What to know:

- On a fateful Monday, the U.S. bitcoin ETFs saw a staggering outflow of $516.4 million, the second-largest this year. 💰

- For the first time, the Bitcoin CME annualized basis dipped below the risk-free rate of 5%. Talk about a plot twist! 📉

- Institutions are playing a game of chess with CME, going long on the asset while shorting the futures market, all while collecting a premium. Checkmate! ♟️

In the land of digital gold, the U.S. spot-listed bitcoin (BTC) exchange-traded funds (ETFs) faced a tempest on Monday, with a dramatic drop of $516.4 million, as reported by Farside data. It seems the crypto cowboys are getting a bit jittery! 🤠

These withdrawals mark the ninth net outflow in just ten days, revealing a growing unease with the largest cryptocurrency, which has been stuck in a narrow price range between $94,000 and $100,000 for most of this month. It’s like watching paint dry, but with more zeros! 🎨

Then came Tuesday, when bitcoin decided to break free from its three-month channel, plummeting below $90,000 and hitting a low of $88,250. Ouch! That’s gotta hurt! 😱

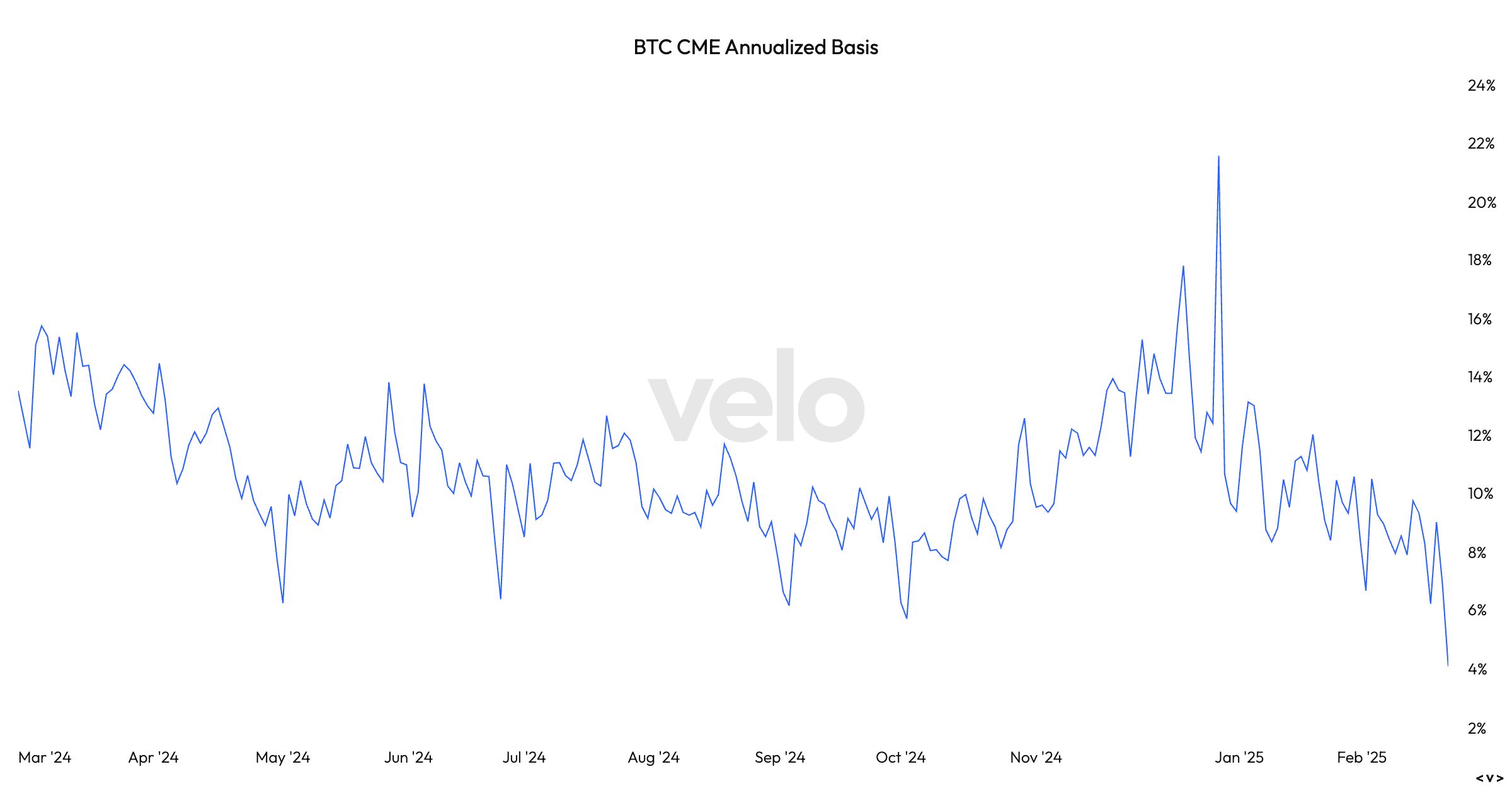

According to Velo data, the bitcoin CME annualized basis—the difference between the spot price and futures—has now dropped to a mere 4%. This is the lowest since the ETFs began trading in January 2024. It’s like a cash-and-carry trade gone wrong, where the market-neutral strategy is just a mirage! 🌵

This strategy involves taking a long position in the spot market while shorting the futures market. Velo data shows a one-month futures forward contract, where investors collect a premium until the futures contract expiry date closes. It’s a waiting game, folks! ⏳

At this level, the basis trade is now less than the so-called risk-free rate, the yield on the U.S. 10-year Treasury of 5%. This difference might just nudge investors to close their positions for a better return. More outflows from the ETFs could be on the horizon! 🌅

Arthur Hayes, the co-founder of Bitmex, hinted at the unraveling of the basis trade in a post on X. He quipped, “Lots of IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short term US treasuries.” Sounds like a mouthful, doesn’t it? 😜

He continued, “If that basis drops as bitcoin falls, then these funds will sell IBIT and buy back CME futures. These funds are in profit, and given basis is close to UST yields they will unwind during US hours and realize their profit. $70,000 I see you mofo!” Now that’s some spicy banter! 🔥

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-02-25 11:58