What to know:

- Bitcoin continues to consolidate between the valuations of $90,000 to $100,000.

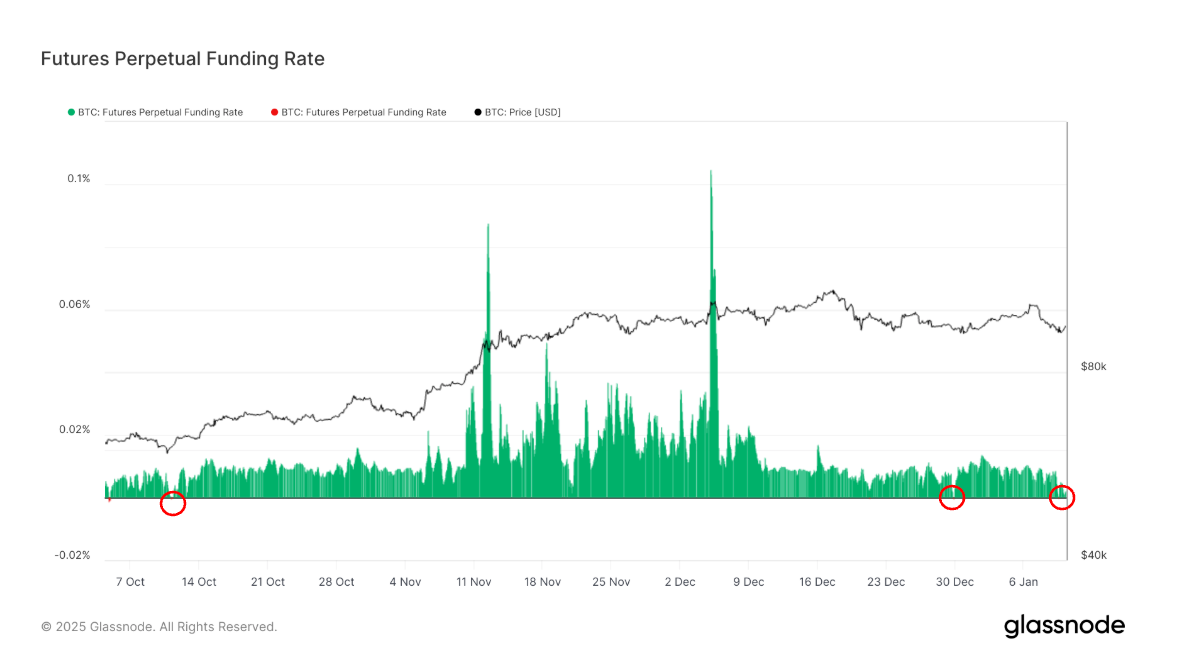

- The perceptual funding rate briefly went negative yesterday, which tends to mark a local bottom in price.

Bitcoin’s price hasn’t dipped below the $90,000 mark since November 18th, instead fluctuating between $90,000 and $100,000.

As a researcher examining Bitcoin’s price dynamics, I’ve noticed an intriguing pattern. When Bitcoin nears the $100,000 mark, investor sentiment often becomes optimistic, aiming to sustain the bull market. Conversely, as Bitcoin approaches around $90,000, similar to what happened on Thursday, investor sentiment can shift towards pessimism or bearishness.

The price of Bitcoin tends to rise or fall towards points that cause the most discomfort for its holders, currently experiencing a phase of fluctuation between these two value ranges.

In bitcoin markets, derivatives like futures and options significantly impact the dramatic price fluctuations we see due to their volatility; these derivatives account for just a small fraction (a few percentage points) of the total market value, yet they’re exerting a growing impact on the market dynamics.

As a researcher, I closely monitor the perpetual funding rate in my analysis of futures trading. This rate, expressed as a percentage, reflects the regular payments made by exchanges for perpetual futures contracts. When the rate is positive, it means long position holders are making periodic payments to short position holders. On the flip side, when the rate is negative, it’s the short position holders who are making the periodic payments to their long counterparts.

In periods of a thriving stock market, Bitcoin often experiences a favorable financing fee because investors anticipate its price increase. However, when the market becomes excessively hot, Bitcoin may lose momentum, causing the price to drop. This decrease can trigger chain reactions of liquidations.

During a bear market, just as support levels emerge after prolonged periods, sudden rebounds in prices may occur, causing traders to rush to secure their positions. In such instances, temporary price floors, or local bottoms, are established.

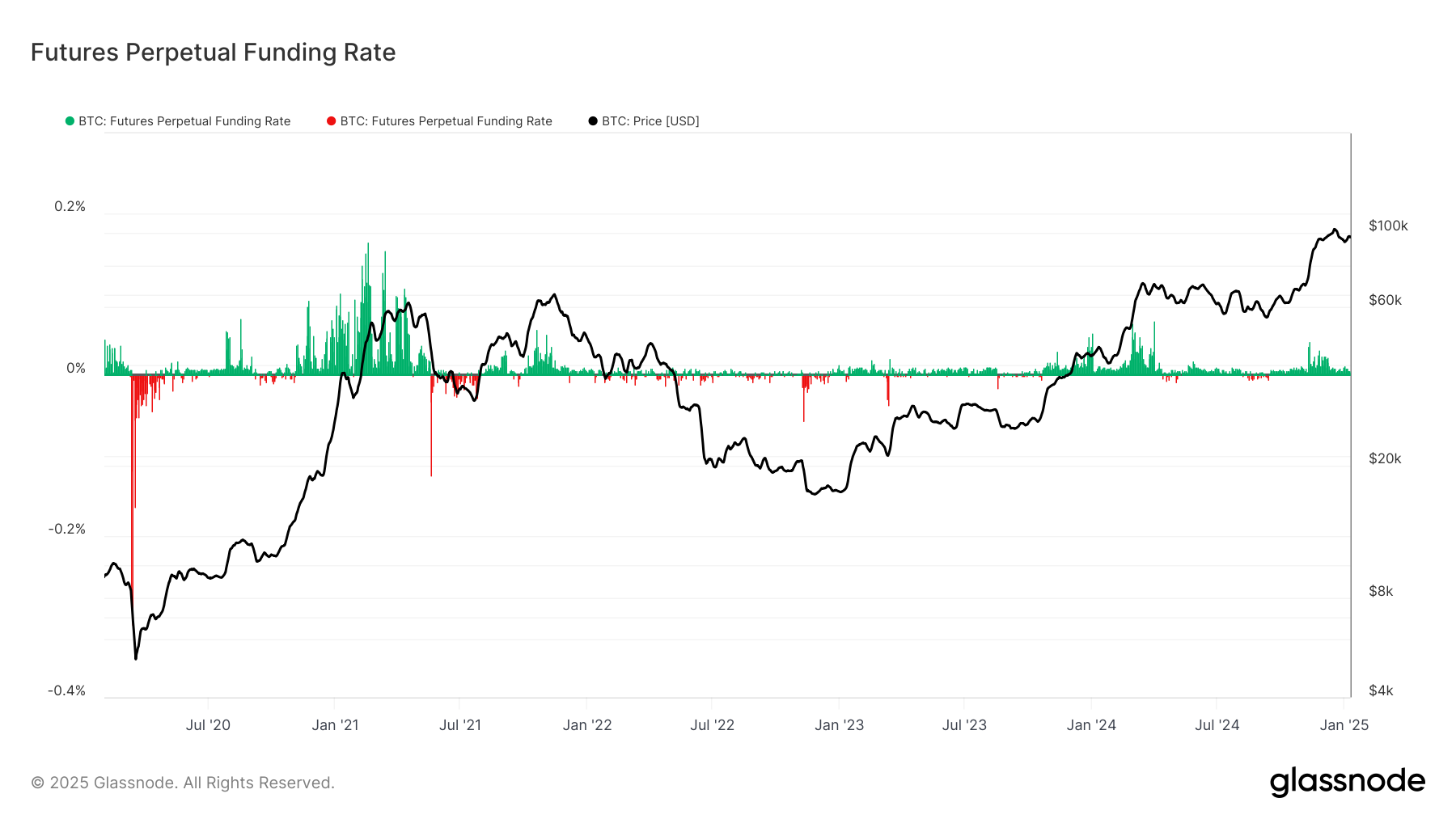

On Thursdays, data from Glassnode revealed a brief dip in the funding rate to -0.001%, marking the first such occurrence this year and only a few instances since November. This event triggered a liquidation of positions and a shift in sentiment before Bitcoin regained its position above $94,000. To put Thursday’s relatively modest negative funding rate into perspective, during the peak of the COVID-19 crisis in March 2020, we observed funding rates plummeting as low as -0.309%.

In simpler terms, just because a funding rate is negative doesn’t automatically trigger a price rebound or mark the bottom of the market. Instead, it’s one factor to consider when forming your market perspective, along with other chart tools and technical indicators. A negative funding rate might indicate that the bear market could continue rather than signaling an immediate bottom. Conversely, during a bull market, a positive funding rate doesn’t necessarily mean the market is overheated; it could simply reflect ongoing strong demand.

From 2023 onwards, I’ve noticed that the funding rate for Bitcoin has predominantly been positive, primarily because of the bull market. However, it hasn’t been all smooth sailing; there have been brief instances of negative rates as well. Interestingly, these negative periods typically coincide with price bottoms. For instance, we observed this during the Silicon Valley Bank collapse in 2023 and again in 2024, just before Bitcoin experienced a surge in both years.

When the funding rate drops below zero (becomes negative), and traders grow excessively confident as bears, a situation often arises where a floor is established. This also happens when bulls become too relaxed and the spot price can no longer match the leverage being employed. In such scenarios, traders frequently face liquidation, with the bears experiencing this event in the instance under discussion.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-10 13:39