Oh, look, Bitcoin‘s decided to lounge around after hitting that dizzying $123,000 high just ten days ago. Now it’s squeezed between $117,000 and $120,000, like it’s pondering whether to keep climbing or just chill with its gains. Volatility’s taken a coffee break, but the charts are dropping hints that this party’s not over yet—more upside might be brewing. 😏

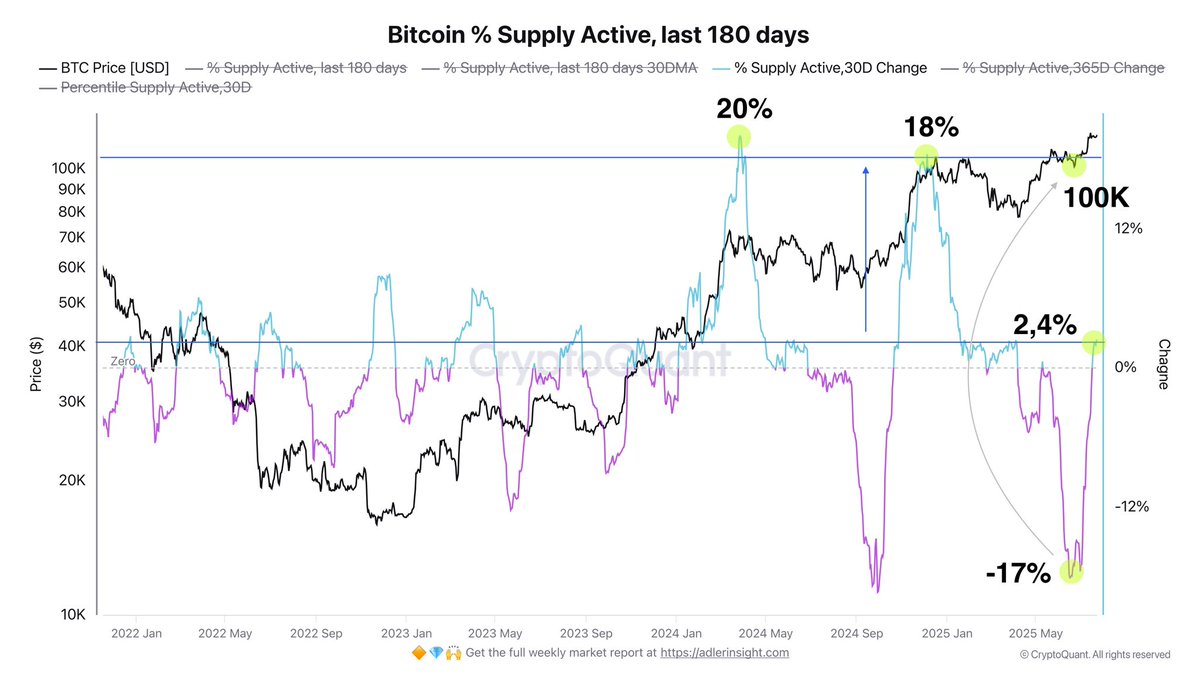

This % Supply Active metric is basically Bitcoin’s drama queen indicator—it spikes when things get interesting. Back in spring 2024, when BTC strutted to $70,000, it hit 20%. Then in December 2024, smashing through $100,000, it clocked 18%. These were like wake-up calls from long-forgotten coins, signaling the start of some wild distribution parties. Now? It’s just starting to fidget, suggesting we’re early in this cycle’s shindig, with holders still glued to their stacks. Early distribution vibes? More like a slow jam session. 🎸

Supply Activity’s Tepid Tease: Bitcoin’s Macro Cycle Flirting with Upside

Analyst Axel Adler’s chiming in with his sage wisdom—supply activity kicked up in June 2025 when BTC crossed $100,000, creeping from negative to +2.4% over the last month. It’s a baby step compared to past blowouts, meaning holders aren’t panic-selling just yet. Adler’s betting that if BTC hangs tough above $120,000, this metric could saunter up to 8-10%, maybe even revisit those 18-20% glory days. Fingers crossed it’s not all talk! 🤞

Historically, when Bitcoin goes on a tear, this supply active thing explodes—like it did at $70,000 or $100,000 marks. But right now, it’s lagging, which Adler says means most holders are still committed, not ready to cash out. A delayed spike? Sounds like Bitcoin’s playing hard to get, keeping us on our toes. 😜

BTC’s Chill Session: Holding Above $115K, But Is It Bored or Plotting?

Glance at the 12-hour chart, and you’ll see Bitcoin’s in full consolidation mode post its record high. It’s hovering around $118,267, ping-ponging between $122,077 resistance and $115,724 support. Got a little rejection at $120,000, but as long as it stays above those 50 and 100-period SMAs (chilling around $113K-$110K), the bulls are still smirking. Volume’s dipping, which is typical for these “let’s catch our breath” phases after a breakout binge. A smash above $122,000 could launch it toward $130,000, but dip below support and it might sulk back to $113,000. Buyers better step up, or it’s drama time! 😂

Volume’s waning during this sideways shuffle, a classic sign that the market’s indecisive or secretly stockpiling for the next move. BTC blasted past $120,000 on a volume high, but now it’s just meandering. A breakout upward could be epic if on-chain vibes align, or a drop might test those SMA supports. Either way, crypto’s never dull—always one surprise away from chaos or champagne. 🎉

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- LINK PREDICTION. LINK cryptocurrency

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

2025-07-23 19:35