional adoption. With the U.S.’s approval of bitcoin (BTC) exchange-traded funds and an increasing number of companies publicly stating their intention to purchase large amounts of BTC for their assets, crypto is now more prominently featured than ever in mainstream financial discussions.

This year, Bitcoin has experienced a staggering rise of nearly 130%, setting new all-time highs multiple times. At present, it’s teetering close to the psychologically significant level of $100,000. The ETFs that received approval in January have attracted net investments amounting to $36 billion and amassed more than 1 million Bitcoins.

As a crypto investor, I’ve noticed an increasing number of publicly traded companies announcing their intent to incorporate bitcoin into their corporate treasury. This trend, which was initially spearheaded by MicroStrategy (MSTR) in 2020, has recently gained momentum with KULR Technology (KULR), a manufacturer of energy storage solutions for the space and defense industries, joining the bandwagon. Based in Houston, Texas, this company has invested $21 million in 217.18 BTC and plans to allocate up to 90% of any future excess cash reserves towards Bitcoin.

Currently, Bitwise Asset Management, known for its spot Bitcoin and Ethereum ETFs, has submitted an application for an Exchange-Traded Fund (ETF) that will focus on tracking the stocks of companies holding over 1,000 Bitcoins in their treasury. The proposed ETF, named Bitwise Bitcoin Standard Corporations ETF, also sets other conditions such as a market capitalization of at least $100 million, daily liquidity of more than $1 million on average, and a publicly-traded free float below 10%, as outlined in the filing made on December 26.

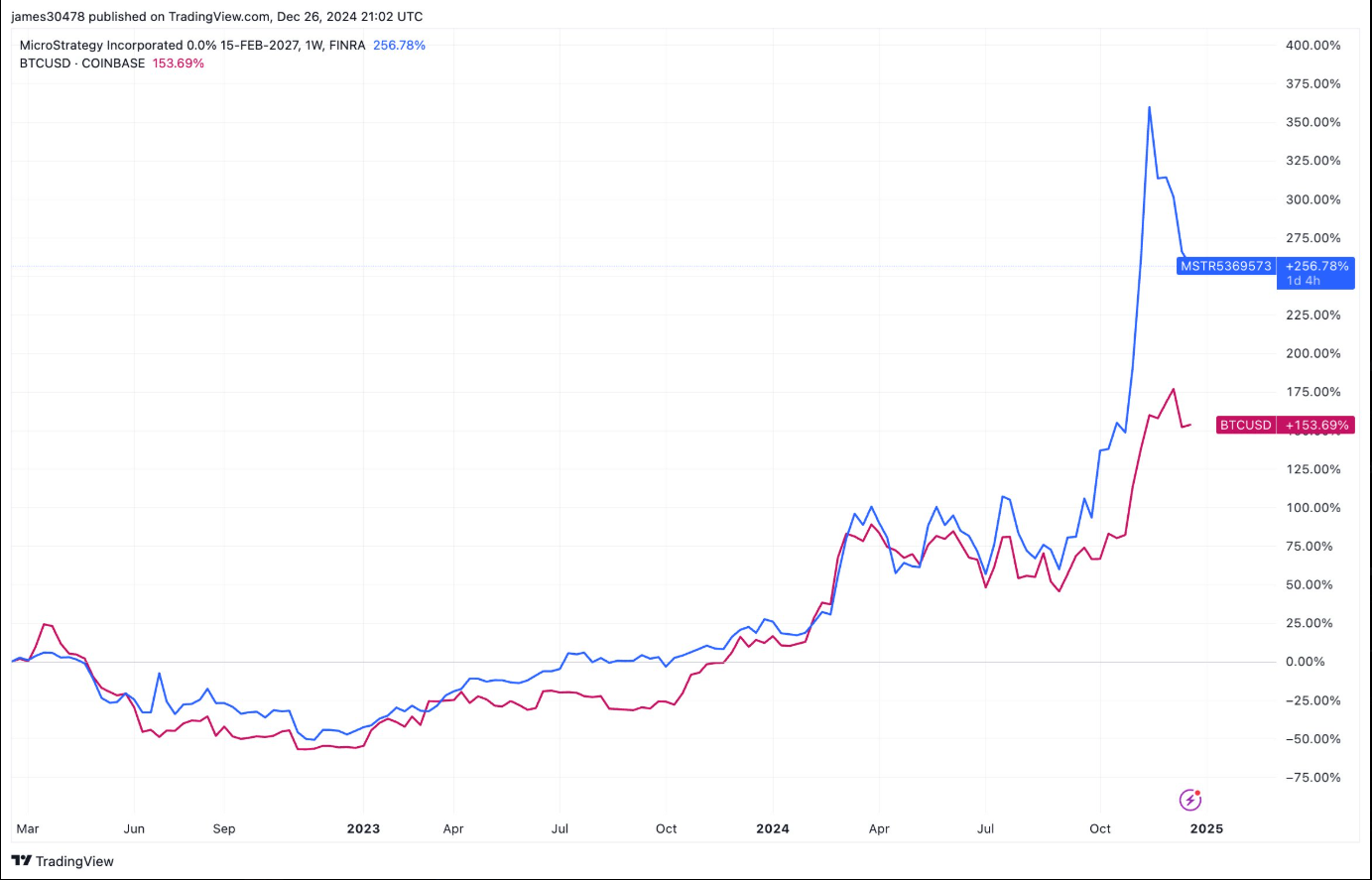

On the second Thursday, Strive Asset Management – a firm co-founded by Vivek Ramaswamy, who served in the administration of the U.S. President-elect Donald Trump – submitted a filing. This ETF, known as the Bitcoin Bond, aims to gain exposure using derivative tools like MicroStrategy’s convertible securities. It operates under active management, and the bonds have proven highly popular. Specifically, the zero-coupon bond maturing in 2027 is trading at 150% above its face value, and it has surpassed bitcoin in performance since its launch.

From its inception, Strive has consistently warned about the potential long-term risks associated with the worldwide debt crisis of fiat currencies, inflation, and geopolitical disputes, according to Matt Cole, CEO of Strive. He firmly asserts that there is no more suitable long-term investment for safeguarding against these risks than a well-considered investment in bitcoin.

As a researcher, I am excited to announce that our first initiative among several upcoming Bitcoin solutions aims to democratize the access to corporate Bitcoin bonds. These bonds, issued by corporations for purchasing Bitcoin, offer an appealing risk-reward profile in the cryptocurrency market, yet they are typically not accessible to the majority of investors.

Read More

- Why Sona is the Most Misunderstood Champion in League of Legends

- SUI PREDICTION. SUI cryptocurrency

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- Square Enix Boss Would “Love” A Final Fantasy 7 Movie, But Don’t Get Your Hopes Up Just Yet

- House Of The Dead 2: Remake Gets Gruesome Trailer And Release Window

- US Blacklists Tencent Over Alleged Ties With Chinese Military

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Fortnite’s Most Underrated Skin Deserves More Love

- „It’s almost like spoofing it.” NCIS is a parody of CSI? Michael Weatherly knows why the TV series is viewed this way in many countries

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

2024-12-27 18:24